- United States

- /

- Hospitality

- /

- NYSE:VAC

Assessing Marriott Vacations Worldwide After 46.7% Stock Plunge and Industry Uncertainty

Reviewed by Bailey Pemberton

- Wondering if Marriott Vacations Worldwide is a hidden bargain or a value trap? Let’s dig beneath the surface to see what the numbers are really saying.

- The stock has faced some serious turbulence, dropping 30.4% over the last month and plunging 46.7% year-to-date. This has many investors asking if opportunity or risk is growing.

- Much of the recent price volatility has been linked to industry-wide concerns, including shifting travel trends and changing consumer sentiment, as highlighted by major news outlets covering leisure and hospitality. Ongoing debates around timeshare demand have added extra uncertainty, making headlines and fueling speculation about the company’s future path.

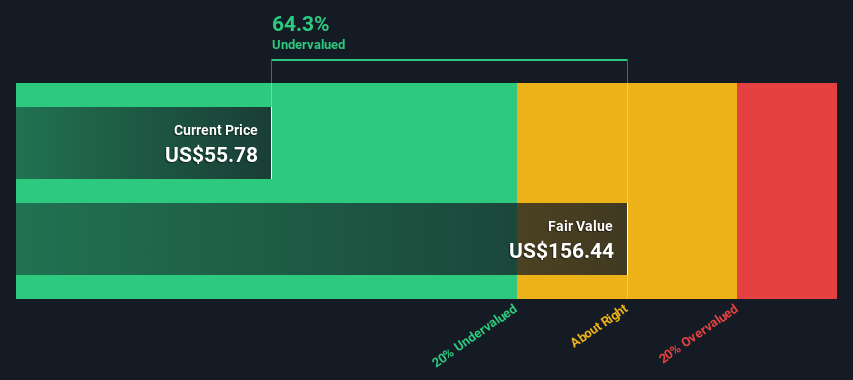

- Despite the noise, Marriott Vacations Worldwide currently achieves a valuation score of 5 out of 6 for undervaluation. We’ll break down how that score takes shape and explore the classic valuation measures, but be sure to stick around because there may be a more insightful way to judge the stock’s fair price by the end.

Approach 1: Marriott Vacations Worldwide Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a business’s intrinsic value by projecting its future cash flows and discounting them back to today’s dollars. This model is useful because it attempts to look past short-term market noise, focusing instead on the fundamental ability of the company to generate cash over time.

For Marriott Vacations Worldwide, the DCF approach starts with current Free Cash Flow of $19.1 million. Analysts provide projections for the next five years and, beyond that, Simply Wall St extends estimates to create a full ten-year picture. By 2026, annual Free Cash Flow is expected to rise sharply to $224.8 million. Looking further ahead, this trajectory continues, reaching over $872 million by 2035, as extrapolated by long-term estimates.

After discounting all these future cash flows back to the present, the calculated fair value per share is $169.87. This is significantly higher than Marriott Vacations Worldwide’s current stock price, implying the shares are trading at a 72.6% discount to their intrinsic value based on current projections.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Marriott Vacations Worldwide is undervalued by 72.6%. Track this in your watchlist or portfolio, or discover 904 more undervalued stocks based on cash flows.

Approach 2: Marriott Vacations Worldwide Price vs Earnings

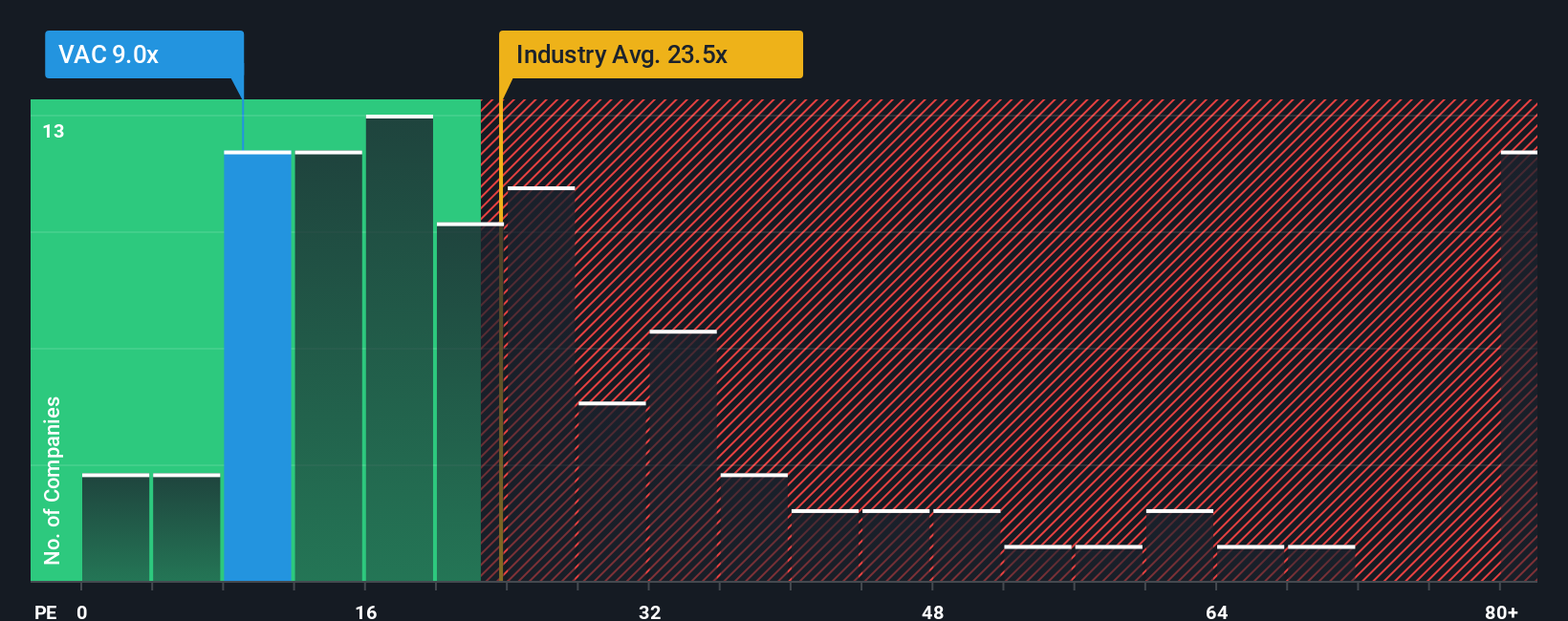

The Price-to-Earnings (PE) ratio is a widely recognized metric for valuing profitable companies like Marriott Vacations Worldwide. Since it compares a company’s stock price to its earnings, it provides a straightforward way for investors to gauge how much they are paying for each dollar of profit the company generates.

Growth expectations and risk are critical in shaping what investors consider a "normal" or "fair" PE ratio. Companies with stronger earnings growth or lower risk profiles typically command higher PE ratios, while those facing greater uncertainty often trade at lower multiples.

Marriott Vacations Worldwide currently trades at a PE ratio of 9.3x. For context, this is significantly below both the hospitality industry average of 20.8x and the average of its peers, which stands at 24.2x. At first glance, this may suggest the stock is undervalued compared to its sector and competitors.

However, Simply Wall St's proprietary "Fair Ratio" metric, at 28.7x for Marriott Vacations Worldwide, goes a step further. This Fair Ratio blends factors like earnings growth, profitability, risk profile, market capitalization, and sector dynamics to provide a more holistic and individualized benchmark. Unlike a simple industry comparison, the Fair Ratio highlights the unique strengths and risks facing each company to offer a more accurate sense of what the multiple should be.

Looking at Marriott Vacations Worldwide’s current PE ratio of 9.3x versus the Fair Ratio of 28.7x, the company appears deeply undervalued on this measure.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1416 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Marriott Vacations Worldwide Narrative

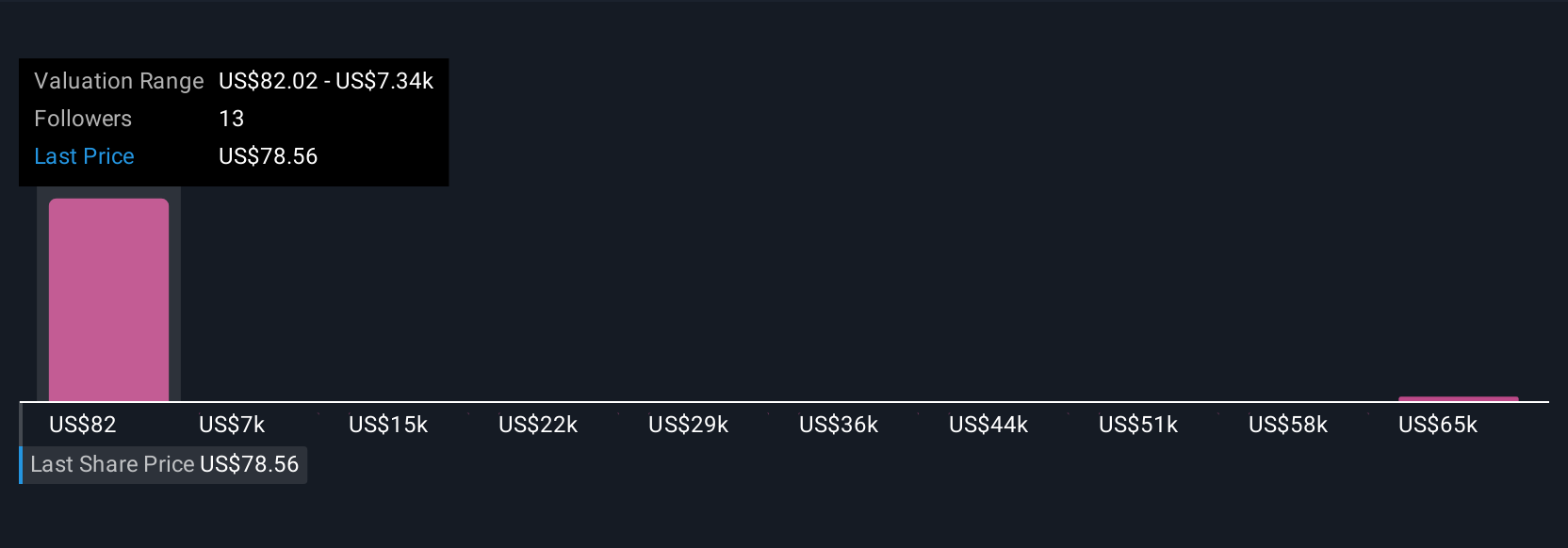

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your opportunity to connect the actual story behind Marriott Vacations Worldwide, such as customer trends, modernization, or market risks, to the financial forecasts and fair value you believe best reflect reality.

Instead of just comparing ratios and price targets, Narratives let you outline what you expect for the company’s future revenue, profit margins, or risks, and see how those assumptions affect what you think the shares are really worth. This approach creates a direct link between your perspective and the numbers, helping you translate business trends into actionable investment insight.

Narratives are easy to create and update on the Simply Wall St Community page, and are used by millions of investors worldwide to guide their buy or sell decisions by comparing the Fair Value from their Narrative with the current market Price.

As fresh news or results come in, Narratives update in real time, so your view of the stock stays relevant and aligned with the latest facts. For example, some investors may craft a bullish Narrative around rapid modernization and loyalty growth, arriving at a fair value of $127 per share. Others may worry about rising costs and shrinking margins, setting their Narrative around a much lower $65 per share.

Do you think there's more to the story for Marriott Vacations Worldwide? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VAC

Marriott Vacations Worldwide

A vacation company, engages in the vacation ownership, exchange, rental, and resort and property management businesses in the United States and internationally.

Undervalued with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives