- United States

- /

- Hospitality

- /

- NYSE:TNL

Is Raised 2025 Guidance and Share Buybacks Changing the Investment Case for Travel + Leisure (TNL)?

Reviewed by Sasha Jovanovic

- On October 22, 2025, Travel + Leisure Co. reported higher third quarter sales, revenue, and net income year over year, raised its full-year 2025 guidance for Gross VOI sales to between US$2.45 billion and US$2.50 billion, and disclosed repurchasing 1,168,760 shares for US$70.01 million in the quarter.

- These developments highlight stronger consumer demand and management’s confidence in the company’s growth outlook while also underscoring a consistent focus on returning capital to shareholders.

- We’ll explore how the raised 2025 earnings guidance informs Travel + Leisure’s investment narrative and future growth expectations.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Travel + Leisure Investment Narrative Recap

Shareholders in Travel + Leisure need to believe in strong, recurring demand for vacation ownership and the company’s ability to expand beyond its US core, while staying alert to persistent headwinds in the travel and membership segment. The recent guidance raise and solid third-quarter results primarily support the near-term sales catalyst, but do not appear to materially address the ongoing structural challenges from industry consolidation or the risk of shifting consumer preferences.

The most relevant announcement is the updated 2025 gross VOI sales guidance, now raised to between US$2.45 billion and US$2.50 billion, indicating management’s expectations for continued demand in its core business during the current year. This is particularly important given the company’s reliance on the vacation ownership segment for revenue growth and investor confidence.

But on the flip side, investors should be aware that persistent membership segment headwinds could still weigh on...

Read the full narrative on Travel + Leisure (it's free!)

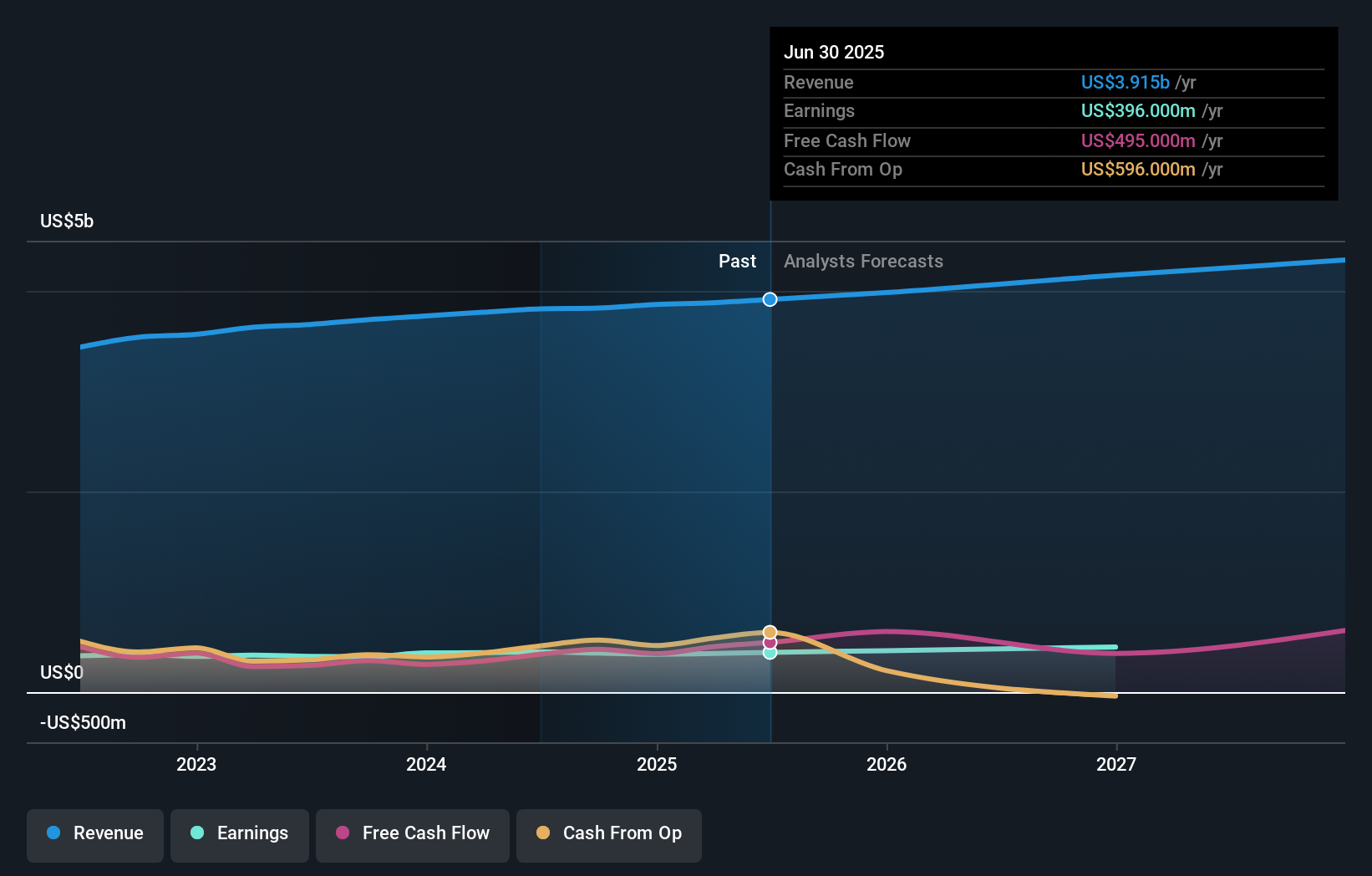

Travel + Leisure's outlook anticipates $4.4 billion in revenue and $506.9 million in earnings by 2028. This scenario assumes a 3.9% annual revenue growth rate and a $110.9 million increase in earnings from the current $396.0 million level.

Uncover how Travel + Leisure's forecasts yield a $73.18 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided four fair value estimates for TNL ranging from US$43.13 to a striking US$61,186.95. While some see substantial growth potential, others have flagged that concentration in vacation ownership revenue remains a key issue for long-term performance, explore these diverse viewpoints to inform your understanding.

Explore 4 other fair value estimates on Travel + Leisure - why the stock might be a potential multi-bagger!

Build Your Own Travel + Leisure Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Travel + Leisure research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Travel + Leisure research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Travel + Leisure's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Travel + Leisure might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TNL

Travel + Leisure

Provides hospitality services and travel products in the United States and internationally.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives