- United States

- /

- Consumer Services

- /

- NYSE:STUB

StubHub Holdings (STUB) Is Down 23.5% After Loss Widens Despite Higher Sales—Does Profit Path Remain Unclear?

Reviewed by Sasha Jovanovic

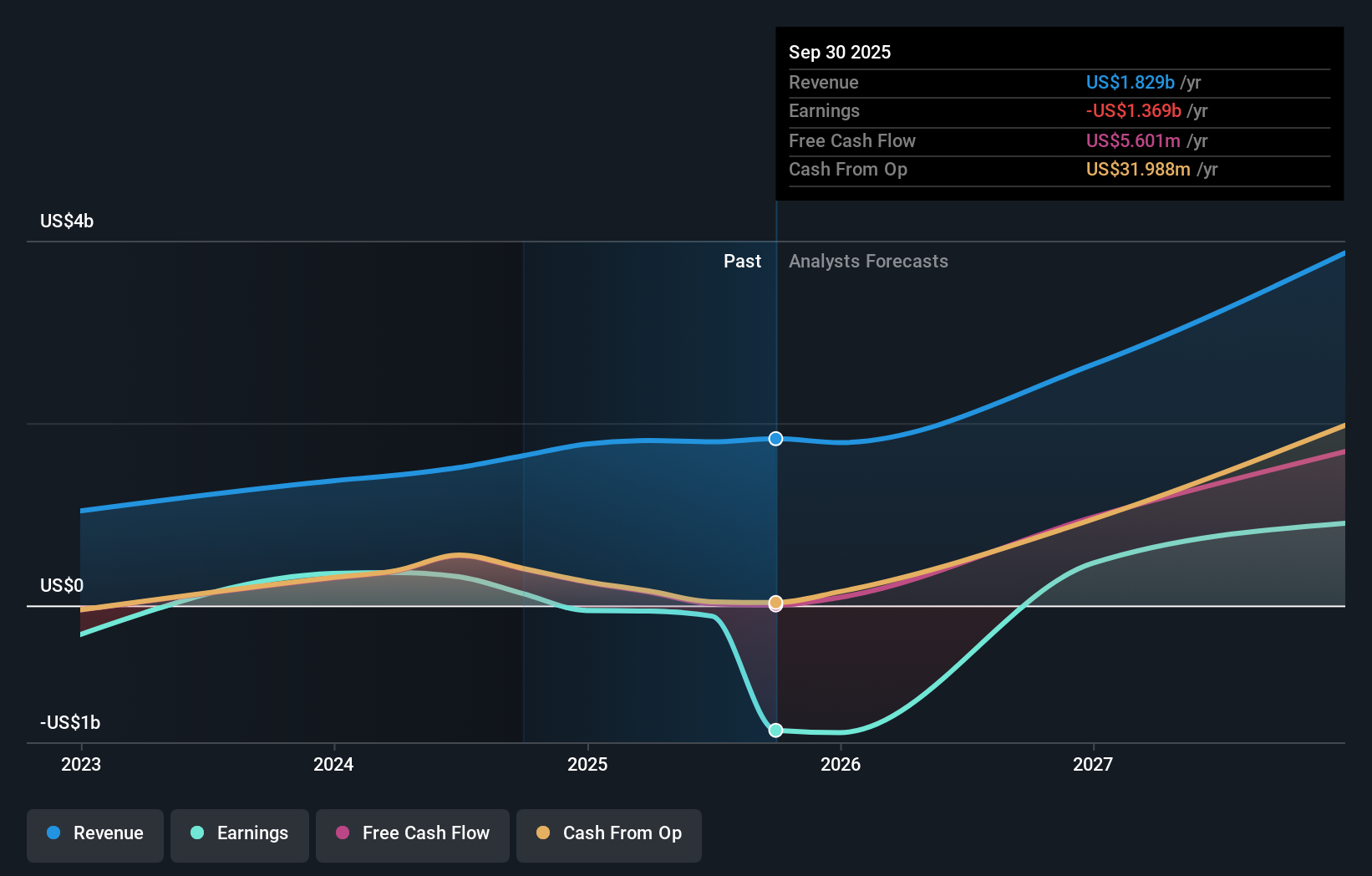

- On November 13, 2025, StubHub Holdings announced its third quarter results, reporting sales of US$468.11 million but a net loss of US$1.29 billion, compared to a net loss of US$33.01 million in the same period last year.

- The sharp increase in net losses despite higher sales is drawing attention, with year-to-date net losses also rising significantly from a year ago.

- We'll examine how StubHub Holdings' widening losses amid sales growth impact its investment story and long-term business outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is StubHub Holdings' Investment Narrative?

To be a StubHub Holdings shareholder right now, you really need to believe in the power of ticketing technology and the long-term shift to digital platforms for live events. The appeal remains rooted in strong revenue growth forecasts and recent partnerships, such as the tie-up with Peachtree Entertainment, which could expand StubHub’s reach in live music. However, the third quarter results bring fresh reasons for concern. The company’s net loss ballooned to US$1.29 billion despite higher sales, far outpacing prior period losses and signaling that profitability is a much steeper hill than many anticipated. This turn may reshape short-term investor focus, since increasing losses could potentially weigh on planned growth investments and may require the company to re-examine its strategy. The risk profile has shifted: capital management and expense control may need even closer attention after such a sharp earnings miss.

But could rising losses threaten some of StubHub’s most promising growth plans? Investors should know.

Exploring Other Perspectives

Explore 3 other fair value estimates on StubHub Holdings - why the stock might be a potential multi-bagger!

Build Your Own StubHub Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your StubHub Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free StubHub Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate StubHub Holdings' overall financial health at a glance.

No Opportunity In StubHub Holdings?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:STUB

StubHub Holdings

Operates ticketing marketplace for live event tickets worldwide.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives