- United States

- /

- Hospitality

- /

- NYSE:SHAK

Is Shake Shack’s Value Changing After Recent Store Openings and Menu Launches?

Reviewed by Bailey Pemberton

- Ever found yourself wondering if Shake Shack's stock is a savvy buy or just riding the wave of hype? This is a good time to get clear on what the numbers really say about its value.

- After a 5.0% gain over the last month but a sharp 31.6% drop year-to-date, Shake Shack’s recent price swings have caught plenty of investor attention.

- Adding fuel to the movement, news around new store openings and innovative menu launches have sparked renewed optimism about the company’s growth trajectory. At the same time, industry-wide volatility keeps some investors on their toes. Headlines recently highlighted Shake Shack’s strategic expansion and shake-ups in fast-casual dining, which offer important context behind these price moves.

- Currently, Shake Shack scores just 1 out of 6 on our valuation checks, meaning only one metric signals it may be undervalued. Let’s break down the standard approaches to valuation first, but keep reading for an even smarter way to make sense of Shake Shack’s true worth.

Shake Shack scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Shake Shack Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and discounting them back to today’s dollars. This method relies on expectations for both near-term and long-term free cash flow, adjusting for the time value of money.

For Shake Shack, the current Free Cash Flow sits at $38.87 Million. Analysts expect continuing growth, with free cash flow projected to reach around $179 Million by the end of 2029. Professional analysts provide forecasts for the next five years, while longer-term growth out to 2035 is estimated using trends and expert models. This approach helps address uncertainties beyond the analyst consensus window.

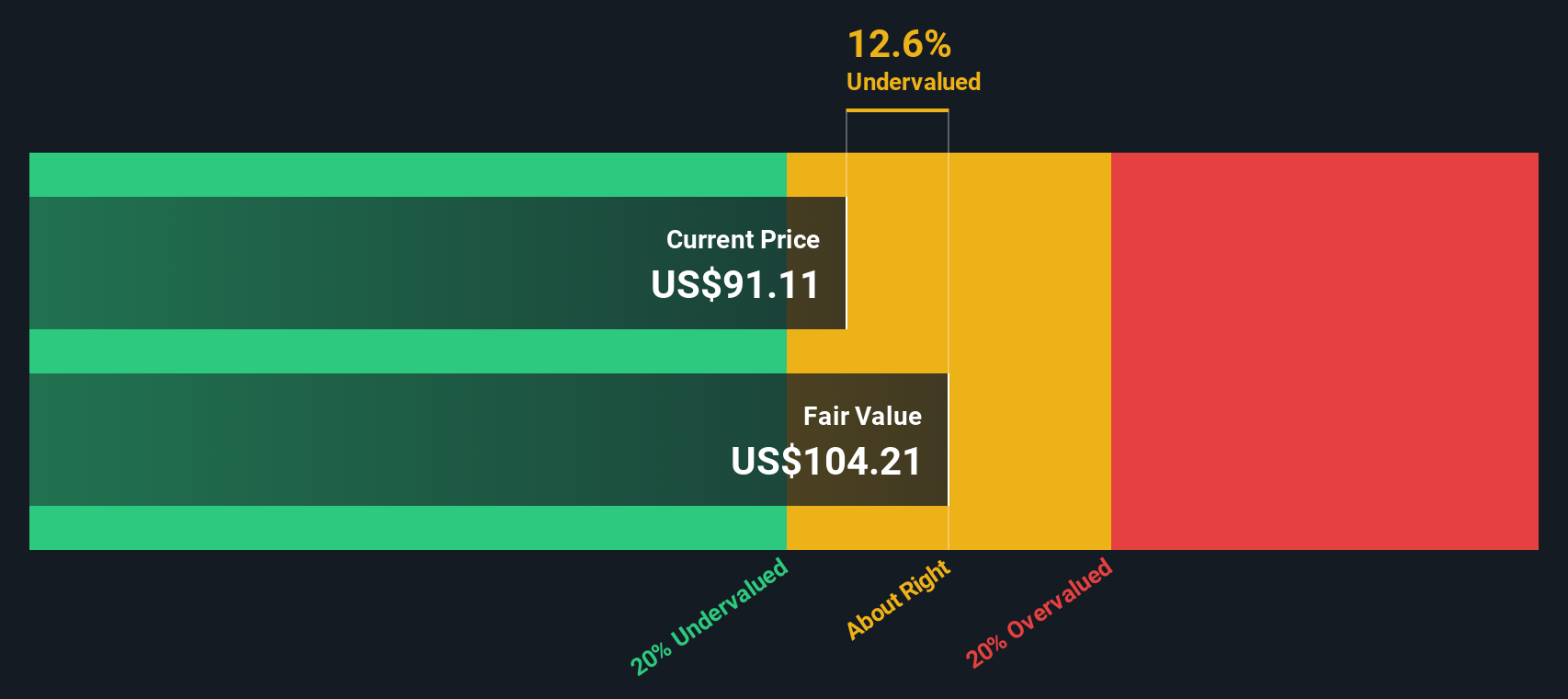

Based on these projections, the DCF model calculates an intrinsic value of $104.21 per share. With the stock currently trading about 12.6% below this level, the model indicates the shares are undervalued compared to their projected future cash generation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Shake Shack is undervalued by 12.6%. Track this in your watchlist or portfolio, or discover 874 more undervalued stocks based on cash flows.

Approach 2: Shake Shack Price vs Earnings (PE Ratio)

For profitable companies like Shake Shack, the Price-to-Earnings (PE) ratio is a widely used benchmark to gauge valuation. The PE ratio compares a company's share price to its earnings per share, offering a quick snapshot of how highly investors value its current profits.

Growth expectations and risk play a big role in what is considered a normal or fair PE ratio. Companies with stronger growth prospects or more stable earnings typically justify a higher PE, while those facing uncertainty or industry challenges tend to trade at a lower multiple.

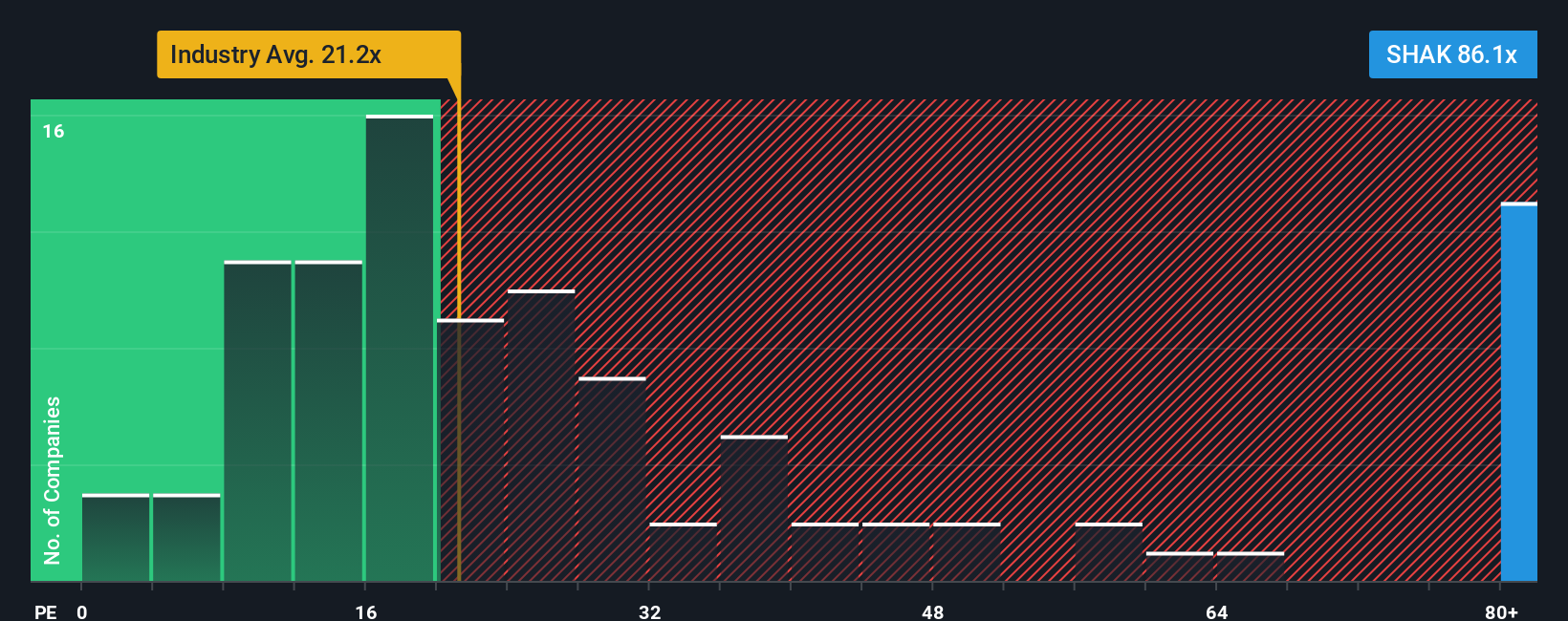

Currently, Shake Shack trades at a PE ratio of 86.08x, which is significantly higher than both the hospitality industry average of 21.15x and the peer average of 21.40x. At first glance, this suggests the market is placing a premium on Shake Shack’s future growth or unique positioning.

However, Simply Wall St’s proprietary “Fair Ratio” takes a more tailored approach. This metric considers Shake Shack’s earnings growth, sector dynamics, profit margins, company size, and risk factors, arriving at a Fair Ratio of 27.31x. Unlike using broad industry averages, the Fair Ratio is designed to capture the specific circumstances affecting Shake Shack and therefore provides a more meaningful assessment.

Comparing Shake Shack’s actual PE ratio (86.08x) with its Fair Ratio (27.31x), the current share price appears to reflect significantly higher expectations than fundamentals alone would justify.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1404 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Shake Shack Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. Rather than only relying on numbers, a Narrative lets you craft your perspective on Shake Shack by linking the company’s story, your views on its potential, risks, and drivers, directly to specific forecasts for revenue, profit margins, and fair value.

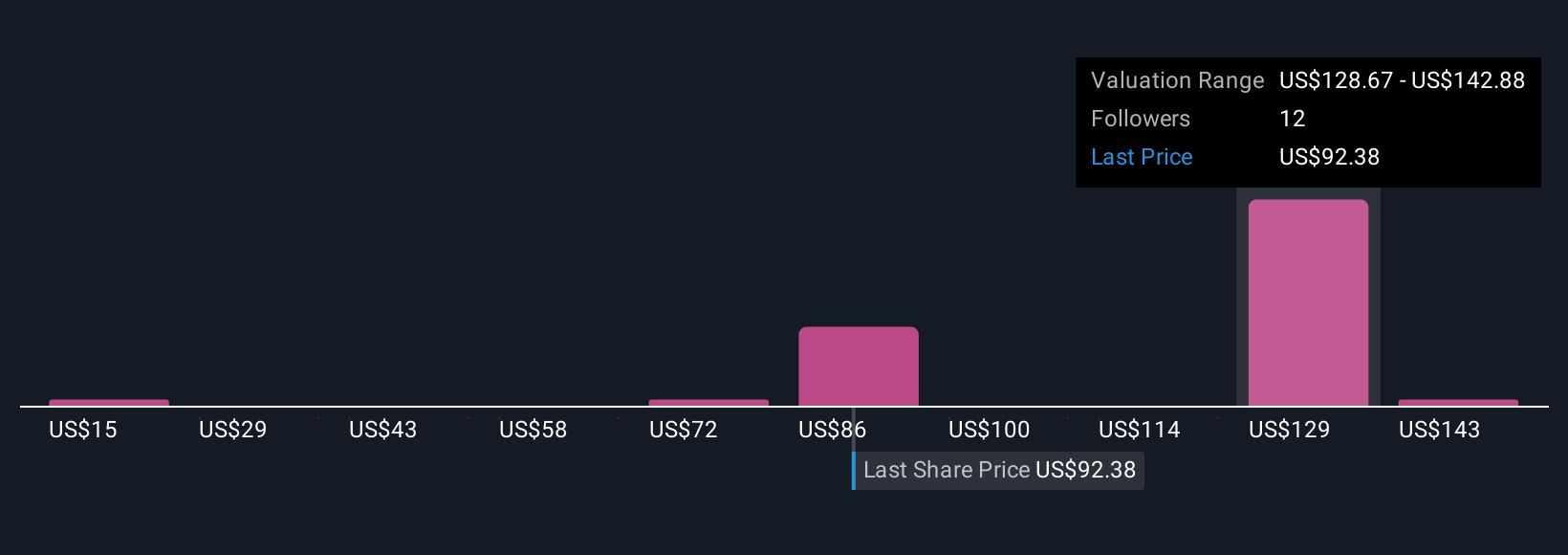

This approach is about more than just plugging in formulas. It is about anchoring your investment decision to your own understanding of what matters most for Shake Shack’s future. On Simply Wall St’s Community page, millions of investors use Narratives as an easy, interactive tool to connect their investment thesis with updated financial forecasts and an automatically calculated Fair Value.

Every Narrative helps you instantly weigh a new Fair Value against the current share price, guiding you on whether it is the right time to buy, hold, or sell. Narratives refresh dynamically as news breaks or results are reported, so your views and valuations always stay relevant.

For example, one investor might believe menu innovation and global expansion will drive strong earnings, leading them to a Narrative with a fair value as high as $162 per share. Another, more cautious investor might focus on rising costs and sector headwinds, seeing fair value closer to $110. Which fits your view?

Do you think there's more to the story for Shake Shack? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SHAK

Shake Shack

Owns, operates, and licenses Shake Shack restaurants (Shacks) in the United States and internationally.

Solid track record with reasonable growth potential.

Market Insights

Community Narratives