- United States

- /

- Hospitality

- /

- NYSE:SGHC

Super Group (SGHC): Assessing Valuation Following Upgraded Growth Guidance and Bullish Analyst Sentiment

Reviewed by Simply Wall St

Super Group (NYSE:SGHC) recently lifted its full-year revenue and adjusted EBITDA guidance, a move that suggests management sees continued growth ahead. This update, along with supportive analyst consensus, is getting investors’ attention.

See our latest analysis for Super Group (SGHC).

Super Group (SGHC) has seen its share price surge an impressive 92.8% year-to-date, reflecting growing investor confidence after its upgraded revenue forecasts and continued public support from commentators. Momentum has been building, and its three-year total shareholder return of 316% underscores a strong long-term trend.

If faster-than-expected growth stories like this catch your interest, now is a good time to broaden your investing horizons and discover fast growing stocks with high insider ownership

With shares running nearly 93% higher this year and analysts still seeing almost 49% upside, is Super Group an overlooked value play, or is the stock already reflecting all its promising growth ahead?Most Popular Narrative: 32.8% Undervalued

Super Group (SGHC)'s fair value is estimated at $18 according to the most widely followed narrative, setting it well above the recent close of $12.09. This sets the stage for a deeper look at the bullish outlook driving this conviction.

Accelerated investment in technology, including the addition of a Group CTO and scaling AI/data-driven initiatives, is enhancing product offerings, automating processes, and driving cost and marketing efficiencies. This may lead to structurally higher EBITDA margins and improved free cash flow. The shift of resources away from the unprofitable U.S. iGaming business toward high-return/core markets is expected to improve overall profitability and enable higher incremental margin capture as revenue grows, strengthening future net income and margin profile.

Curious which aggressive growth levers justify this valuation? The secret sauce is a blend of bold earnings acceleration and higher profit margins. Find out what assumptions underlie the eye-catching fair value by exploring the full narrative. This could surprise even seasoned investors.

Result: Fair Value of $18 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, tightening regulations and the unpredictable impact of exiting key markets could pose challenges for Super Group's ability to sustain its rapid growth trajectory.

Find out about the key risks to this Super Group (SGHC) narrative.

Another View: Is the Market Paying Too Much?

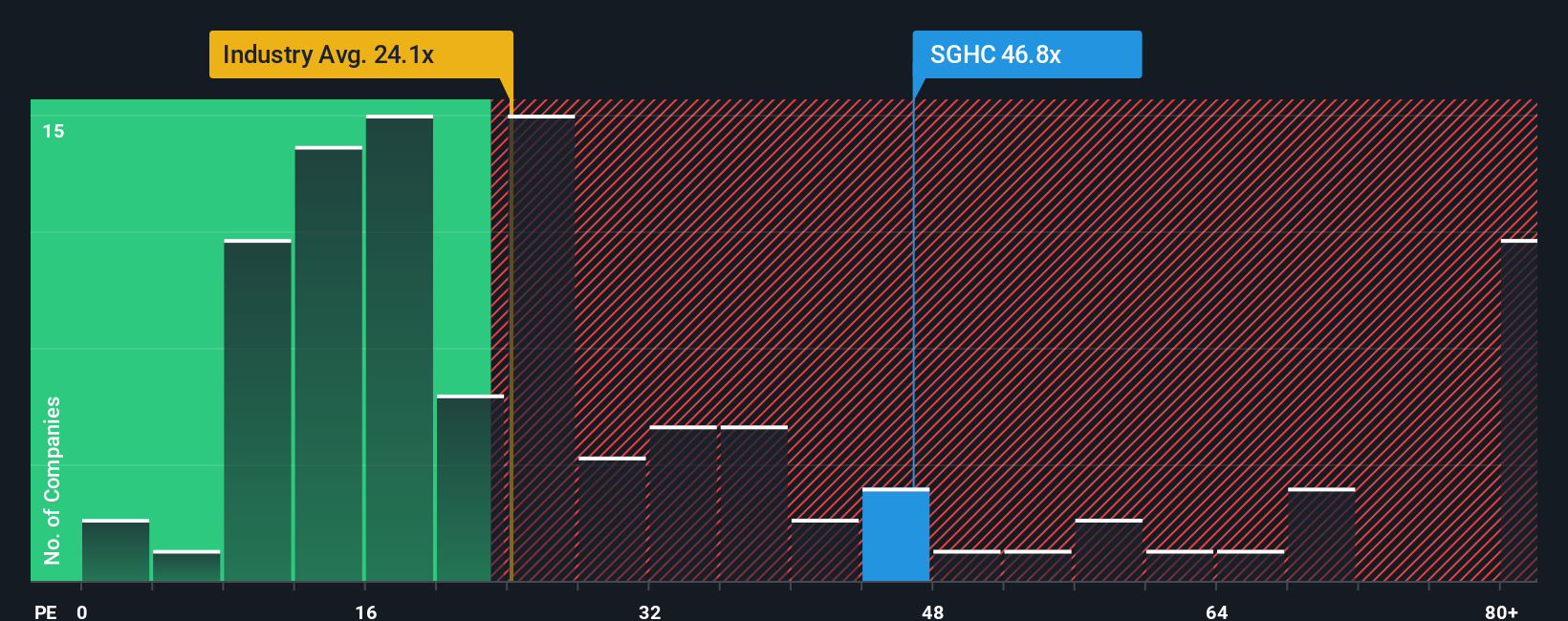

Looking from a different angle, Super Group trades at a price-to-earnings ratio of 26.5x. This is higher than its peer average of 24.5x and the US Hospitality industry average of 20.8x. While this points to confidence in future growth, it also signals greater valuation risk if expectations are missed. Will this premium prove justified, or does it leave little room for disappointment?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Super Group (SGHC) Narrative

If you see things differently or want to dive into the details yourself, it's quick and easy to shape your own view of Super Group. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Super Group (SGHC).

Looking for More Investment Ideas?

Uncover smart opportunities beyond Super Group and get ahead of the crowd. These handpicked screens can help you zero in on tomorrow’s standout stocks.

- Supercharge your portfolio with potential high-flyers by checking out these 3582 penny stocks with strong financials that are making waves with robust fundamentals and breakthrough momentum.

- Capture long-term income and stability by targeting these 14 dividend stocks with yields > 3% which offer attractive yields well above the market average.

- Benefit from the AI revolution by seeking out these 26 AI penny stocks at the forefront of automation, machine learning, and next-level innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SGHC

Super Group (SGHC)

Operates as an online sports betting and gaming operator.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success