- United States

- /

- Hospitality

- /

- NYSE:SG

Does Sweetgreen's Same-Store Sales Decline Revise the Growth Story for SG?

Reviewed by Sasha Jovanovic

- Sweetgreen recently reported its third quarter 2025 results, with sales of US$172.39 million and a net loss of US$36.15 million, alongside updated full-year guidance projecting revenue between US$682 million and US$688 million and a Same-Store Sales Change of 7.7% to 8.5% decline.

- An interesting aspect is that despite continued menu innovation, including the release of a new Late Fall Menu, the company still expects declines in same-store sales for the fiscal year.

- We'll examine how Sweetgreen's lowered same-store sales outlook for 2025 influences its investment narrative and future prospects.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Sweetgreen Investment Narrative Recap

To be a Sweetgreen shareholder, one must rely on the idea that menu innovation and expanded digital engagement can revive sales growth and push the company toward profitability, despite ongoing losses. The company's revised outlook for 2025, projecting a 7.7% to 8.5% same-store sales decline alongside lower revenue guidance, directly challenges near-term recovery hopes. This downward adjustment matters as it reinforces the short-term risk that ongoing same-store sales weakness may signal deeper demand or market saturation concerns, rather than just temporary headwinds.

Among recent announcements, the Late Fall Menu launch highlights Sweetgreen’s continued push into seasonal, health-focused menu offerings. While this return to culinary creativity may help sustain brand engagement, it has yet to reverse or materially offset the same-store sales declines reflected in the latest guidance. How effective such limited-time menu moves are in reigniting sales momentum is still an open question for investors watching top-line catalysts.

In contrast, even as seasonal menus roll out, the persistent negative same-store sales trends remain a crucial detail investors should not overlook...

Read the full narrative on Sweetgreen (it's free!)

Sweetgreen's narrative projects $1.0 billion in revenue and $84.5 million in earnings by 2028. This requires 14.5% yearly revenue growth and a $182.5 million improvement in earnings from the current $-98.0 million.

Uncover how Sweetgreen's forecasts yield a $11.46 fair value, a 83% upside to its current price.

Exploring Other Perspectives

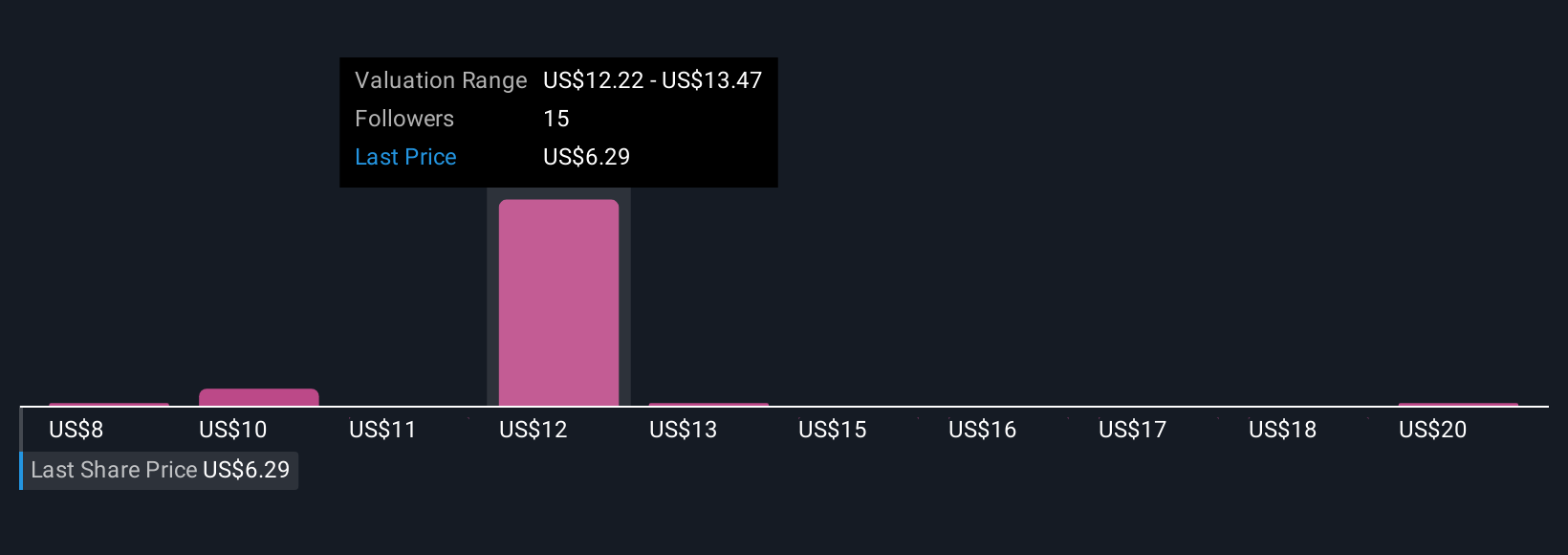

Six Simply Wall St Community fair value estimates for Sweetgreen range from US$8.45 to US$21 per share, revealing wide variance in user views. Against this backdrop, the pronounced risk of ongoing same-store sales declines looms large for future business performance; review these varied perspectives to consider all sides.

Explore 6 other fair value estimates on Sweetgreen - why the stock might be worth over 3x more than the current price!

Build Your Own Sweetgreen Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sweetgreen research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Sweetgreen research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sweetgreen's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SG

Sweetgreen

Operates fast food restaurants serving healthy food and beverages in the United States.

Excellent balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives