- United States

- /

- Consumer Services

- /

- NYSE:SCI

SCI's Upbeat Cash Flow Outlook Might Change the Case for Investing in Service Corporation International

Reviewed by Simply Wall St

- Service Corporation International reported second quarter 2025 earnings that exceeded analyst expectations, with revenue rising to US$1.07 billion and net income increasing to US$122.87 million compared to the same period last year.

- The company reaffirmed its full-year guidance and raised its 2025 cash flow outlook, citing operational improvements, lower cash taxes, and effective cost management as key contributors.

- We'll now examine how the company's improved cash flow guidance influences its investment narrative and prospects moving forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Service Corporation International Investment Narrative Recap

To be a shareholder in Service Corporation International, you need to believe in the company's ability to stabilize and grow preneed sales as it continues its transition to an insurance-funded model, while managing costs and maintaining consistent operating margins. The recent earnings report shows stronger-than-expected revenue and net income, and management’s raised cash flow outlook supports the view that the transition is gaining traction; however, it does not eliminate the near-term risk of lower preneed funeral sales production during this changeover period.

The company’s confirmation of its 2025 diluted EPS guidance of US$3.70 to US$4.00 stands out as the most applicable announcement in light of the new financials. This guidance reaffirms SCI's expectations for solid earnings, aligning with improved cash flow and highlighting the importance of sustained cost controls during a period of evolving revenue streams. However, with the insurance-funded preneed transition still underway, near-term variation in sales production remains a key issue to monitor.

Yet, in contrast to these reaffirmed strengths, investors should not overlook the possibility that ongoing volatility in large cemetery sales could...

Read the full narrative on Service Corporation International (it's free!)

Service Corporation International's narrative projects $4.6 billion revenue and $652.8 million earnings by 2028. This requires 3.1% yearly revenue growth and a $122.6 million earnings increase from $530.2 million.

Uncover how Service Corporation International's forecasts yield a $89.80 fair value, a 15% upside to its current price.

Exploring Other Perspectives

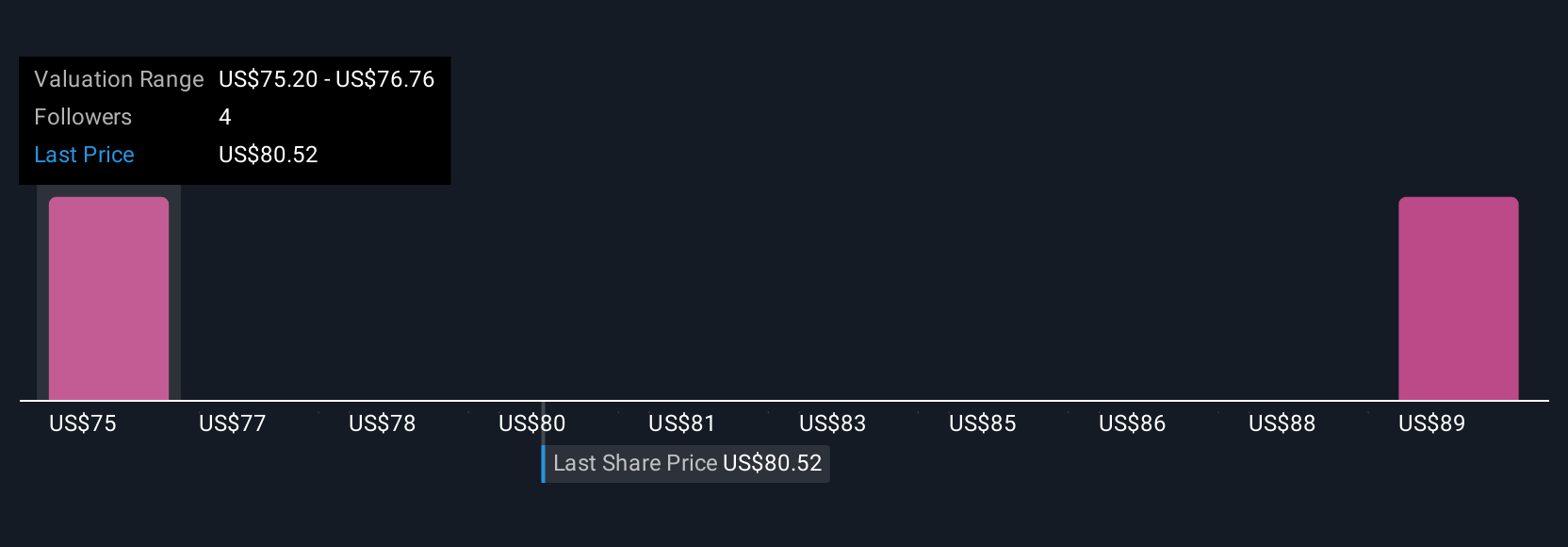

Fair value estimates from the Simply Wall St Community range from US$73.40 to US$89.80 across two unique viewpoints. As changes to preneed sales production continue, this diversity reminds you to closely consider how company transitions could influence both margin expectations and future cash flows.

Explore 2 other fair value estimates on Service Corporation International - why the stock might be worth as much as 15% more than the current price!

Build Your Own Service Corporation International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Service Corporation International research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Service Corporation International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Service Corporation International's overall financial health at a glance.

No Opportunity In Service Corporation International?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 25 companies in the world exploring or producing it. Find the list for free.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SCI

Service Corporation International

Provides deathcare products and services in the United States and Canada.

Established dividend payer with limited growth.

Similar Companies

Market Insights

Community Narratives