- United States

- /

- Consumer Services

- /

- NYSE:SCI

SCI’s $324 Million One-Off Gain Challenges Earnings Quality Narrative for Service Corporation International

Reviewed by Simply Wall St

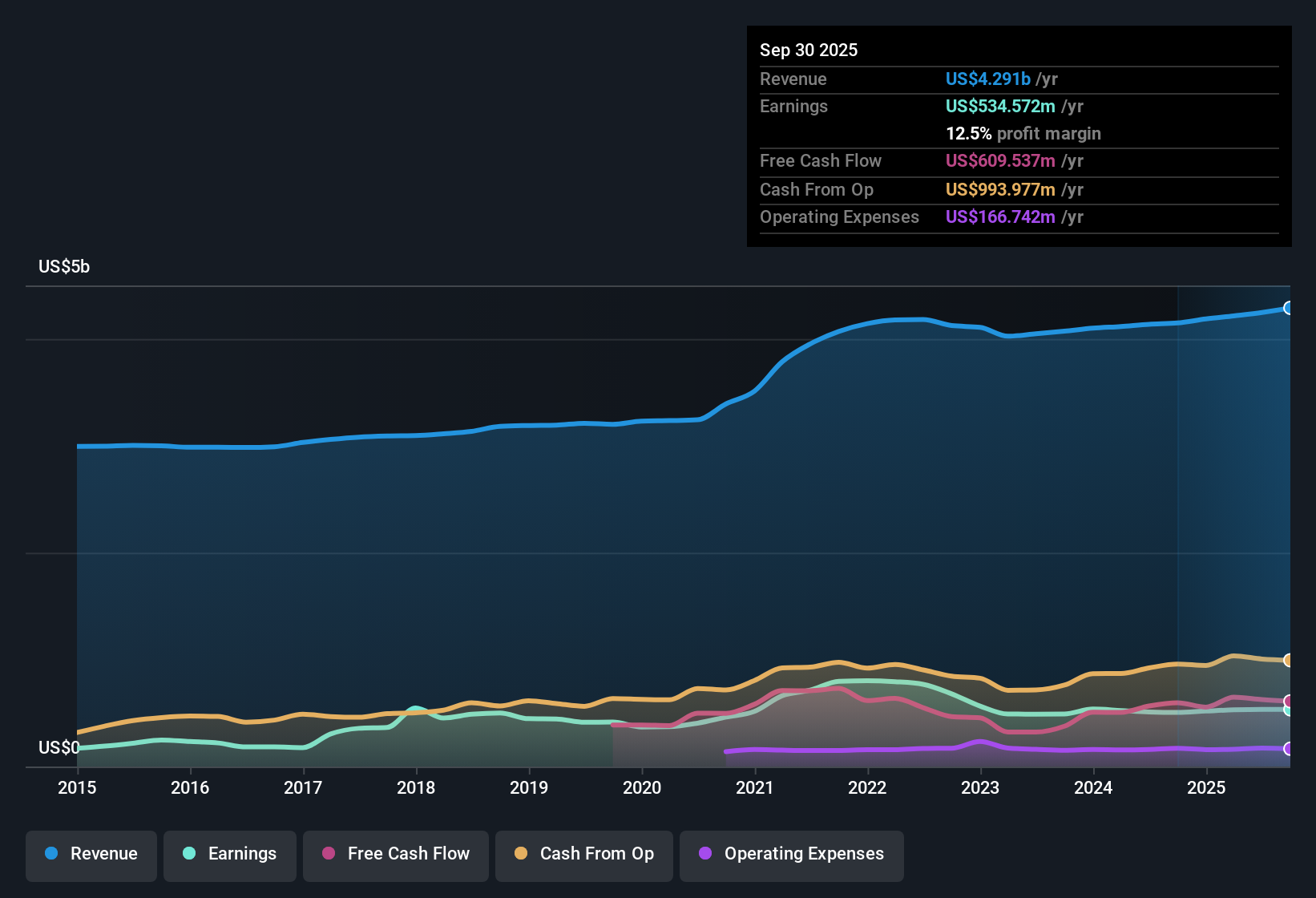

Service Corporation International (SCI) reported net profit margins of 12.5%, edging up from 12.2% a year ago, with earnings growth of 5.7% for the year outpacing its longer-term five-year average decline of 6.1% per year. The most recent results were boosted by a one-off gain of $323.9 million, and shares now trade at $83.77, which is below an estimated fair value of $102.51. As investors weigh projected earnings growth of 7.9% per year and attractive dividend characteristics against a few minor risks, such as earnings quality from non-recurring items and a higher price-to-earnings ratio than peers, the overall mix shapes sentiment around SCI’s latest performance.

See our full analysis for Service Corporation International.Next, we will put these headline numbers in context by comparing them with the current narratives that investors and analysts are following for SCI, highlighting where the results reinforce expectations and where they challenge them.

See what the community is saying about Service Corporation International

Preneed Sales Fuel Recurring Revenue

- Growth in preneed funeral and cemetery sales stands out as a driver of predictable, recurring revenue streams and improved earnings visibility, with recent analyst expectations for revenue to grow by 3.5% annually over the next three years.

- According to the analysts' consensus narrative, steady installment receipts for prearranged cemetery services and rising consumer engagement with advance planning bolster the company's cash flow stability.

- This level of advance purchase activity supports future cash inflows and offers a hedge against unexpected dips in at-need service demand.

- Momentum in advance planning trends is expected to accelerate earnings predictability well into 2026, aligning with demographic tailwinds from an aging U.S. population.

- What’s most notable is how the upward trend in preneed sales aligns with analyst projections for margin expansion. This gives investors additional confidence in the sustainability of SCI’s cash flow generation. 📊 Read the full Service Corporation International Consensus Narrative.

Acquisitions and Digital Push Expand Market Reach

- Investments in acquisitions, digital transformation, and greenfield sites are a major part of SCI’s capital allocation strategy, with targeted annual acquisition spending between $75 million and $125 million to continue consolidating the highly fragmented deathcare market.

- Consensus narrative notes these efforts are expected to drive long-term top-line growth and operating leverage.

- Continuous expansion underpins higher revenue potential, with stabilized consumer payment patterns for prearranged services supporting digital sales initiatives.

- Strategic focus on technology is designed to not only capture more market share but also increase average revenue per service, countering lower-margin trends from the rise in cremations.

Valuation: Trades Below DCF Fair Value Despite Premium to Peers

- SCI shares currently trade at $83.77, which is not only below the DCF fair value estimate of $102.51, but also at a 22x Price-to-Earnings ratio, higher than both the industry average of 17.2x and the peer average of 15.3x.

- Under the analysts’ consensus view, this valuation premium reflects moderate but stable margin expansion, positive dividend characteristics, and the company’s ability to generate profit growth even as market-wide growth expectations remain higher.

- Investors may see the current discount to the DCF fair value as an opportunity, as long as SCI continues to deliver on the consensus outlook for higher future profit margins and recurring revenue.

- At the same time, elevated price multiples signal that the market is already factoring in a good portion of this growth, so any shortfall versus expected performance may be met with sharper downside than for peers.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Service Corporation International on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own interpretation of SCI's results? Take just a few minutes to shape your perspective and present your individual narrative. Do it your way.

A great starting point for your Service Corporation International research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

While SCI’s premium price-to-earnings ratio signals confidence, it also means much of the expected growth is already reflected in the share price. This leaves little room for disappointment.

If you want to focus on opportunities where upside potential isn’t already priced in, check out these 850 undervalued stocks based on cash flows that may offer a better value proposition right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SCI

Service Corporation International

Provides deathcare products and services in the United States and Canada.

Established dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives