- United States

- /

- Hospitality

- /

- NYSE:RCL

Is Royal Caribbean’s Expanded Caribbean Lineup and Samana Return Shaping the Investment Case for RCL?

Reviewed by Sasha Jovanovic

- Royal Caribbean recently unveiled an expanded lineup of Caribbean vacations for 2027-28, featuring new destinations like Samana in the Dominican Republic, enhanced ship deployments, and exclusive access to premier beach clubs in The Bahamas and Mexico.

- The new offerings highlight the company’s continued investment in guest experiences and destination variety, further positioning Royal Caribbean as a key innovator in the cruise industry.

- We'll explore how Royal Caribbean's expanded vacation lineup and return to Samana could influence its long-term investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Royal Caribbean Cruises Investment Narrative Recap

To own Royal Caribbean Cruises stock, investors need to believe in the company’s ability to sustain vacation demand and drive yield growth through continual fleet expansion and enhanced guest experiences. The latest announcement of expanded 2027-28 Caribbean itineraries, while highlighting product innovation, may not materially shift near-term catalysts, which remain focused on yield growth and managing consumer discretionary trends, nor significantly reduce the greatest current risk, potential volatility in last-minute bookings should economic sentiment falter.

Among recent developments, the introduction of “Star of the Seas” and the rollout of new beach clubs in The Bahamas and Mexico directly align with efforts to enhance guest experience and boost onboard and pre-cruise spending, a key catalyst underpinning current revenue growth targets. While these product upgrades support long-term positioning, the biggest uncertainties still hinge on how resilient consumer booking patterns will prove in an unpredictable macro environment.

By contrast, investors should remain aware that unexpected shifts in consumer confidence or booking behavior...

Read the full narrative on Royal Caribbean Cruises (it's free!)

Royal Caribbean Cruises is projected to reach $22.4 billion in revenue and $5.9 billion in earnings by 2028. This outlook assumes a 9.2% annual revenue growth rate and reflects a $2.3 billion increase in earnings from the current $3.6 billion.

Uncover how Royal Caribbean Cruises' forecasts yield a $344.09 fair value, a 31% upside to its current price.

Exploring Other Perspectives

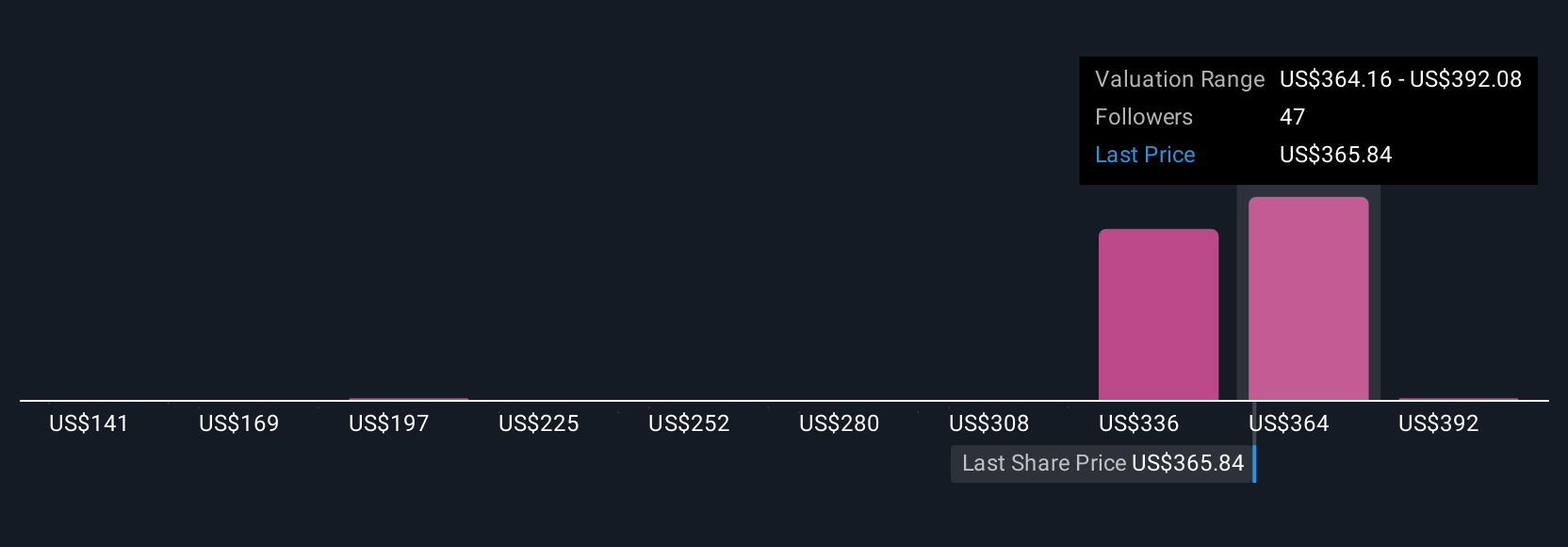

Ten separate fair value estimates from the Simply Wall St Community span US$214 to US$440.34 per share. Opinions differ, especially as yield growth initiatives compete with risks of booking volatility, so consider several viewpoints before making decisions.

Explore 10 other fair value estimates on Royal Caribbean Cruises - why the stock might be worth as much as 67% more than the current price!

Build Your Own Royal Caribbean Cruises Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Royal Caribbean Cruises research is our analysis highlighting 5 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Royal Caribbean Cruises research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Royal Caribbean Cruises' overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RCL

Very undervalued with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives