Stock Analysis

- United States

- /

- Hospitality

- /

- NYSE:QSR

Here's Why Restaurant Brands International (NYSE:QSR) Has Caught The Eye Of Investors

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Restaurant Brands International (NYSE:QSR). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for Restaurant Brands International

Restaurant Brands International's Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That means EPS growth is considered a real positive by most successful long-term investors. Restaurant Brands International managed to grow EPS by 12% per year, over three years. That's a good rate of growth, if it can be sustained.

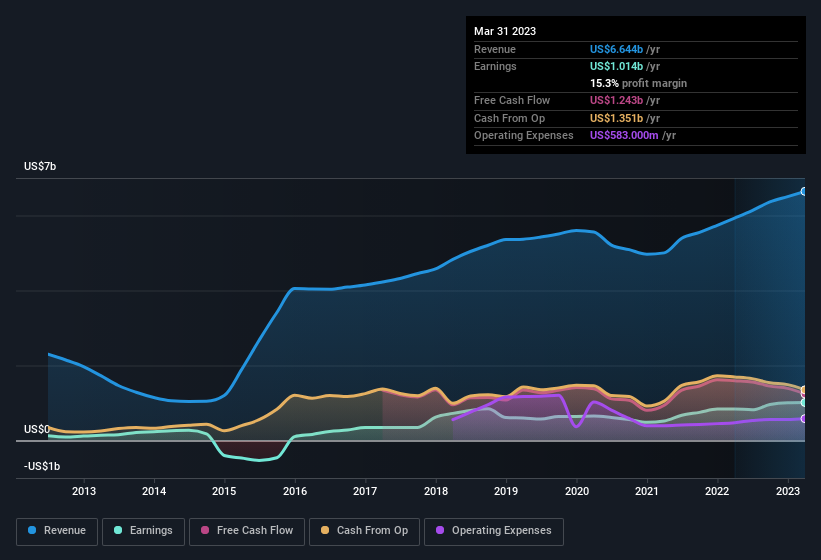

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. While Restaurant Brands International did well to grow revenue over the last year, EBIT margins were dampened at the same time. So if EBIT margins can stabilize, this top-line growth should pay off for shareholders.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Restaurant Brands International.

Are Restaurant Brands International Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The US$14m worth of shares that insiders sold during the last 12 months pales in comparison to the US$30m they spent on acquiring shares in the company. We find this encouraging because it suggests they are optimistic about Restaurant Brands International'sfuture. It is also worth noting that it was Executive Chairman J. Doyle who made the biggest single purchase, worth US$30m, paying US$60.77 per share.

On top of the insider buying, it's good to see that Restaurant Brands International insiders have a valuable investment in the business. Indeed, they have a considerable amount of wealth invested in it, currently valued at US$347m. Holders should find this level of insider commitment quite encouraging, since it would ensure that the leaders of the company would also experience their success, or failure, with the stock.

Should You Add Restaurant Brands International To Your Watchlist?

One important encouraging feature of Restaurant Brands International is that it is growing profits. In addition, insiders have been busy adding to their sizeable holdings in the company. That should do plenty in prompting budding investors to undertake a bit more research - or even adding the company to their watchlists. Even so, be aware that Restaurant Brands International is showing 3 warning signs in our investment analysis , and 1 of those is a bit unpleasant...

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Restaurant Brands International, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're helping make it simple.

Find out whether Restaurant Brands International is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:QSR

Restaurant Brands International

Operates as a quick-service restaurant company in Canada, the United States, and internationally.

Solid track record and good value.