- United States

- /

- Hospitality

- /

- NYSE:MGM

Will Las Vegas Pricing Shifts and Share Buybacks Reshape MGM Resorts International's (MGM) Investment Story?

Reviewed by Sasha Jovanovic

- In the past week, MGM Resorts International reported third-quarter 2025 financials, revealing revenues of US$4.25 billion and a shift from net income to a net loss, while CEO Bill Hornbuckle publicly addressed pricing missteps at Las Vegas properties and discussed efforts to restore customer value.

- Alongside its earnings release, MGM finalized a new credit agreement, concluded one major share buyback program totaling over US$1.87 billion, and initiated pricing adjustments at key casino hotels to address falling guest satisfaction and visitation.

- We'll examine how MGM's focus on recalibrating Las Vegas pricing to attract and retain guests shapes its investment narrative going forward.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

MGM Resorts International Investment Narrative Recap

To stand behind MGM Resorts International as a shareholder, belief in the recovery of Las Vegas visitation and success in enhancing customer value at its flagship properties is essential. The most recent earnings decline and management’s focus on recalibrating hotel pricing directly address the near-term need to stabilize guest traffic, which remains the key catalyst, while persistent softness in value-oriented bookings is still the main risk; these updates have a moderate but not transformative impact on either in the immediate term.

Of the recent company developments, MGM's completion of a US$1.87 billion share buyback stands out. While this move returns capital to shareholders, its relevance in the context of soft earnings growth and ongoing adjustment of property pricing connects directly to short-term investor focus on margin stabilization and free cash flow strength.

But despite management’s reassurances, investors should be mindful that if declines in Las Vegas Strip visitation persist...

Read the full narrative on MGM Resorts International (it's free!)

MGM Resorts International's outlook anticipates $18.4 billion in revenue and $906.1 million in earnings by 2028. This reflects a 2.3% annual revenue growth rate and a $369.7 million increase in earnings from the current $536.4 million.

Uncover how MGM Resorts International's forecasts yield a $44.21 fair value, a 35% upside to its current price.

Exploring Other Perspectives

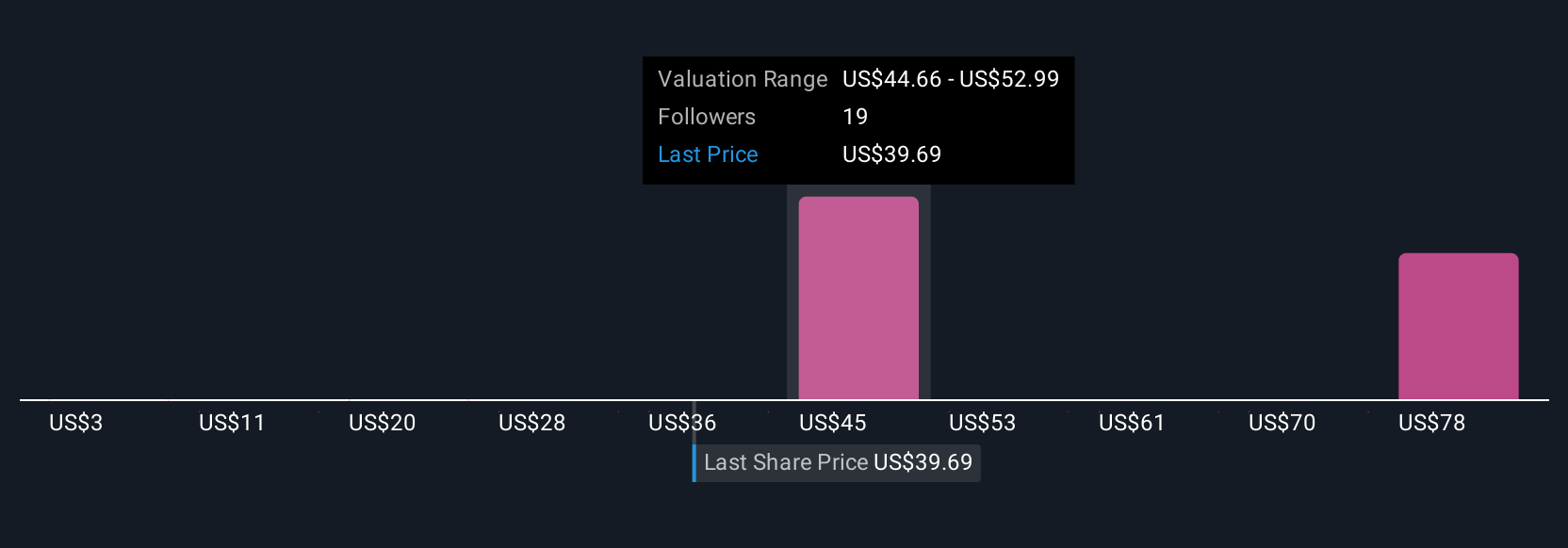

Seven perspectives from the Simply Wall St Community put fair value estimates for MGM between US$26.92 and US$86.31 per share. Opinions vary widely among individuals, especially considering that further pressure on Las Vegas demand could affect both near-term cash flows and longer term upside; make sure you weigh these differing viewpoints for a broader understanding.

Explore 7 other fair value estimates on MGM Resorts International - why the stock might be worth 18% less than the current price!

Build Your Own MGM Resorts International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MGM Resorts International research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free MGM Resorts International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MGM Resorts International's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MGM

MGM Resorts International

Through its subsidiaries, operates as a gaming and entertainment company in the United States, China, and internationally.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives