- United States

- /

- Hospitality

- /

- NYSE:MCD

Is It the Right Time to Consider McDonald's After Digital Expansion Headlines?

Reviewed by Bailey Pemberton

- Ever wondered whether McDonald's is serving up good value for investors as well as customers? Let’s dig in and see if the current share price offers a tasty opportunity or if the stock is overcooked.

- After hitting $304.59, McDonald's stock is up 4.1% year-to-date and has delivered a solid 7.2% return over the last 12 months. However, it has dipped 0.7% in the past week and 1.1% in the last month.

- Recently, headlines have highlighted McDonald's push into digital ordering and expansion of its loyalty program, sparking conversations about what these moves could mean for growth and margins. There has also been ongoing attention on how the company is navigating broader economic shifts and changing consumer habits.

- Right now, McDonald's achieves a valuation score of 2 out of 6 on our checks for undervaluation. This raises the question of whether traditional methods are the best way to judge its true worth, and there may be an even smarter way to analyze value that we will explore by the end of this article.

McDonald's scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: McDonald's Discounted Cash Flow (DCF) Analysis

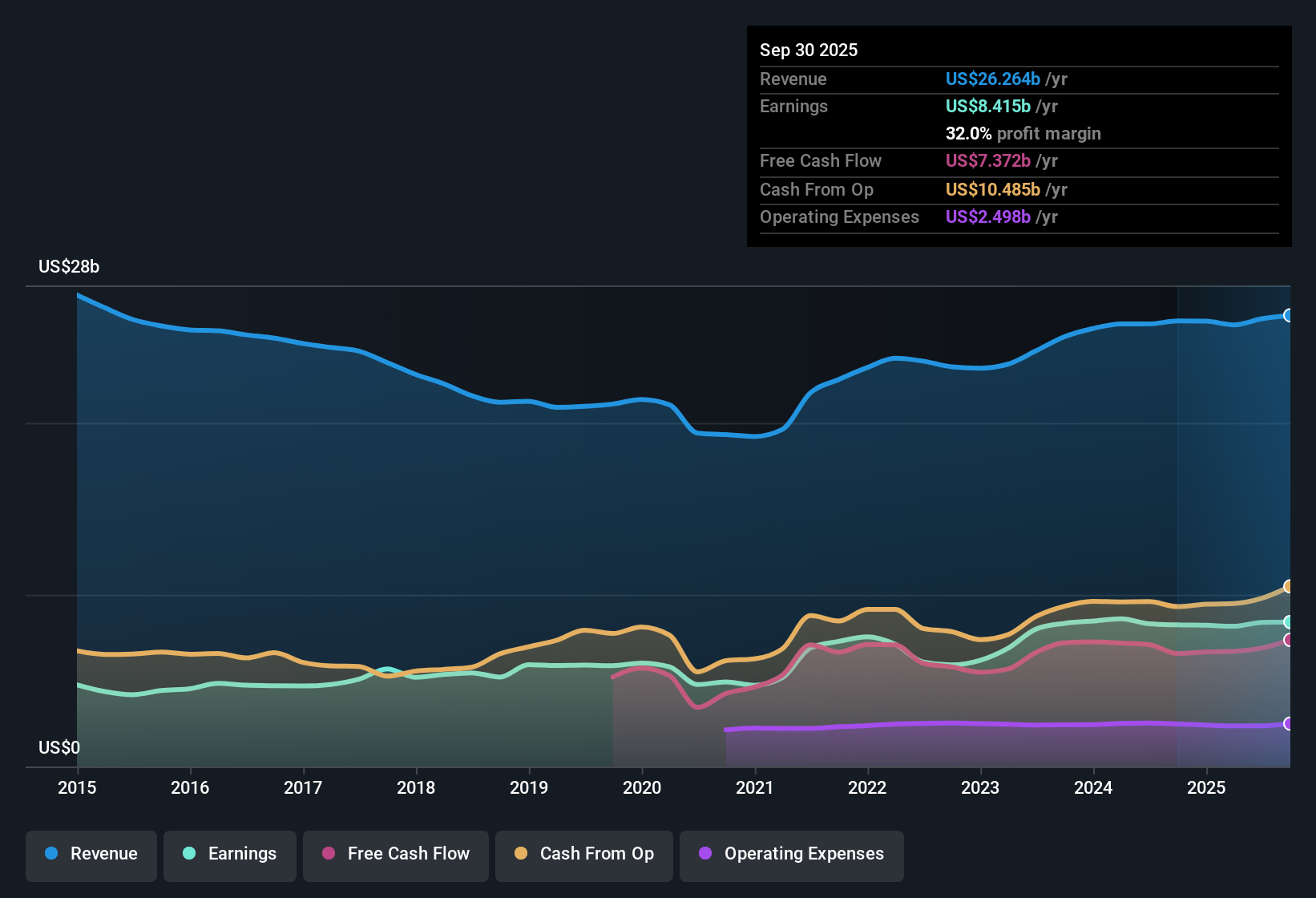

A Discounted Cash Flow (DCF) model estimates a company's true value by projecting its future cash flows and discounting them back to reflect what they are worth today. This approach relies on anticipated future free cash flows and seeks to capture the long-term earning potential of a business.

For McDonald's, the current Free Cash Flow stands at approximately $7.8 Billion. Analysts estimate this will grow steadily, reaching around $10.7 Billion by 2028. Beyond the next five years, Simply Wall St extends these projections, arriving at a forecasted Free Cash Flow of about $14.4 Billion in 2035. These figures provide a forward-looking snapshot based on cash flow trends.

After factoring in these cash flows and applying the DCF calculation, the estimated intrinsic value per share comes out at $263.35. With McDonald’s current share price sitting at $304.59, this DCF analysis suggests the stock is trading at a 15.7% premium, meaning it is overvalued based on these discounted cash flow projections.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests McDonald's may be overvalued by 15.7%. Discover 906 undervalued stocks or create your own screener to find better value opportunities.

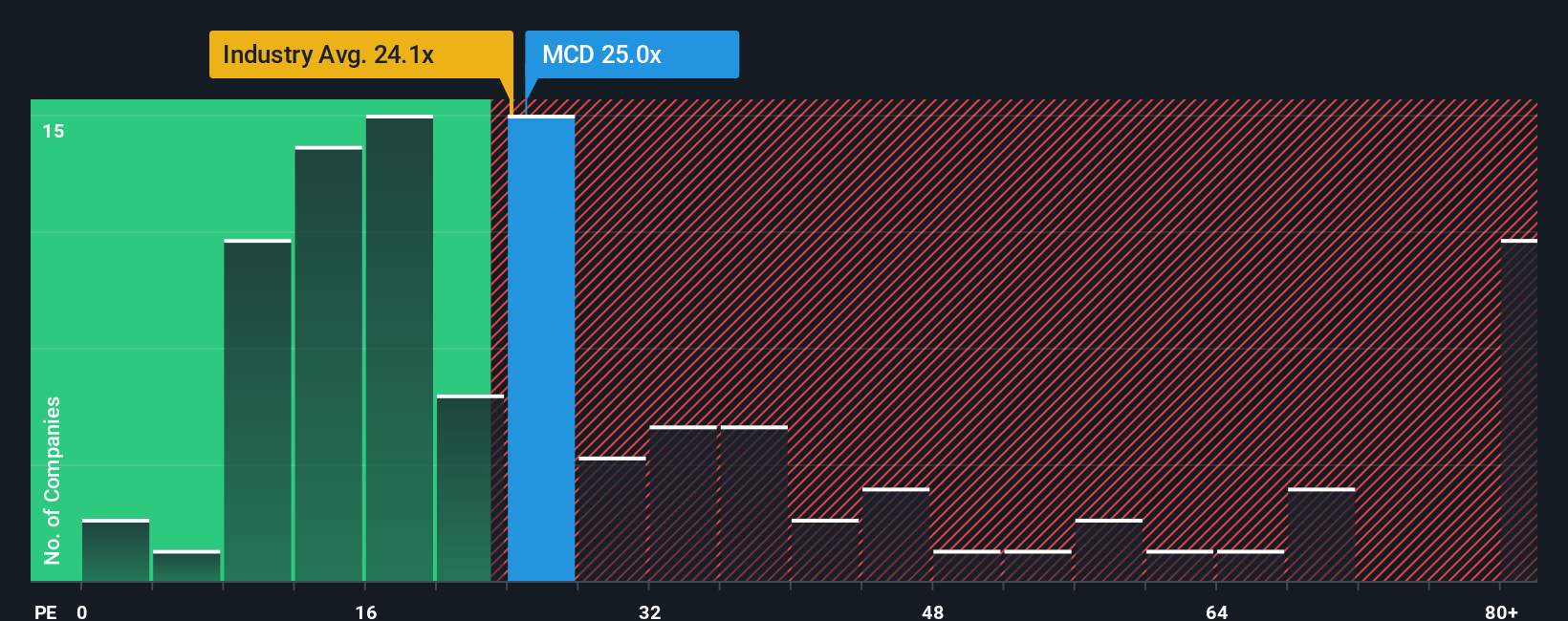

Approach 2: McDonald's Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used method to value profitable companies like McDonald's because it relates a company's share price to its earnings, providing a quick sense of what the market is willing to pay for current profits. For established, consistently profitable businesses, the PE ratio helps investors weigh whether the stock's price reflects reasonable growth expectations.

Typically, companies with higher anticipated earnings growth or lower risk justify a higher PE ratio, while those facing slower growth or greater uncertainty warrant a lower one. McDonald’s currently trades at a PE ratio of 25.8x, notably above the hospitality industry average of 20.7x but below the 53.1x seen across similar global peers. This suggests that while McDonald’s is valued at a premium compared to its industry, it is still significantly cheaper than other comparable giants.

To go beyond basic comparisons, Simply Wall St calculates a proprietary "Fair Ratio" for each company. This considers key factors like expected earnings growth, profit margins, company size, market risks, and industry dynamics. This tailored Fair Ratio, here calculated at 29.3x for McDonald's, provides a more comprehensive benchmark than raw peer or industry averages.

With McDonald’s current PE multiple (25.8x) modestly below its Fair Ratio (29.3x), the valuation appears reasonable and even appealing for investors looking for exposure to a resilient, global franchise with solid financials.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1421 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your McDonald's Narrative

Earlier, we mentioned there might be a smarter way to understand valuation, so let’s introduce you to Narratives, a new, more dynamic approach to making investment decisions.

In simple terms, a Narrative is your story about a company: it’s where you connect your view of a business and its future prospects directly to the numbers, such as fair value estimates, projected revenues, earnings, and margins. Narratives link a company’s real-world story to a financial forecast, and from there, to an actionable fair value for the stock. This empowers you to step beyond formulaic ratios by translating headlines, strategy changes, and business shifts into your own valuation framework.

On Simply Wall St’s Community page, used by millions, anyone can build and refine their own Narrative. It is easy to use and updates automatically when key news or earnings are released, so your view of McDonald's stays current.

By comparing each Narrative’s fair value to today’s share price, you can quickly judge whether McDonald's looks attractive or risky based on your unique perspective. For instance, some investors believe McDonald's future growth and digital expansion support a price as high as $373 per share, while more cautious views suggest a fair value closer to $260 per share.

Do you think there's more to the story for McDonald's? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MCD

McDonald's

Owns, operates, and franchises restaurants under the McDonald’s brand in the United States and internationally.

Established dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives