- United States

- /

- Hospitality

- /

- NYSE:LUCK

Assessing Lucky Strike Entertainment (LUCK): Is the Current Valuation a Bargain After Recent Share Price Declines?

Reviewed by Simply Wall St

Lucky Strike Entertainment (LUCK) has seen its stock price slip over the past month, dropping about 17%. Investors might be wondering what is driving this downward momentum and whether there is value to be found at current levels.

See our latest analysis for Lucky Strike Entertainment.

Zooming out, Lucky Strike Entertainment’s share price has been losing ground not just recently, but steadily over the past year. The 30-day share price return stands at -17.2%, and the 1-year total shareholder return is -28.5%. The downward trend reflects fading momentum, as recent price slides suggest shifting investor sentiment or greater caution around the company’s growth prospects.

If this shifting momentum makes you curious about what else is moving, now is the perfect moment to broaden your investing horizons and check out fast growing stocks with high insider ownership.

With shares trading at a noticeable discount to both analyst targets and some measures of intrinsic value, there is real debate: does Lucky Strike Entertainment represent a compelling bargain, or is the market factoring in all the future risks and tempered growth ahead?

Most Popular Narrative: 40.6% Undervalued

With the latest close at $8.05, the most widely followed narrative puts Lucky Strike Entertainment’s fair value considerably higher, suggesting there is a significant disconnect between current trading levels and future prospects. The foundation of this valuation rests on the company's strategic expansions and growing brand platform.

The conversion of Bowlero locations to Lucky Strike, along with targeted, higher-return marketing spend and refreshed branding, is already showing early signs of comp improvement in key markets and is expected to meaningfully accelerate same-store sales and operating leverage as the transition scales system-wide.

Want to know what powers this bold valuation? The narrative leans heavily on forecasts of margin expansion and an entirely new growth trajectory. The foundation includes fast-changing brand dynamics, ambitious profit targets, and a revenue leap that defies recent trends. Curious to see how these forecasts align with the company’s turnaround story? Unlock the core drivers fueling this aggressive price target.

Result: Fair Value of $13.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a rapid shift to digital entertainment and rising labor costs could derail Lucky Strike Entertainment’s turnaround. This could challenge optimism on its future prospects.

Find out about the key risks to this Lucky Strike Entertainment narrative.

Another View: Multiples Offer a Different Perspective

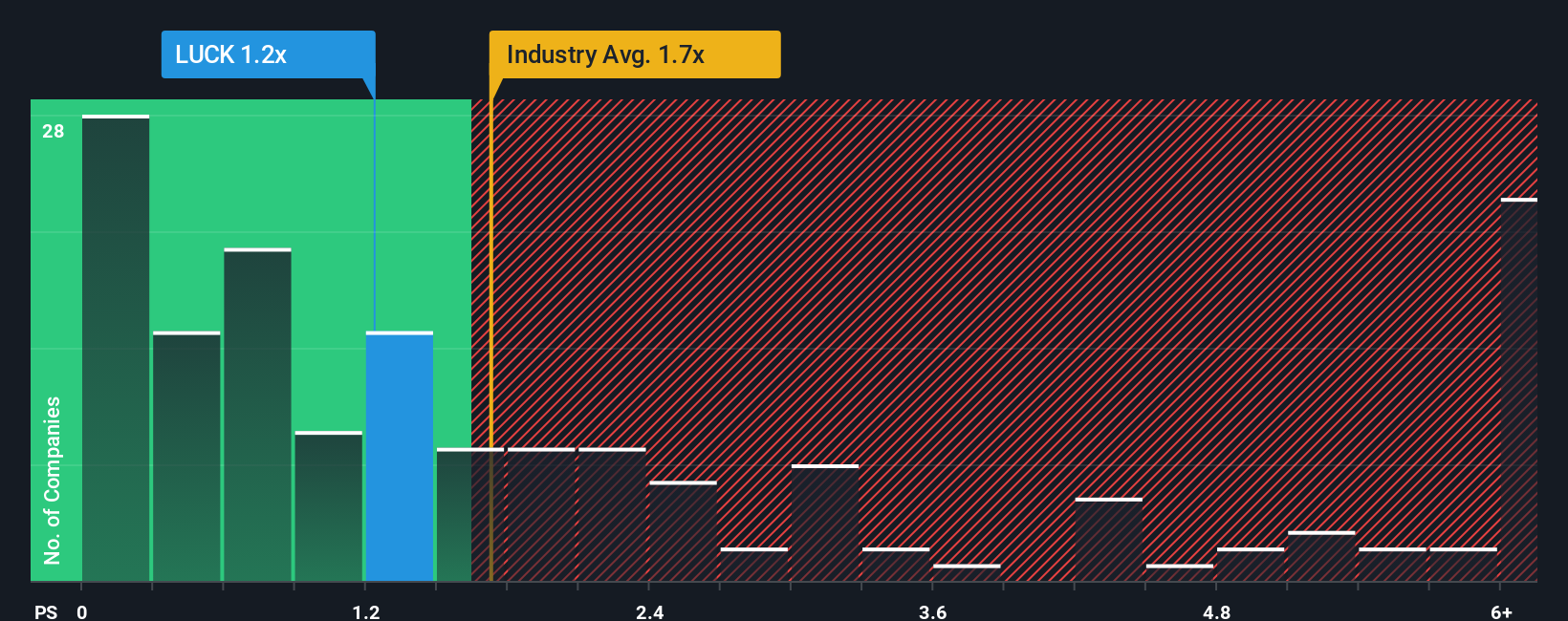

While some see significant upside, the numbers tell a more cautious story when we look at valuations based on price-to-sales. Lucky Strike Entertainment trades at 0.9 times sales, which is the same as its peer group but far below the broader US industry average of 1.7. The current ratio also matches the calculated fair ratio of 0.9. This suggests there is less obvious under- or overvaluation from this angle. Does this alignment hint at limited upside, or does it just mark a low-risk entry point for patient investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Lucky Strike Entertainment Narrative

If you think there’s more to the story or want a hands-on look at the numbers, you can craft your own narrative in just a few minutes. Do it your way.

A great starting point for your Lucky Strike Entertainment research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know that opportunity is everywhere. Make sure you’re not missing out on high-potential companies. Simply Wall Street’s screeners let you target tomorrow’s winners before they hit the mainstream.

- Spot untapped gems by reviewing these 876 undervalued stocks based on cash flows and position yourself ahead of the crowd as value stocks get noticed.

- Seize market shifts in global healthcare by tracking these 32 healthcare AI stocks as it drives innovation in diagnostics, patient care, and medical technology.

- Capture explosive growth stories and real potential with these 3589 penny stocks with strong financials that have strong fundamentals and unique catalysts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LUCK

Lucky Strike Entertainment

Operates location-based entertainment venues in North America.

Fair value with moderate growth potential.

Market Insights

Community Narratives