- United States

- /

- Hospitality

- /

- NYSE:HLT

We Ran A Stock Scan For Earnings Growth And Hilton Worldwide Holdings (NYSE:HLT) Passed With Ease

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Hilton Worldwide Holdings (NYSE:HLT), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

How Fast Is Hilton Worldwide Holdings Growing Its Earnings Per Share?

Hilton Worldwide Holdings has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. So it would be better to isolate the growth rate over the last year for our analysis. Hilton Worldwide Holdings' EPS skyrocketed from US$4.35 to US$6.38, in just one year; a result that's bound to bring a smile to shareholders. That's a impressive gain of 46%.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Not all of Hilton Worldwide Holdings' revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. EBIT margins for Hilton Worldwide Holdings remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 7.7% to US$4.7b. That's encouraging news for the company!

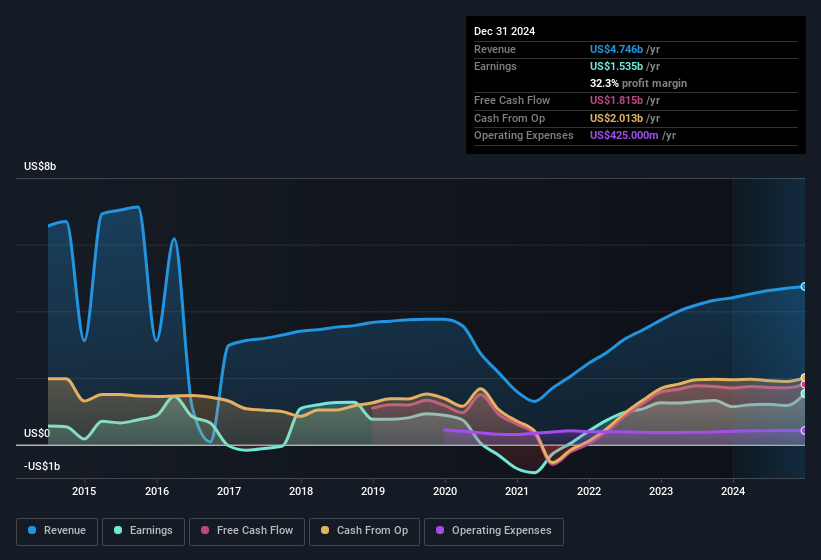

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

See our latest analysis for Hilton Worldwide Holdings

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Hilton Worldwide Holdings .

Are Hilton Worldwide Holdings Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

It's pleasing to note that insiders spent US$1.4m buying Hilton Worldwide Holdings shares, over the last year, without reporting any share sales whatsoever. Buying like that is a fantastic look for the company and should rouse the market in anticipation for the future. It is also worth noting that it was Independent Director Judith McHale who made the biggest single purchase, worth US$1.0m, paying US$211 per share.

On top of the insider buying, it's good to see that Hilton Worldwide Holdings insiders have a valuable investment in the business. We note that their impressive stake in the company is worth US$1.0b. This suggests that leadership will be very mindful of shareholders' interests when making decisions!

Is Hilton Worldwide Holdings Worth Keeping An Eye On?

You can't deny that Hilton Worldwide Holdings has grown its earnings per share at a very impressive rate. That's attractive. Furthermore, company insiders have been adding to their significant stake in the company. These things considered, this is one stock worth watching. It's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Hilton Worldwide Holdings (at least 1 which is potentially serious) , and understanding these should be part of your investment process.

Keen growth investors love to see insider activity. Thankfully, Hilton Worldwide Holdings isn't the only one. You can see a a curated list of companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Hilton Worldwide Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:HLT

Hilton Worldwide Holdings

A hospitality company, engages in managing, franchising, owning, and leasing hotels and resorts.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives