- United States

- /

- Hospitality

- /

- NYSE:HLT

Should You Be Adding Hilton Worldwide Holdings (NYSE:HLT) To Your Watchlist Today?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Hilton Worldwide Holdings (NYSE:HLT). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for Hilton Worldwide Holdings

Hilton Worldwide Holdings' Improving Profits

Hilton Worldwide Holdings has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. As a result, we'll zoom in on growth over the last year, instead. To the delight of shareholders, Hilton Worldwide Holdings' EPS soared from US$3.86 to US$5.16, over the last year. That's a fantastic gain of 34%.

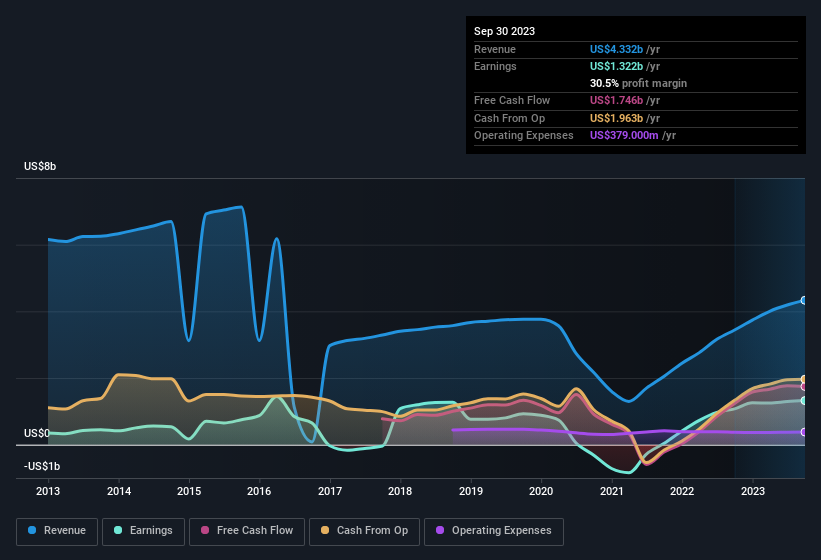

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Our analysis has highlighted that Hilton Worldwide Holdings' revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. EBIT margins for Hilton Worldwide Holdings remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 26% to US$4.3b. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Hilton Worldwide Holdings.

Are Hilton Worldwide Holdings Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a US$46b company like Hilton Worldwide Holdings. But we do take comfort from the fact that they are investors in the company. Notably, they have an enviable stake in the company, worth US$742m. Investors will appreciate management having this amount of skin in the game as it shows their commitment to the company's future.

Is Hilton Worldwide Holdings Worth Keeping An Eye On?

If you believe that share price follows earnings per share you should definitely be delving further into Hilton Worldwide Holdings' strong EPS growth. With EPS growth rates like that, it's hardly surprising to see company higher-ups place confidence in the company through continuing to hold a significant investment. On the balance of its merits, solid EPS growth and company insiders who are aligned with the shareholders would indicate a business that is worthy of further research. We should say that we've discovered 3 warning signs for Hilton Worldwide Holdings that you should be aware of before investing here.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in the US with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Hilton Worldwide Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:HLT

Hilton Worldwide Holdings

A hospitality company, engages in managing, franchising, owning, and leasing hotels and resorts.

Moderate growth potential with questionable track record.