- United States

- /

- Hospitality

- /

- NYSE:H

Here's Why We Think Hyatt Hotels (NYSE:H) Might Deserve Your Attention Today

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Hyatt Hotels (NYSE:H). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Hyatt Hotels

Hyatt Hotels' Improving Profits

Investors and investment funds chase profits, and that means share prices tend rise with positive earnings per share (EPS) outcomes. Which is why EPS growth is looked upon so favourably. It's an outstanding feat for Hyatt Hotels to have grown EPS from US$1.20 to US$4.73 in just one year. While it's difficult to sustain growth at that level, it bodes well for the company's outlook for the future. Could this be a sign that the business has reached an inflection point?

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. It's noted that Hyatt Hotels' revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. EBIT margins for Hyatt Hotels remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 20% to US$3.6b. That's encouraging news for the company!

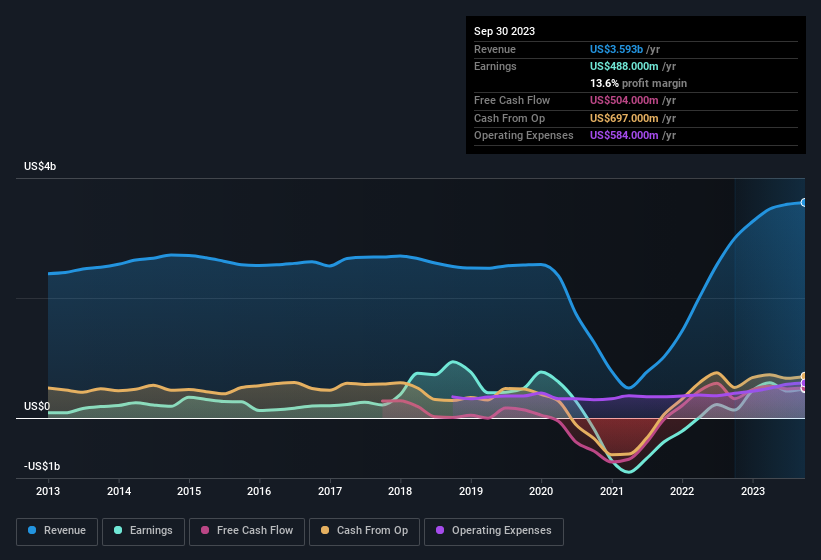

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Hyatt Hotels' future profits.

Are Hyatt Hotels Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a US$12b company like Hyatt Hotels. But we do take comfort from the fact that they are investors in the company. Notably, they have an enviable stake in the company, worth US$1.2b. This suggests that leadership will be very mindful of shareholders' interests when making decisions!

Does Hyatt Hotels Deserve A Spot On Your Watchlist?

Hyatt Hotels' earnings have taken off in quite an impressive fashion. That sort of growth is nothing short of eye-catching, and the large investment held by insiders should certainly brighten the view of the company. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. Based on the sum of its parts, we definitely think its worth watching Hyatt Hotels very closely. It is worth noting though that we have found 1 warning sign for Hyatt Hotels that you need to take into consideration.

Although Hyatt Hotels certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Hyatt Hotels might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:H

Hyatt Hotels

Operates as a hospitality company in the United States and internationally.

Solid track record and good value.