- United States

- /

- Consumer Services

- /

- NYSE:GHC

Graham Holdings (GHC): Assessing Valuation After Major Debt Refinancing and Strengthened Financial Flexibility

Reviewed by Simply Wall St

Graham Holdings (GHC) just wrapped up two major financing moves: completing a $500 million senior unsecured notes offering due 2033 and amending its credit agreement to secure a new $400 million five-year revolving facility. Both actions are aimed at refinancing existing debt and increasing financial flexibility.

See our latest analysis for Graham Holdings.

The recent refinancing moves come as Graham Holdings’ shares have posted a year-to-date price return of 26.12%, reflecting growing investor confidence as the company strengthens its balance sheet. Notably, total shareholder return over the past three and five years stands at a robust 74.38% and 154.64%, respectively, signaling sustained momentum that extends beyond short-term price action.

If these financial maneuvers have you thinking about where momentum and insider conviction intersect, now is a great opportunity to discover fast growing stocks with high insider ownership

With share prices firmly in positive territory this year, investors may be wondering whether Graham Holdings is still trading below its intrinsic value or if the current momentum has already priced in future growth. This could leave little room for upside.

Price-to-Earnings of 6.5x: Is it justified?

Graham Holdings is trading at a price-to-earnings ratio of 6.5x, well below both the industry and peer averages. This suggests the stock may be undervalued by the market.

The price-to-earnings ratio (P/E) measures what investors are willing to pay today for a dollar of company earnings. In sectors like consumer services, P/E can reflect expectations around profitability and growth. A lower P/E typically means investors are cautious, or earnings are temporarily elevated.

In the context of Graham Holdings, recent profit acceleration may not be fully recognized by the market. The current multiple may not reflect the company’s rapid earnings growth or operational momentum. The figure stands out in stark contrast to the US Consumer Services industry average of 15.7x and a peer average of 21.3x, highlighting just how much lower GHC is priced relative to comparables.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 6.5x (UNDERVALUED)

However, risk remains if analyst price targets prove more accurate than market sentiment, or if revenue growth slows even though there has been recent positive momentum.

Find out about the key risks to this Graham Holdings narrative.

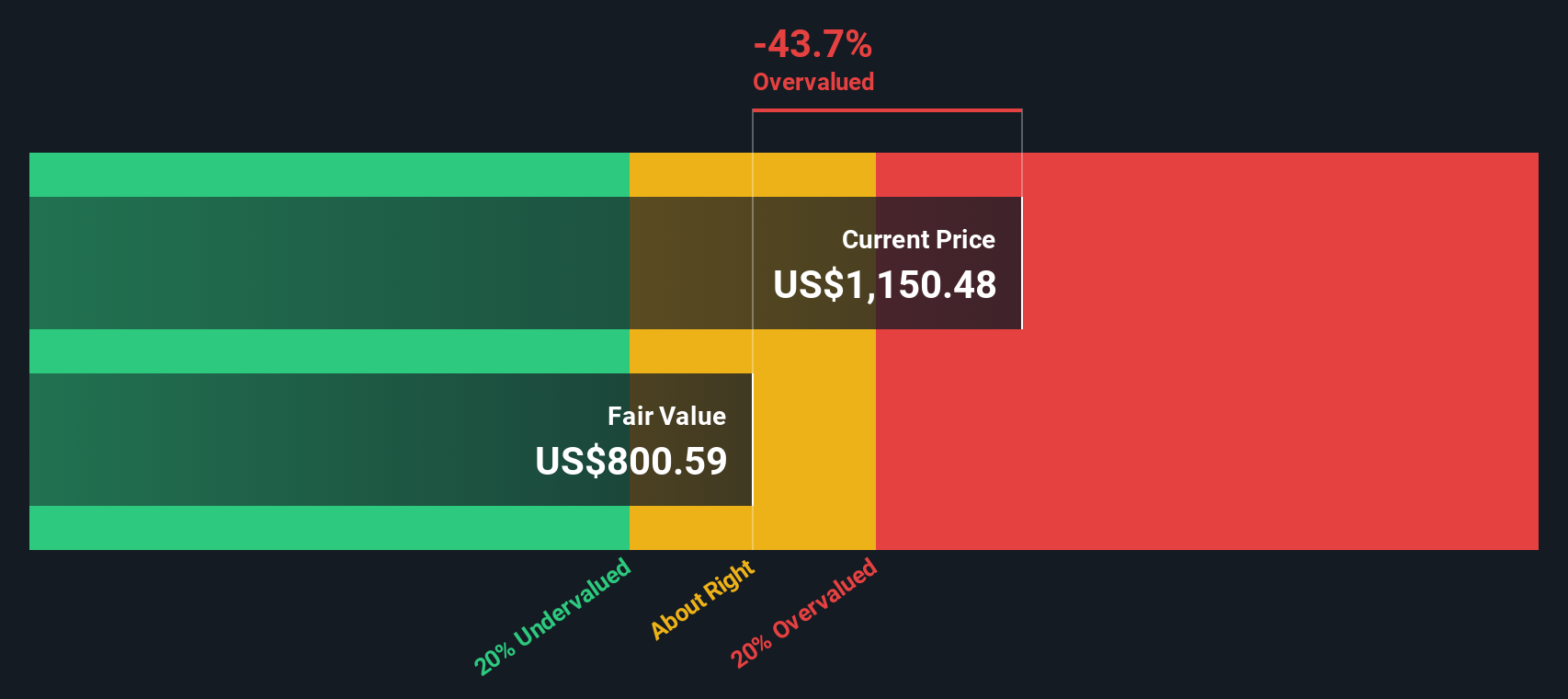

Another View: The SWS DCF Model

While the price-to-earnings ratio points to a potentially undervalued stock, our DCF model suggests Graham Holdings may actually be slightly overvalued, with the current share price sitting just above its estimated fair value. This could indicate that recent optimism is already reflected in the stock price, or there may be additional upside yet to be realized.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Graham Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 927 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Graham Holdings Narrative

If you have a different perspective or want to analyze the numbers for yourself, it only takes a few minutes to build your own view. So why not Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Graham Holdings.

Looking for more investment ideas?

Open the door to smarter investing by checking out handpicked stocks with unique growth stories and strong return potential. You do not want to regret missing them.

- Boost your portfolio by targeting reliable income streams in today’s market with these 15 dividend stocks with yields > 3% yielding over 3%.

- Stay ahead of the curve by tapping into innovation with these 27 quantum computing stocks making waves in emerging tech sectors.

- Capitalize on opportunity by uncovering value-packed picks in these 927 undervalued stocks based on cash flows that the market may be overlooking.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GHC

Graham Holdings

Through its subsidiaries, operates as a diversified holding company in the United States and internationally.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success