- United States

- /

- Hospitality

- /

- NYSE:GBTG

A Fresh Look at Global Business Travel Group (GBTG) Valuation Following $413 Million Shelf Registration Filing

Reviewed by Simply Wall St

Global Business Travel Group (GBTG) has filed a shelf registration for about $413 million in Class A Common Stock. This move is capturing investor attention as it opens the door to future capital raising or strategic moves.

See our latest analysis for Global Business Travel Group.

GBTG’s shelf registration comes as the company gears up to report quarterly results and continues its role in the broader recovery of business travel. After a rapid 29% share price gain over the past three months, momentum has cooled. The year-to-date return is down double digits, while the total return over three years stands at nearly 39%. Investors appear to be weighing short-term volatility against the company's longer-term resilience and evolving capabilities.

If you’re taking stock of recent moves in travel and services, this could be a great time to broaden your search with fast growing stocks with high insider ownership

With the stock trading well below analyst targets and recent volatility shaping sentiment, investors now face a familiar question: is there untapped value in Global Business Travel Group, or is the company’s future already reflected in the current price?

Most Popular Narrative: 20.7% Undervalued

With a fair value estimate from the most popular narrative sitting at $9.91, Global Business Travel Group’s last close of $7.86 suggests significant upside if narrative assumptions hold. Investors are taking note as analysts present a case built on transformative changes, not just short-term momentum.

The pending acquisition of CWT, now cleared for completion in Q3, is expected to drive substantial net synergies ($155 million targeted over three years). This is anticipated to deliver scale and operational efficiency that should enhance EBITDA margins and long-term earnings power.

Want to know why analysts are betting big? The secret sauce behind this valuation depends on ambitious expansion and a projected turn to robust profitability. The numbers that justify the fair value might surprise you. What is the expected growth path, and which financial levers are the game changers? Unpack the details driving these projections in the full narrative.

Result: Fair Value of $9.91 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent macroeconomic uncertainty and rising customer acquisition costs could still challenge the optimistic outlook for Global Business Travel Group in terms of long-term growth.

Find out about the key risks to this Global Business Travel Group narrative.

Another View: The Multiples Perspective

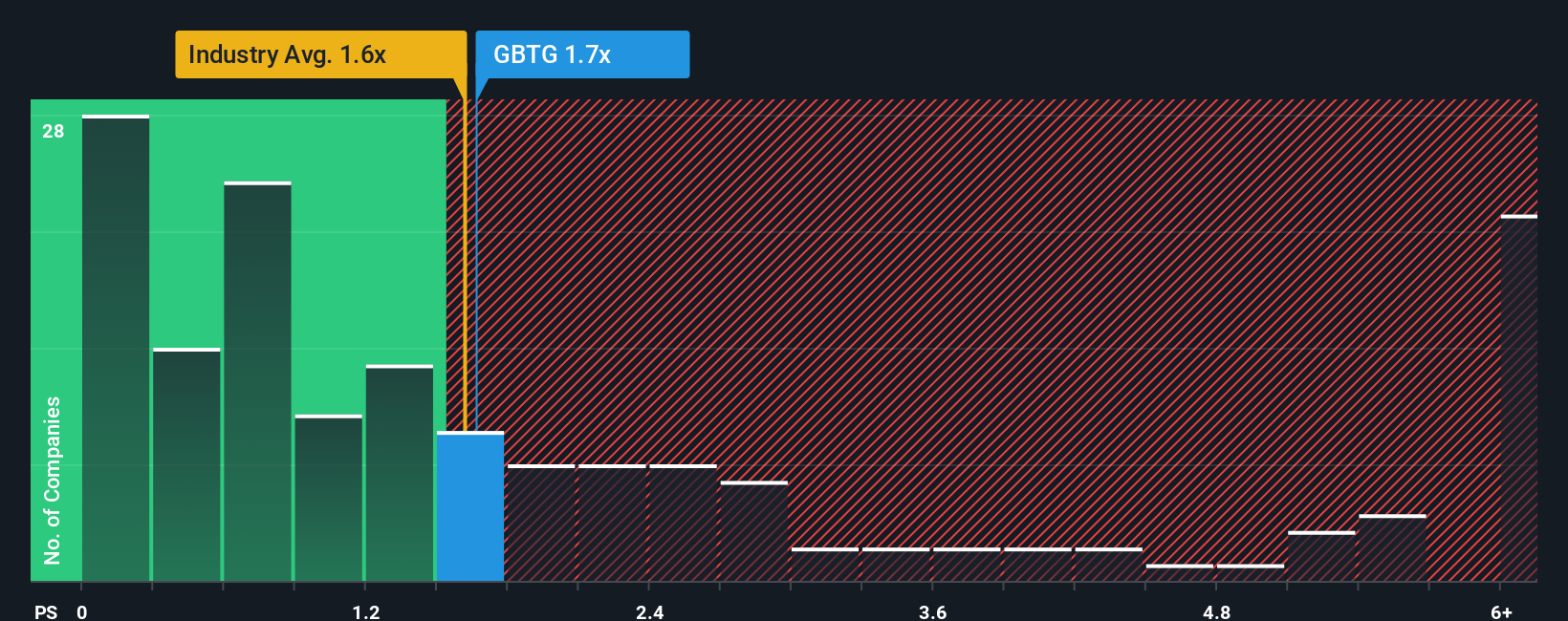

Looking at valuation through the lens of the price-to-sales ratio, Global Business Travel Group’s 1.7x is almost perfectly aligned with its fair ratio of 1.7x. It is also only slightly higher than the US Hospitality industry average of 1.6x. This suggests limited upside from rerating, but also lowers the risk that the stock is priced too aggressively. When market momentum shifts, could this tight spread give buyers an entry point, or signal caution?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Global Business Travel Group Narrative

If you have your own angle on the numbers or want to dive even deeper, build your own take in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Global Business Travel Group.

Looking for More Investment Ideas?

Level up your investing by acting now. Other investors are already seizing standout opportunities you may not have seen yet. Don’t miss your chance to get ahead.

- Power up your portfolio with these 22 dividend stocks with yields > 3% offering strong yields and the potential for steady income, even in uncertain markets.

- Tap into the future of healthcare by checking out these 33 healthcare AI stocks driving advances in AI-powered treatments, diagnostics, and patient care.

- Ride the next wave of digital innovation. Get in early with these 81 cryptocurrency and blockchain stocks leading transformation in blockchain and decentralized financial systems.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GBTG

Global Business Travel Group

Provides business-to-business (B2B) travel platform in the United States, the United Kingdom, and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives