- United States

- /

- Consumer Services

- /

- NYSE:EDU

Does First Beijing’s Stake Buildup in New Oriental (EDU) Hint at Shifting Institutional Conviction?

Reviewed by Sasha Jovanovic

- On September 30, 2025, First Beijing Investment Ltd increased its holdings in New Oriental Education & Technology Group Inc by acquiring over 7 million shares, equating to a 4.07% rise in its stake.

- This move highlights growing institutional interest in New Oriental and emphasizes the company’s perceived long-term potential within the education and technology sectors.

- We’ll now explore how First Beijing’s substantial stake increase could shape New Oriental’s investment narrative going forward.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

New Oriental Education & Technology Group Investment Narrative Recap

Being a shareholder in New Oriental Education & Technology Group often requires belief in the company’s ability to deliver steady growth through premium education services and the adoption of new learning technologies, all while effectively managing regulatory and macroeconomic challenges. While First Beijing Investment Ltd’s acquisition of over 7 million shares reflects institutional confidence, this event does not materially change the most important near-term catalyst, which remains the growth of non-academic and AI-driven offerings, or the biggest immediate risk: sustained competitive pressure in K-12 and non-academic segments. Among the company’s recent updates, the October 28 announcement of Q2 and fiscal year revenue guidance stands out. Management now expects year-over-year revenue growth in the 5% to 12% range, suggesting that operational momentum in its core education and technology segments continues to support management’s focus on forward growth catalysts and margin stabilization. Yet, in contrast to this positive guidance, investors should be mindful that accelerating competitive risks in core and adjacent education segments could…

Read the full narrative on New Oriental Education & Technology Group (it's free!)

New Oriental Education & Technology Group is projected to reach $6.5 billion in revenue and $628.5 million in earnings by 2028. This outlook assumes a 9.7% annual revenue growth rate and an earnings increase of $256.8 million from the current $371.7 million.

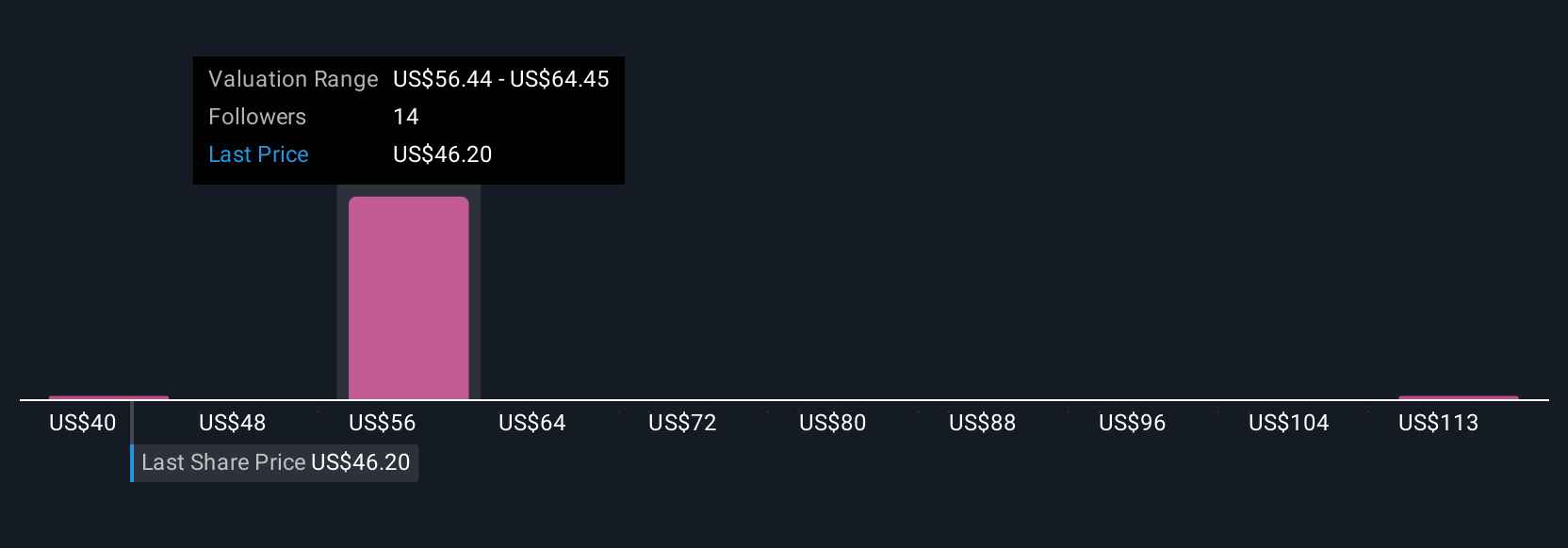

Uncover how New Oriental Education & Technology Group's forecasts yield a $64.49 fair value, a 26% upside to its current price.

Exploring Other Perspectives

Four recent fair value estimates from the Simply Wall St Community span US$38.90 to US$141.78, highlighting wide disparities in price targets. While growth in non-academic and AI-powered offerings is often cited as a potential driver, these different outlooks show just how varied investor expectations are for New Oriental’s earnings and valuation, explore these diverse viewpoints for deeper insight.

Explore 4 other fair value estimates on New Oriental Education & Technology Group - why the stock might be worth over 2x more than the current price!

Build Your Own New Oriental Education & Technology Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your New Oriental Education & Technology Group research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free New Oriental Education & Technology Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate New Oriental Education & Technology Group's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if New Oriental Education & Technology Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EDU

New Oriental Education & Technology Group

New Oriental Education & Technology Group Inc.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives