- United States

- /

- Hospitality

- /

- NYSE:DIN

Dine Brands Global (DIN): Net Profit Margin Drops to 5.3%—Profitability Slide Challenges Bullish Narratives

Reviewed by Simply Wall St

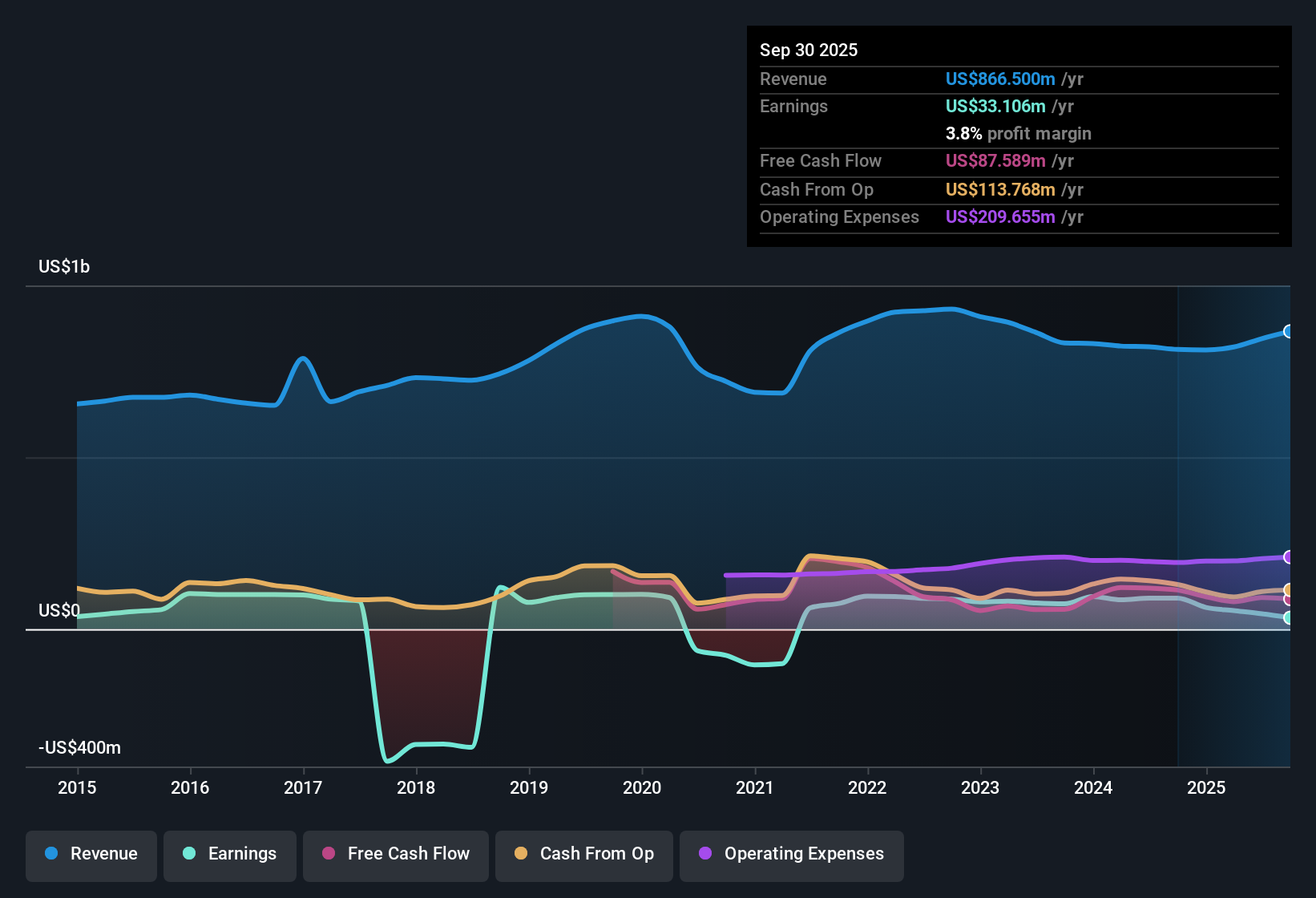

Dine Brands Global (DIN) posted a net profit margin of 5.3%, down from 10.9% a year ago. Although the company has averaged an impressive 28.9% annual earnings growth over the past five years, the most recent year bucked that trend with negative growth, and revenue is forecast to inch up at just 1.5% per year, which is well behind the US market’s 10.5% pace. For investors, the story right now is one of shrinking margins and muted near-term growth. However, value-focused buyers may see opportunity given how the stock trades below estimated fair value and on attractive earnings multiples compared to peers.

See our full analysis for Dine Brands Global.Now, let’s see how these earnings results stack up against the prevailing narratives. Some may be confirmed, while others could be challenged.

See what the community is saying about Dine Brands Global

Analyst Price Targets Barely Above Market

- The current share price of $25.46 sits just 7.8% below DCF fair value ($57.51), but is less than $2 below the consensus analyst price target of $27.60. This narrow margin suggests analysts do not see major upside from here based on forward-looking numbers.

- Analysts' consensus view: forecasts expect revenue to grow at 1.5% per year, well behind the 10.5% US market pace, which puts much of the focus on valuation rather than top-line momentum.

- Consensus narrative notes the company's expansion into digital ordering and convenience has helped keep revenue stable, but muted growth and increased costs temper enthusiasm for near-term re-rating.

- Despite operational improvements, rising G&A expenses and menu fatigue are weighing on forecasts, limiting the projected gains for both margins and share price in coming years.

- Curious where analysts see growth and risk unfolding next? Dive into the professional consensus take on Dine Brands Global with the full story in the consensus narrative. 📊 Read the full Dine Brands Global Consensus Narrative.

Profit Margins Dented by Higher Costs

- Net profit margin has dropped to 5.3% from 10.9% last year, a sharp decline that highlights how cost pressures are squeezing profitability more than peer averages suggest.

- According to the consensus narrative, competition from fast-casual chains, higher franchisee costs, and commodity inflation are pressing on margins, and analysts are watching whether modernization and dual-brand initiatives can offset these challenges.

- Elevated commodity prices, such as eggs and coffee rising 8% at IHOP, have directly contributed to margin compression.

- Investment in restaurant tech and new formats is expected to improve efficiency, but has so far come with higher G&A expenses, creating short-term pain for potential long-term gain.

Valuation Remains a Silver Lining

- Dine Brands Global's Price-to-Earnings ratio is just 8.8x, sharply lower than both the peer average of 13.5x and the US Hospitality industry at 23.4x. This means the stock screens as “cheap” by earnings multiples.

- Consensus narrative underlines that even with flat growth, the discounted P/E suggests the stock’s risk is at least partially reflected in the price, inviting value-oriented investors to weigh potential rewards against the ongoing threats to steady profitability.

- Bulls could point to high historical earnings quality as evidence the company can eventually bounce back if cost headwinds ease.

- Bears may argue that unfavorable trends in unit closures and only modest forecasted margin recovery make the low multiple justified, not opportunistic.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Dine Brands Global on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do the figures add up to a different story for you? Take just a few minutes to shape your own view and add your perspective. Do it your way

A great starting point for your Dine Brands Global research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Dine Brands Global faces shrinking profit margins, muted revenue growth, and higher costs. This leaves its near-term outlook and recovery uncertain compared to peers.

Looking for more reliable performers? Find companies delivering steady results across cycles with stable growth stocks screener (2074 results) built for consistency when momentum stalls elsewhere.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DIN

Dine Brands Global

Owns, franchises, and operates restaurants in the United States and internationally.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives