- United States

- /

- Communications

- /

- NasdaqGS:LITE

US Stock Market Today: S&P 500 Futures Dip as Rate Cut Bets Battle Growth Worries

Reviewed by Sasha Jovanovic

The Morning Bull - US Market Morning Update Tuesday, Nov, 25 2025

US stock futures are hinting lower this morning as cautious investors weigh two big signals from the overnight session. First, the yield on the 10-year US Treasury slipped to 4.04 percent, its lowest in a month. That number matters because it means borrowing is gradually getting cheaper, especially as Federal Reserve officials ramp up talk of a possible interest rate cut next month. On the other hand, economic figures out of Texas show manufacturing is still shrinking, with a key regional scorecard dipping to -10.4. For investors, this sets up a key question: will falling borrowing costs help offset the economic slowdown, and what does that mean for interest-sensitive sectors like banks and real estate versus companies more exposed to the ups and downs of manufacturing?

Protect your portfolio as rates fall and growth slows with our handpicked undervalued stocks based on cash flows. Take advantage of this opportunity before this window closes.

Top Movers

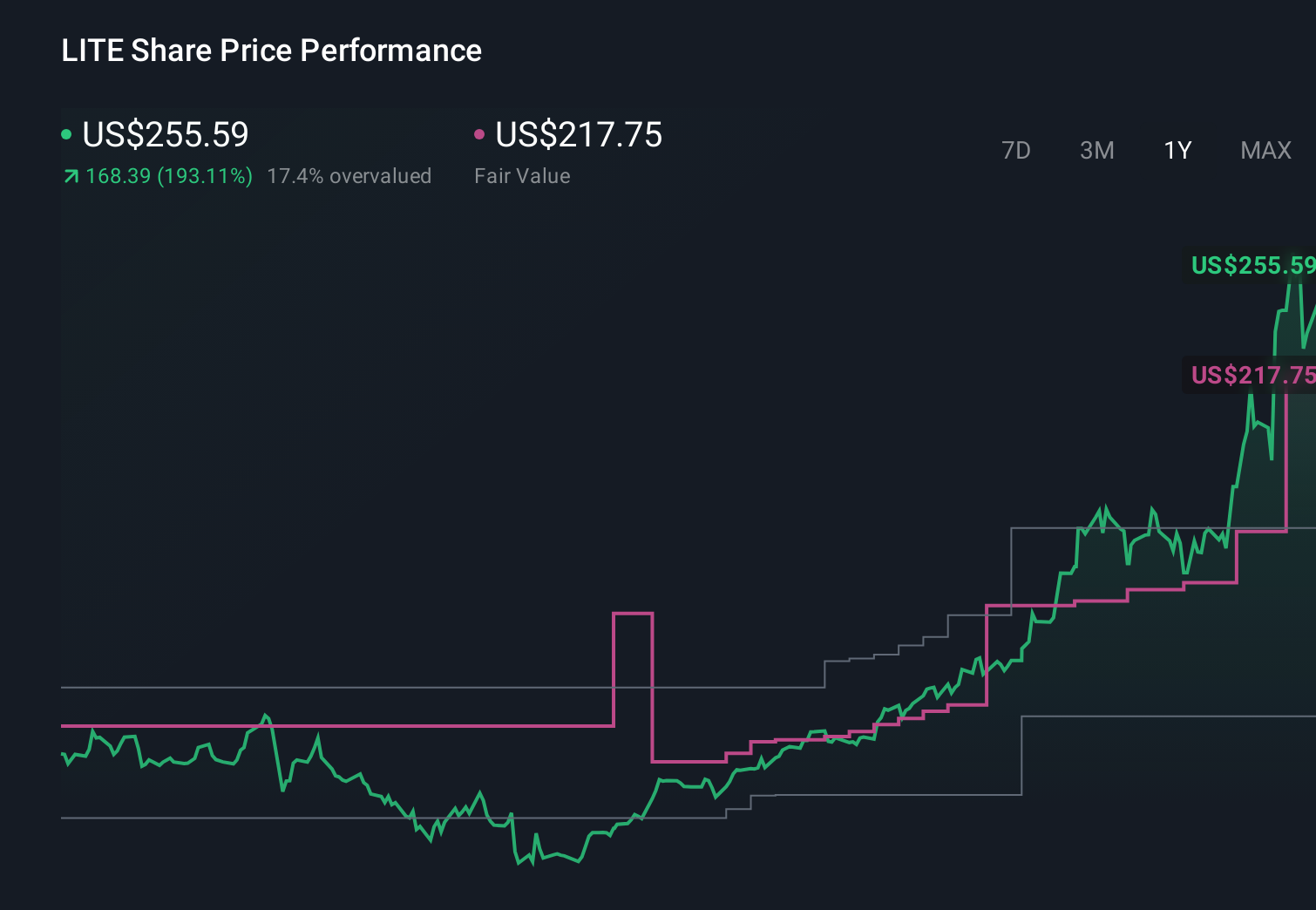

- Lumentum Holdings (LITE) jumped 17.13 percent after Needham boosted its price target and reinforced a bullish data center outlook.

- Sandisk (SNDK) soared 13.33 percent on Morgan Stanley’s price target hike, citing tight memory supply and strong earnings potential.

- Credo Technology Group Holding (CRDO) surged 13.00 percent after announcing a key license agreement covering their active electrical cable patents.

Is Sandisk still a smart investment or just hype? Read our most popular narrative and get all the answers you need.

Top Losers

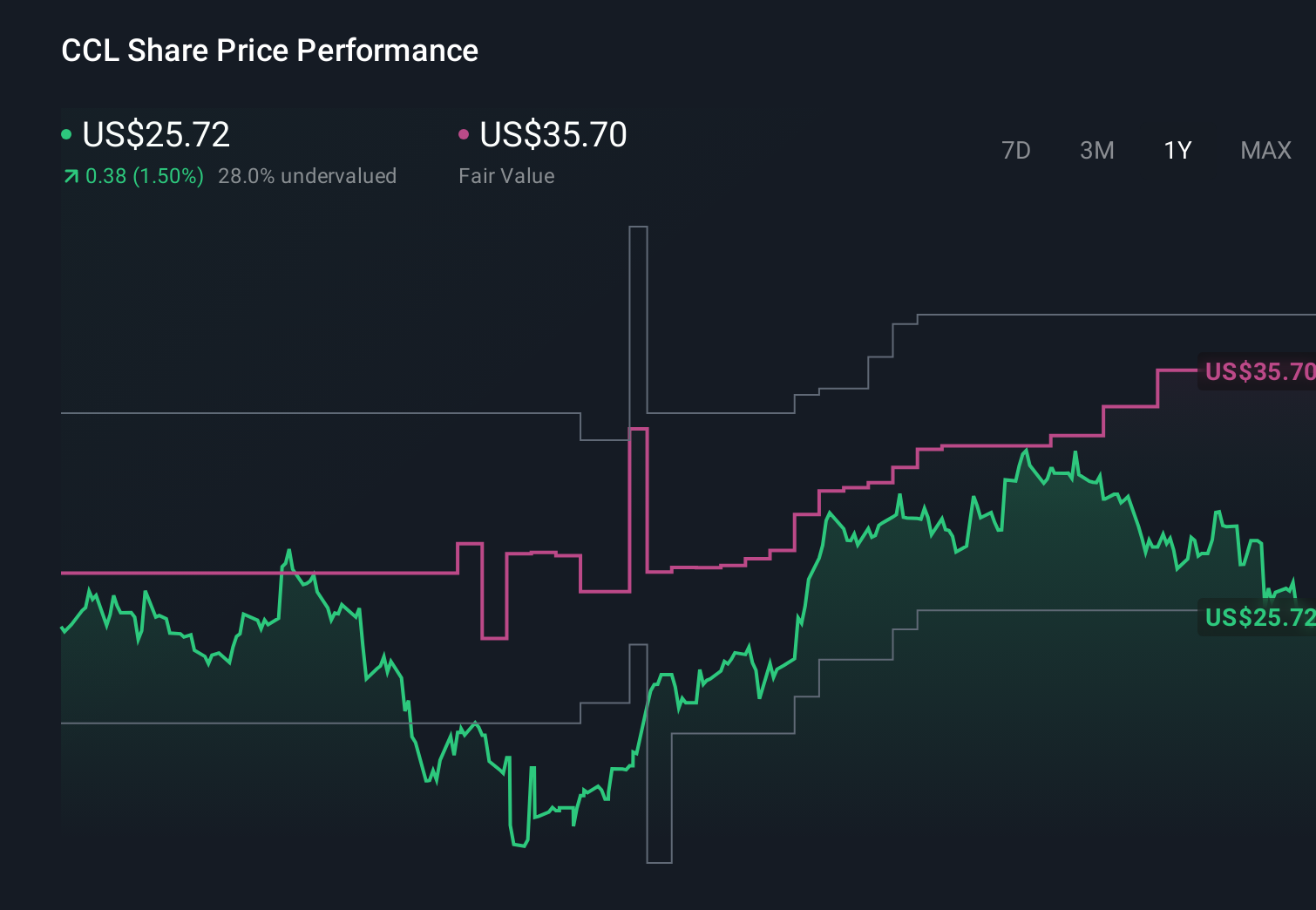

- Carnival Corporation & (CCL) dropped 6.78 percent, no clear catalyst identified.

- Copart (CPRT) fell 4.47 percent after Baird lowered its price target, citing insurance headwinds.

- BeOne Medicines (ONC) declined 4.32 percent.

Look past the noise - uncover the top narrative that explains what truly matters for BeOne Medicines' long-term success.

On The Radar

Tech and cloud leaders headline today's action with a flurry of earnings expected after the closing bell.

- Analog Devices (ADI) reports Q4 earnings this morning, setting the tone for semiconductor margin and demand trends this season.

- Workday (WDAY), NetApp (NTAP) & Zscaler (ZS) post after-market results on Tuesday. These reports offer high-impact insights on enterprise IT spending and cloud adoption signals.

- Dell Technologies (DELL) announces Q3 earnings on Tuesday afternoon, highlighting global hardware demand and supply chain dynamics ahead of year-end.

- Alibaba Group (BABA) shares Q2 numbers this morning, providing investors with a fresh look at Chinese consumer resilience and e-commerce growth.

- Li Auto (LI) will release Q3 results pre-market Wednesday, serving as a key gauge of EV momentum and profit margins in China’s competitive auto sector.

Use our Portfolio or Watchlist features to track market-moving events like these and get alerts for the companies you own, free!

How To Act On Today's Market

Opportunities like this do not last, and our research just uncovered 26 AI penny stocks poised to redefine tomorrow's markets. Each offers proven growth and breakthrough potential right now.

Ready to take control? Use our stock screener to tailor your search, uncover hidden gems, and get timely alerts so you never miss out on new opportunities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LITE

Lumentum Holdings

Manufactures and sells optical and photonic products in the Americas, the Asia-Pacific, Europe, the Middle East, and Africa.

Exceptional growth potential with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success