- United States

- /

- Hospitality

- /

- NYSE:CCL

Can Carnival (CCL) Turn Specialty Cruises Into Stronger Pricing Power and Guest Loyalty?

Reviewed by Sasha Jovanovic

- In recent weeks, Carnival Corporation’s Holland America Line announced its 2027-2028 South America and Antarctica cruise season, offering immersive itineraries to landmark destinations like Machu Picchu and the Galapagos Islands with extended sailings aboard Zuiderdam and Oosterdam.

- This expansion into highly curated and remote cruise offerings highlights the company’s continued focus on unique guest experiences and on broadening appeal to adventure and nature-focused travelers.

- We’ll examine how Holland America’s push into specialty itineraries could reinforce Carnival’s investment narrative around pricing power and guest experience enhancements.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Carnival Corporation & Investment Narrative Recap

Carnival Corporation’s appeal rests on sustained demand for unique cruise experiences, margin expansion, and disciplined cost management, all while navigating a capital-intensive business with substantial debt. Holland America’s newly announced South America and Antarctica itineraries reinforce the company's focus on high-value guest experiences and pricing power, a short-term catalyst that supports Carnival’s premium positioning. This recent product expansion is not expected to materially impact the biggest risk currently facing Carnival, which remains its elevated leverage and ongoing debt refinancing needs.

Among recent announcements, Carnival’s completion of a $322 million senior note redemption stands out as the most relevant. This move underscores the company’s efforts to manage its significant debt load amid ongoing expansion and product initiatives, helping address concerns over financial flexibility that affect its investment outlook.

However, investors should also be aware that, unlike new destination launches, the company’s high interest expenses and future refinancing requirements...

Read the full narrative on Carnival Corporation & (it's free!)

Carnival Corporation & is projected to reach $29.0 billion in revenue and $3.7 billion in earnings by 2028. This outlook assumes annual revenue growth of 3.8% and an increase in earnings of $1.2 billion from the current $2.5 billion.

Uncover how Carnival Corporation &'s forecasts yield a $35.84 fair value, a 34% upside to its current price.

Exploring Other Perspectives

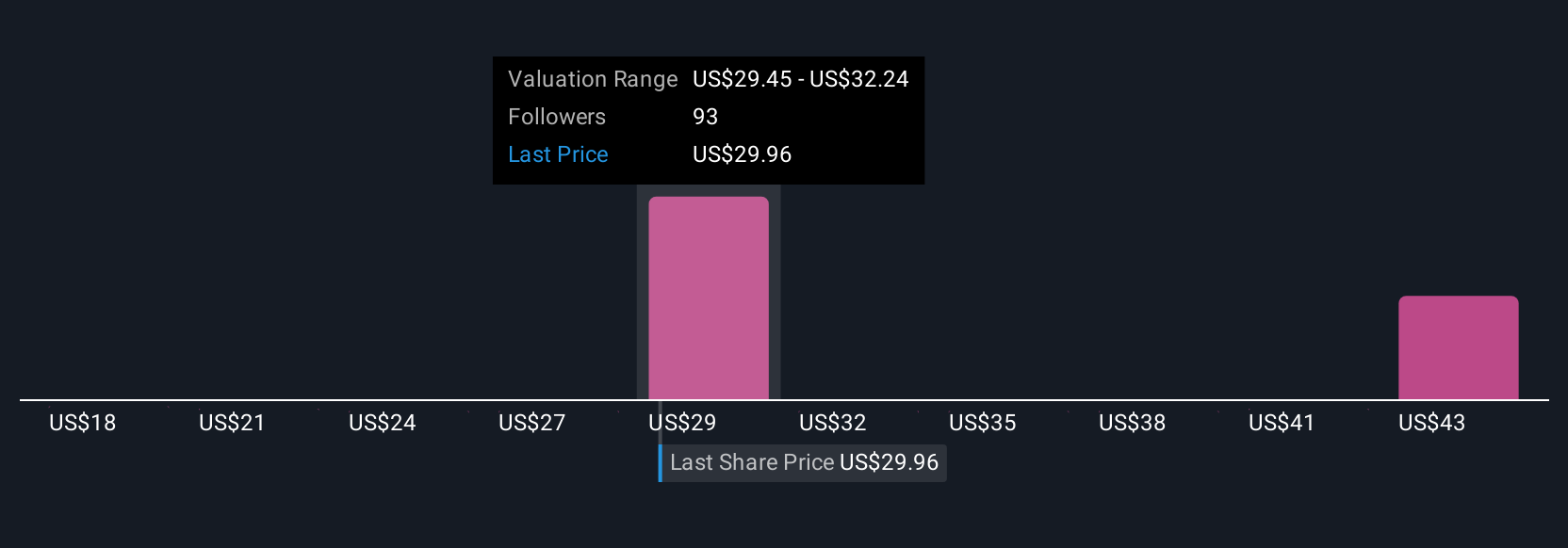

Ten individual fair value estimates from the Simply Wall St Community range from US$24.61 to US$41.57 per share. Many participants cite Carnival’s ongoing debt management as a crucial factor that shapes expectations for future earnings and risk appetite.

Explore 10 other fair value estimates on Carnival Corporation & - why the stock might be worth as much as 56% more than the current price!

Build Your Own Carnival Corporation & Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Carnival Corporation & research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Carnival Corporation & research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Carnival Corporation &'s overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CCL

Carnival Corporation &

A cruise company, provides leisure travel services in North America, Australia, Europe, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives