- United States

- /

- Hospitality

- /

- NYSE:BRSL

How Investors Are Reacting To Brightstar Lottery (BRSL) Revenue Surge, Dividend Hike, and 2025 Outlook

Reviewed by Sasha Jovanovic

- On November 4, 2025, Brightstar Lottery PLC reported strong third quarter results with revenue rising to US$629 million and net income surging to US$117 million, announced a medium-term revenue target of US$2.75 billion for 2028, and increased its quarterly dividend by 10% to US$0.22 per share.

- A key highlight is Brightstar's reaffirmation of its 2025 earnings guidance despite a challenging contract transition in the UK, supported by growth in the US and Italy as well as new product innovation such as AI-developed games.

- We'll explore how the guidance reaffirmation and higher dividend signal management's confidence in Brightstar's long-term growth strategy.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Brightstar Lottery Investment Narrative Recap

Brightstar Lottery appeals to investors who are confident in the company's ability to drive sustained growth through digital innovation, geographic diversification, and contract renewals, even as regulatory and competitive risks remain significant. The recent strong Q3 earnings and management's reaffirmation of near-term and medium-term revenue targets help reinforce confidence in ongoing digital initiatives, while the biggest risk continues to be unpredictable regulatory and tax headwinds in key markets. The impact of these new results on such risks is limited for now, but consistent execution remains crucial.

Among the company's recent news, the 10% increase in the quarterly dividend stands out, underlining Brightstar's pattern of returning value to shareholders and commitment to capital discipline even amid ongoing contract transitions and earnings volatility. This proactive capital return is especially relevant as the company sets its sights on medium-term growth targets and responds to pressures from global regulatory shifts and tech-driven competition.

However, before focusing only on the positive, investors should be aware that Italy’s central role in Brightstar’s revenue mix still exposes the company to concentrated regulatory...

Read the full narrative on Brightstar Lottery (it's free!)

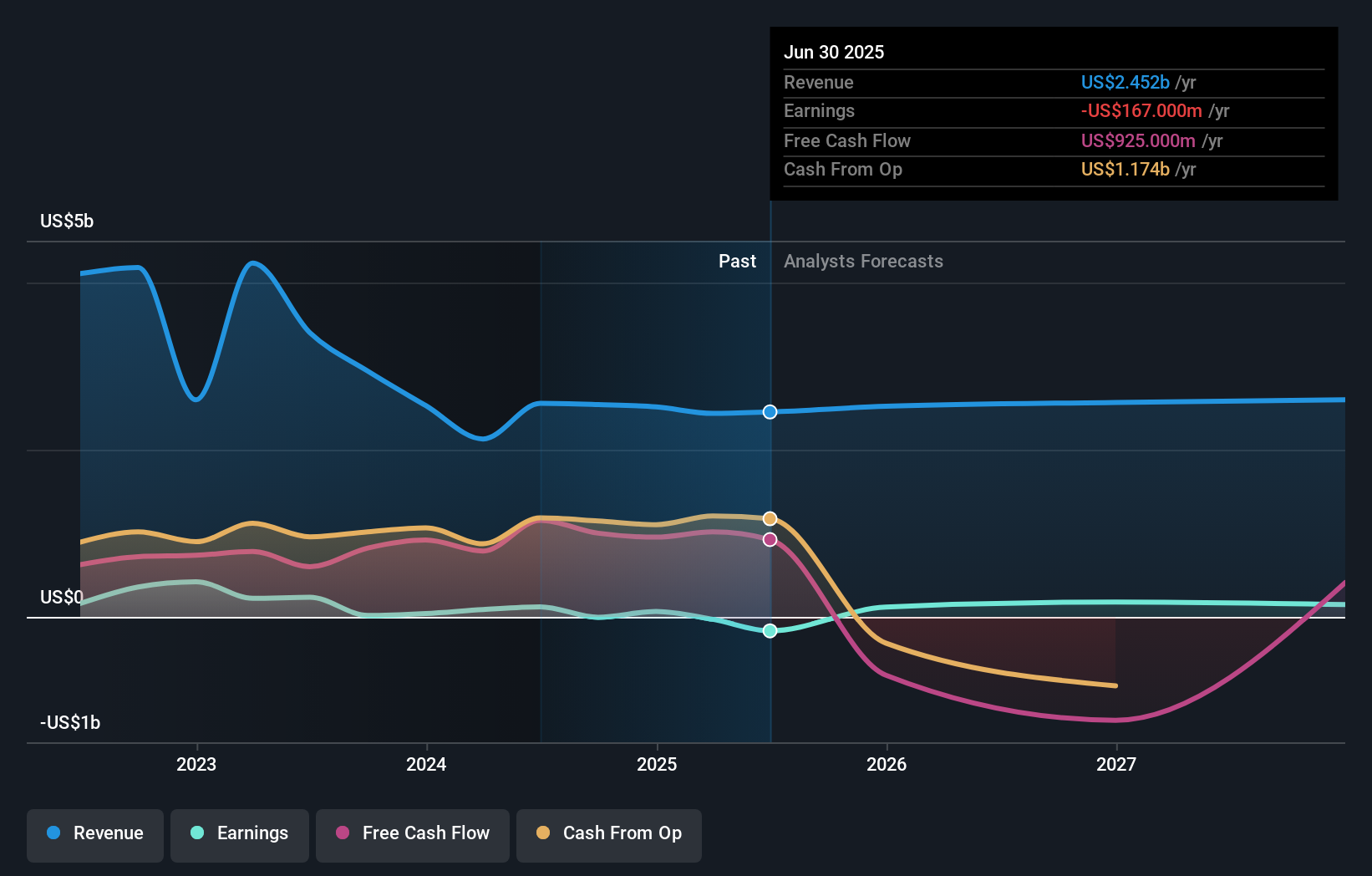

Brightstar Lottery's narrative projects $2.6 billion revenue and $295.9 million earnings by 2028. This requires 2.5% yearly revenue growth and a $462.9 million increase in earnings from -$167.0 million.

Uncover how Brightstar Lottery's forecasts yield a $19.07 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community estimates for Brightstar Lottery fair value range from US$11.16 to US$19.07 based on 2 independent forecasts. With accelerating digital channels supporting organic revenue targets, your outlook may differ, consider multiple viewpoints.

Explore 2 other fair value estimates on Brightstar Lottery - why the stock might be worth 33% less than the current price!

Build Your Own Brightstar Lottery Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Brightstar Lottery research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Brightstar Lottery research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Brightstar Lottery's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brightstar Lottery might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BRSL

Brightstar Lottery

Provides lottery solutions in the United States, Italy, rest of Europe, and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives