- United States

- /

- Hospitality

- /

- NYSE:BRSL

Brightstar Lottery Valuation in Focus After Expansion News and Recent 7.5% Price Drop

Reviewed by Bailey Pemberton

- Wondering if Brightstar Lottery offers real value for your portfolio? Let’s take a closer look at what’s happening beneath the surface to see if now might be the right entry point.

- The shares have been in the spotlight lately, rising just 0.1% over the past week but dropping 7.5% over the last month, with a 5-year return that is still an impressive 133.5%.

- Recent headlines highlight the company’s expansion into new markets, which has caught the attention of both investors and industry watchers. This move is widely seen as a potential catalyst, fueling speculation about future growth and influencing the recent price swings.

- On our checklist of six key valuation measures, Brightstar Lottery currently meets 2, giving it a 2/6 valuation score. However, there is more to true value than just the numbers, so stick around as we break down the approaches and reveal an even better way to judge the stock’s worth.

Brightstar Lottery scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Brightstar Lottery Discounted Cash Flow (DCF) Analysis

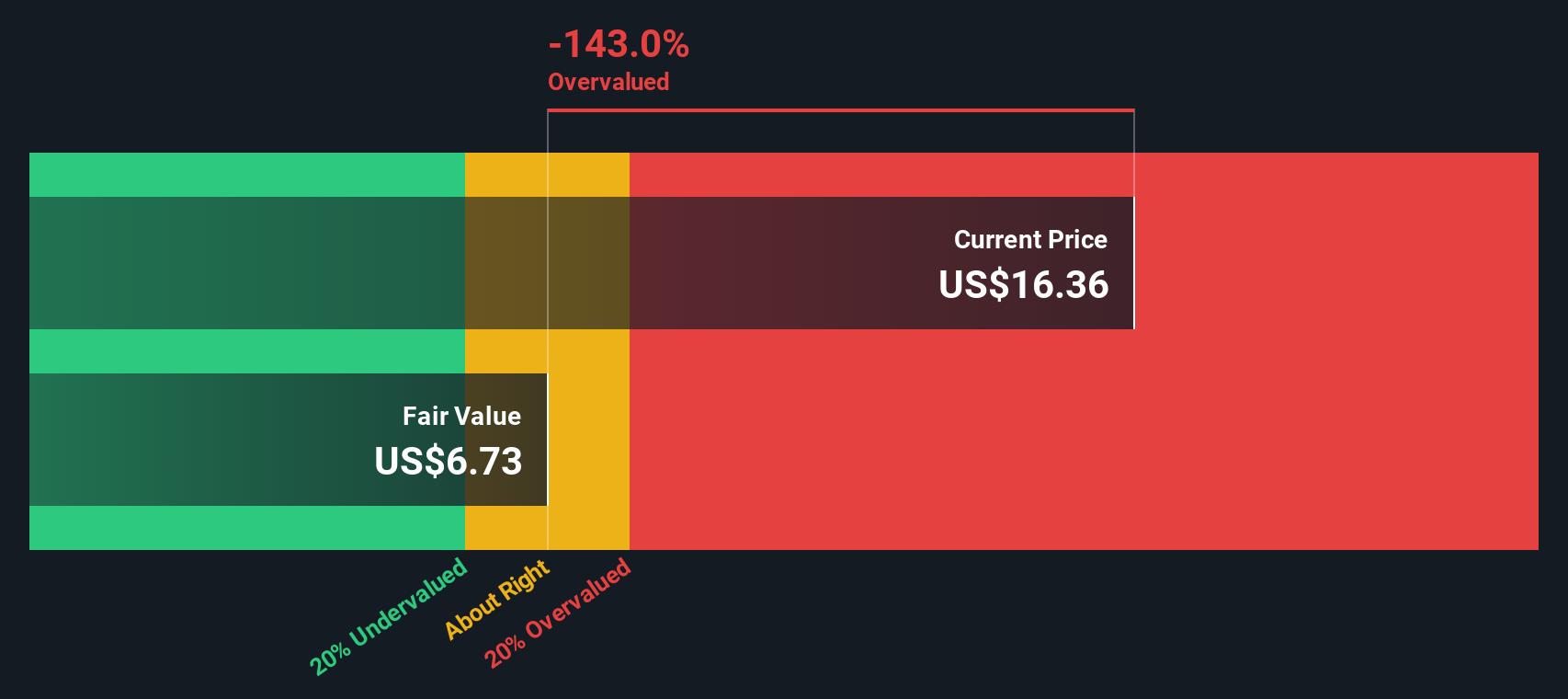

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today’s dollar value. This approach focuses on gauging how much cash Brightstar Lottery is expected to generate in the future and determines what that is worth now.

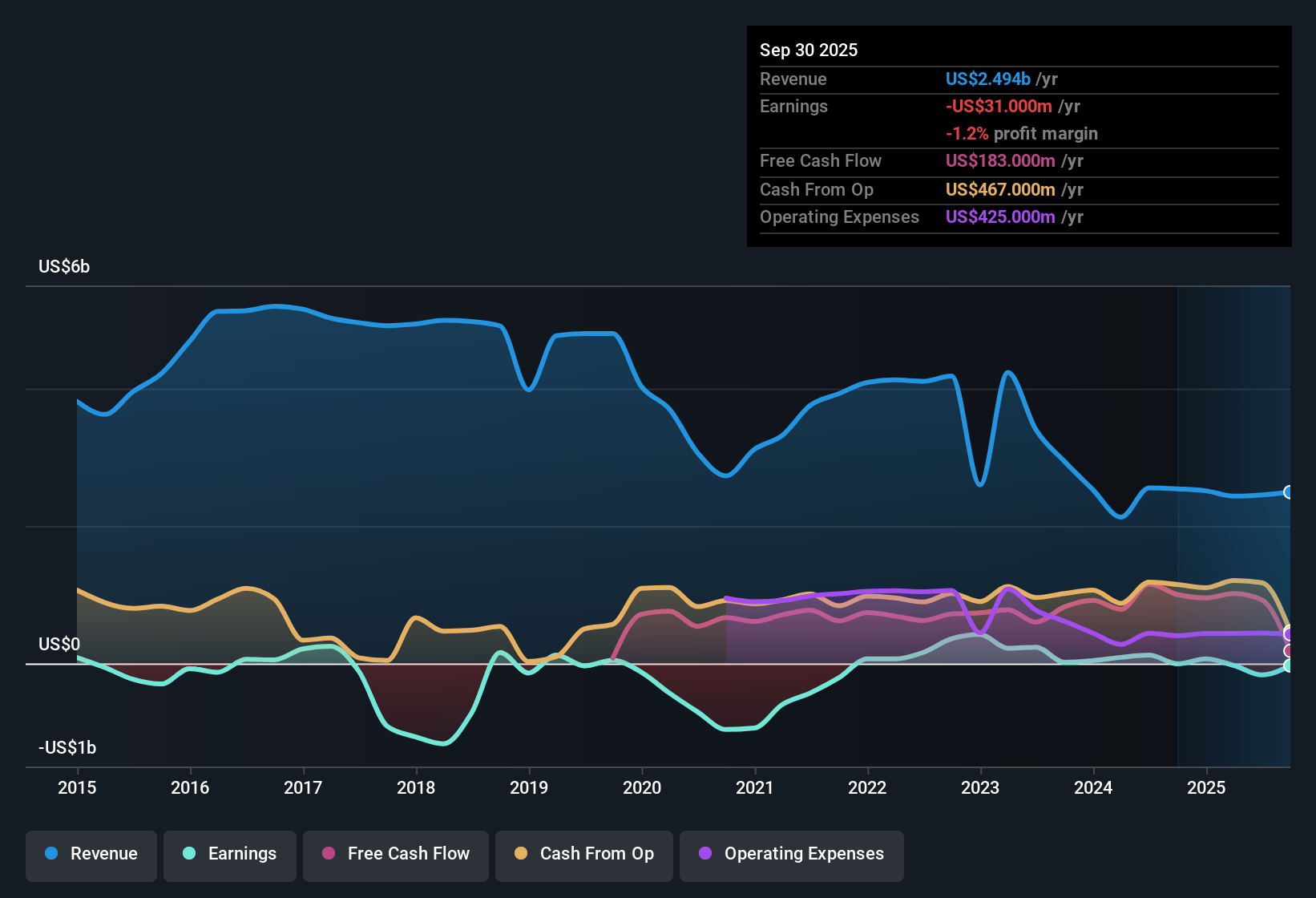

For Brightstar Lottery, the most recent reported Free Cash Flow is $271.13 Million. Analyst estimates forecast Free Cash Flow reaching $378 Million by 2027, with further projections (extrapolated by Simply Wall St) rising steadily to about $443.88 Million in 2035. These projections help investors see whether growth is expected to continue and at what rate cash flow might compound in the coming decade.

Based on these future cash flow projections, the DCF model calculates the stock’s intrinsic value at $11.27 per share. However, this figure is approximately 48.1% below the current share price, meaning that, by this method, Brightstar Lottery appears significantly overvalued at the moment.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Brightstar Lottery may be overvalued by 48.1%. Discover 844 undervalued stocks or create your own screener to find better value opportunities.

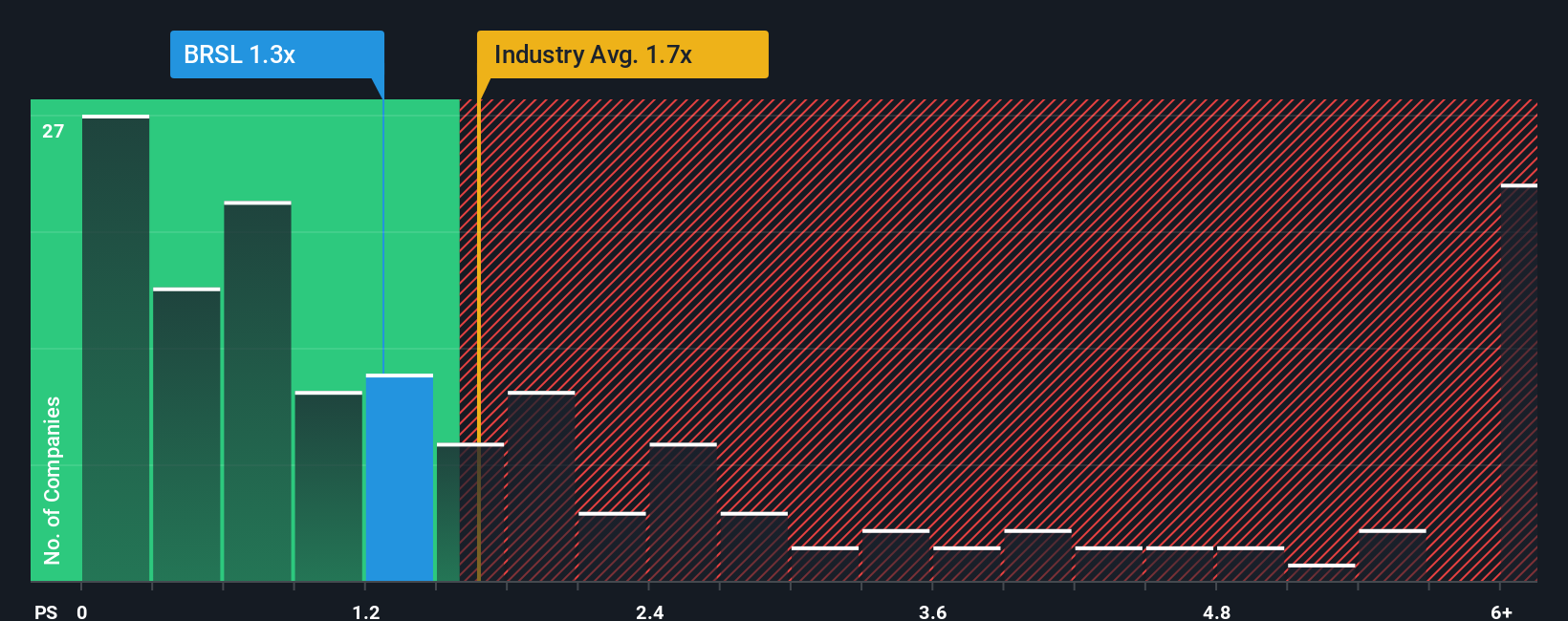

Approach 2: Brightstar Lottery Price vs Sales

For companies like Brightstar Lottery, the Price-to-Sales (P/S) ratio is a particularly useful valuation tool, especially when traditional earnings metrics may be less reliable due to fluctuating profits. The P/S ratio provides insight into how much investors are willing to pay for each dollar of the company’s sales, making it effective for companies in growth industries or those with inconsistent profitability.

It is important to note that a “normal” or “fair” P/S ratio is shaped by both expectations for revenue growth and perceptions of company risk. Higher growth potential or lower risk often justifies a higher multiple, while slow growth or higher risk generally results in a lower multiple.

Currently, Brightstar Lottery trades at a P/S ratio of 1.27x. This is below both its industry average of 1.62x and its peers' average of 1.66x, suggesting the market is more cautious on this stock compared to others in the Hospitality sector. However, simply comparing these ratios can be misleading if growth prospects or risk profiles differ significantly.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. The Fair Ratio, at 1.01x for Brightstar Lottery, reflects a multiple tailored to the company’s unique earnings growth expectations, profit margin, market cap, and underlying risks. This holds it to a more precise and relevant standard than generic peer or sector averages.

Comparing the actual P/S ratio of 1.27x against the Fair Ratio of 1.01x, Brightstar Lottery is trading slightly above what would be considered fair value, but not dramatically. The difference is modest, suggesting the stock's valuation is largely in line with its fundamentals at this time.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1405 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Brightstar Lottery Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your chance to shape a story about a company by linking your own forecast of future revenue, earnings, and margins to a calculated fair value. Essentially, it’s the why and how behind your investment decision, not just the numbers alone.

With Narratives on Simply Wall St’s Community page, millions of investors can turn their research and unique perspectives into actionable, personalized forecasts. This tool seamlessly connects the company’s evolving story, such as new digital expansion or a shift in regulatory policy, to updated financial models. It calculates a fair value that’s continually refreshed whenever major news or earnings are announced.

This approach lets you decide when to buy or sell Brightstar Lottery by directly comparing your Narrative’s fair value with the current market price, and gives you immediate feedback as new information comes in. Investors can easily see a range of opinions: some believe Brightstar’s future value could be as high as $28.00 driven by digital growth and renewed contracts, while others suggest caution with estimates as low as $12.52, focusing on risks from regulation and competition.

In short, Narratives let you move beyond static ratios, empowering you to invest with a living, data-driven story that is uniquely your own.

Do you think there's more to the story for Brightstar Lottery? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brightstar Lottery might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BRSL

Brightstar Lottery

Provides lottery solutions in the United States, Italy, rest of Europe, and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives