- United States

- /

- Hospitality

- /

- NYSE:BRSL

Brightstar Lottery (BRSL): Slower 1.3% Revenue Growth Tests Turnaround Narrative Despite Profit Forecasts

Reviewed by Simply Wall St

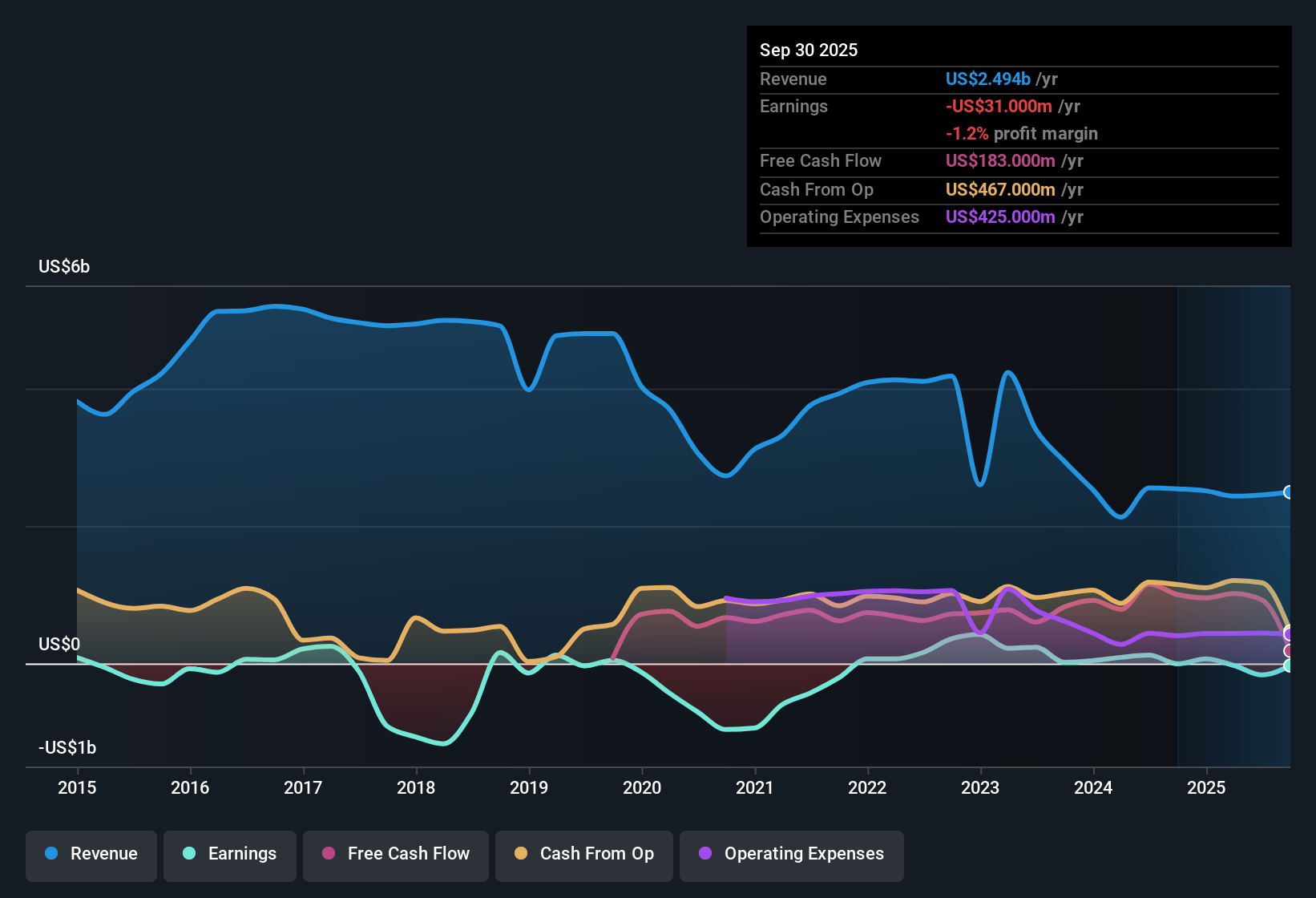

Brightstar Lottery (BRSL) remains in the red but is eyeing a turnaround, with losses shrinking by 51.4% per year over the past five years and expectations for profitability within the next three. While earnings are projected to surge by 76.68% per year, revenue is set to grow more modestly at 1.3% per year, trailing the 10.5% US market average. With margins still negative and profitability yet to be delivered, investors are weighing BRSL's rapid earnings forecast against its slow revenue gains and ongoing concerns around dividend sustainability.

See our full analysis for Brightstar Lottery.Next up, we will set these latest numbers against the market narratives to see where investor expectations are confirmed and where the story might be shifting.

See what the community is saying about Brightstar Lottery

Margins Set to Swing From -6.8% to 11.2%

- Profit margins are forecast to jump from -6.8% to 11.2% over three years, setting up a major turnaround in how much revenue drops to the bottom line.

- According to the analysts' consensus view, digital channel expansion and contract renewals are credited with driving recurring, higher-margin sales. However, the heavy cost base and contract expenses raise the question of whether all these margin gains will stick.

- Consensus notes $50 million per year in cost savings targeted by structural initiatives but warns that Italy's dominance means regulatory or economic changes there could easily cut into margin upside.

- The promised margin expansion rests partially on technology platform investment and digital adoption, themes that depend on both stable demand and no major jumps in compliance costs.

- Consensus narrative suggests that if cost-cutting and tech upgrades really do boost profitability as forecast, Brightstar's shift to digital could finally pay off for shareholders. 📊 Read the full Brightstar Lottery Consensus Narrative.

Contract Life Extends to 7 Years

- Brightstar’s average revenue-weighted contract life now stretches to 7 years following big renewals in Italy and new deals in Missouri, Portugal, and France. This offers rare visibility and stability in cash flow for a lottery firm.

- Analysts' consensus view highlights that this longer contract duration supports both higher long-term revenues and cash flow predictability, but notes risks tied to contract costs and concentration in key markets.

- The $50 million annual savings goal is meant to offset these contract-linked expenses. However, rising competition and regulatory scrutiny could still disrupt the path to reliable earnings.

- Contract wins lock in key geographies, but critics highlight that any negative shock, especially in Italy, could disproportionately harm results given its outsized profit contribution.

Valuation Attractive on Sales But Not Versus DCF Fair Value

- Trading at a 1.3x Price-to-Sales ratio, Brightstar screens cheaper than peers at 1.7x and the US Hospitality sector at 1.6x. However, the current $16.63 share price is 46% above the DCF fair value estimate of $11.41.

- Analysts' consensus narrative points out that although the Price-to-Sales discount may attract value seekers, real upside depends on whether the transition to digital and margin improvement actually materialize over the next three years.

- Consensus cautions that analyst price targets ($18.79) require believing in aggressive earnings and margin expansion, and warns that if these do not materialize, the current share price could face pressure.

- While recurring digital revenue and cost cuts are levers bulls hope will narrow the valuation gap, skeptics stress that risks like regulatory changes and earnings volatility could undermine what is currently priced in.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Brightstar Lottery on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on the figures? Share your unique perspective and shape your view in just a few minutes. Do it your way

A great starting point for your Brightstar Lottery research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite a promising turnaround story, Brightstar’s sluggish revenue growth, ongoing negative margins, and valuation premium raise concerns about the company’s ability to deliver reliable cash flow and steady returns.

For investors seeking more predictable growth and financial consistency, discover stable growth stocks screener (2077 results) that outperform by delivering steady results across shifting markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brightstar Lottery might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BRSL

Brightstar Lottery

Provides lottery solutions in the United States, Italy, rest of Europe, and internationally.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives