- United States

- /

- Hospitality

- /

- NYSE:BROS

Dutch Bros (BROS): Exploring Valuation After Recent Share Price Slide

Reviewed by Simply Wall St

After a mixed few months for Dutch Bros (BROS) shares, investors are watching the stock for signs of stabilization. Over the past three months, the coffee chain’s share price has slid roughly 20% as market sentiment has shifted.

See our latest analysis for Dutch Bros.

While Dutch Bros’ share price has struggled lately, falling over 20% in the past three months, this move follows a stretch of mixed momentum and shifting risk sentiment across consumer stocks. The recent 1-year total shareholder return of -4.6% captures this uncertainty. Meanwhile, the three-year total return remains solidly positive at nearly 39%.

If you’re curious where growth-minded insiders are putting their money in today’s volatile market, now is a perfect time to explore fast growing stocks with high insider ownership

With Dutch Bros trading nearly 23% below its average analyst price target and solid growth figures under its belt, investors are left to wonder: is there real upside ahead, or is the market already looking past future gains?

Most Popular Narrative: 33.6% Undervalued

With Dutch Bros’ last close at $50.22, the most widely tracked narrative assigns a fair value of $75.61. This suggests the market may be underestimating its future potential. This creates a dynamic valuation story that depends on expansion strategy and future financial performance.

Strategic expansion, digital innovation, and menu enhancements aim to capture consumer trends, improve customer value, and drive sustained sales and margin growth. Operational efficiency, focus on company-owned stores, and cost management are supporting margin improvement and scalable long-term earnings growth.

Curious how ambitious store growth and a re-imagined business model combine to produce this valuation? The full narrative reveals surprising financial forecasts meant to push Dutch Bros into new territory. Only by digging deeper will you see what key assumptions drive these lofty expectations.

Result: Fair Value of $75.61 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent labor cost inflation or market saturation could challenge Dutch Bros' growth story if these pressures affect margins or reduce demand.

Find out about the key risks to this Dutch Bros narrative.

Another View: Looking at Earnings Multiples

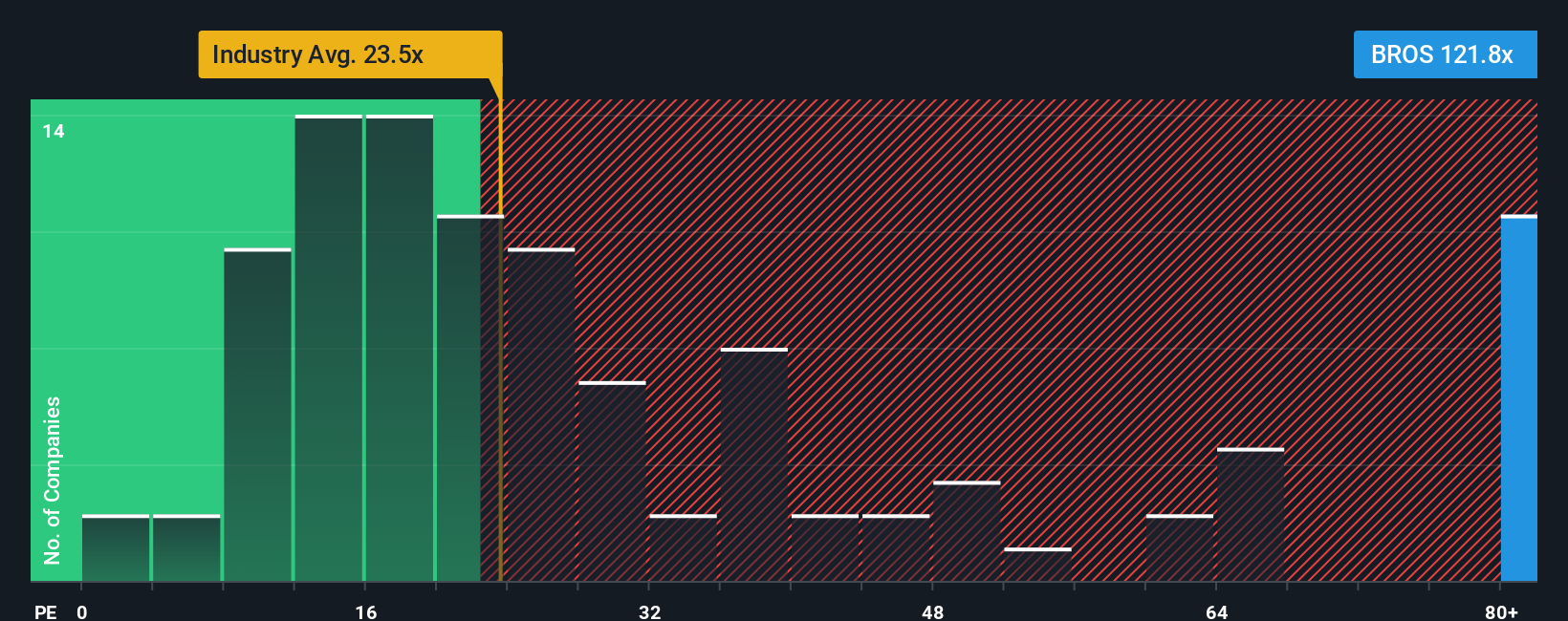

While our earlier fair value estimate paints Dutch Bros as undervalued, a second opinion comes from its price-to-earnings ratio. Right now, Dutch Bros trades at 102.8x earnings, making it much pricier than the US Hospitality industry’s 20.7x average, its peers at 28.3x, and even its fair ratio of just 34.8x. Such a large premium signals higher valuation risk if market expectations do not pan out. Could current optimism be overdone?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Dutch Bros Narrative

If these narratives do not reflect your own outlook or you prefer to analyze the numbers firsthand, you can build your own perspective in just minutes with Do it your way

A great starting point for your Dutch Bros research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Every investor deserves an edge. Use Simply Wall Street’s powerful screener tools to spot unique opportunities before others, and stay ahead of market trends. Don’t let the next big win pass you by.

- Target long-term income growth by reviewing these 15 dividend stocks with yields > 3%, which is packed with stable businesses offering generous yields and consistent payouts.

- Position yourself in the next technology surge by browsing these 27 AI penny stocks, engineered to lead breakthroughs in artificial intelligence and automation.

- Capitalize on value by checking out these 897 undervalued stocks based on cash flows, featuring companies trading below their fair value and ready for potential rebound.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BROS

Dutch Bros

Operates and franchises drive-thru shops in the United States.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives