- United States

- /

- Hospitality

- /

- NYSE:BROS

Can Dutch Bros’ (BROS) Rapid Expansion and Menu Strategies Deepen Its Competitive Moat?

Reviewed by Sasha Jovanovic

- In recent weeks, Dutch Bros reported a third-quarter earnings beat and unveiled continued rapid expansion across both existing and new U.S. markets, including the launch of new stores and a fortressing strategy to boost brand mind share and operational efficiency. The company also introduced several holiday-themed beverages and creative promotions, driving customer engagement and reinforcing its brand loyalty during the festive season.

- While many competitors focus on limited-time offers, Dutch Bros’ blend of aggressive store growth and frequent menu innovation is supporting its strong momentum and broader market presence.

- We'll now explore how Dutch Bros' aggressive market expansion and recent menu innovations might reshape its investment outlook going forward.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Dutch Bros Investment Narrative Recap

For Dutch Bros shareholders, the core thesis is about the power of sustained, high-velocity unit growth and menu innovation to drive consistent revenue and earnings gains, despite mounting competitive and operational headwinds. The recent announcement of a Q3 earnings beat and continued new shop openings further strengthens the expansion story, though it does not meaningfully reduce ongoing concerns around potential market saturation as the company accelerates its fortressing strategy, still the main risk for near-term performance.

This quarter's holiday menu rollout, which featured fan-favorite drinks like Jingle Nog and several festive new items, stands out as highly relevant, reinforcing Dutch Bros' menu innovation as a catalyst for traffic and loyalty. However, with ambitious shop opening targets still in place, same-shop sales trends and margin management remain key areas to monitor in the months ahead.

However, investors should be aware that even with strong near-term results, aggressive market entry could increase exposure to...

Read the full narrative on Dutch Bros (it's free!)

Dutch Bros' outlook anticipates $2.6 billion in revenue and $197.4 million in earnings by 2028. This projection is based on a 21.8% annual revenue growth rate and a $140 million increase in earnings from the current $57.2 million level.

Uncover how Dutch Bros' forecasts yield a $75.61 fair value, a 49% upside to its current price.

Exploring Other Perspectives

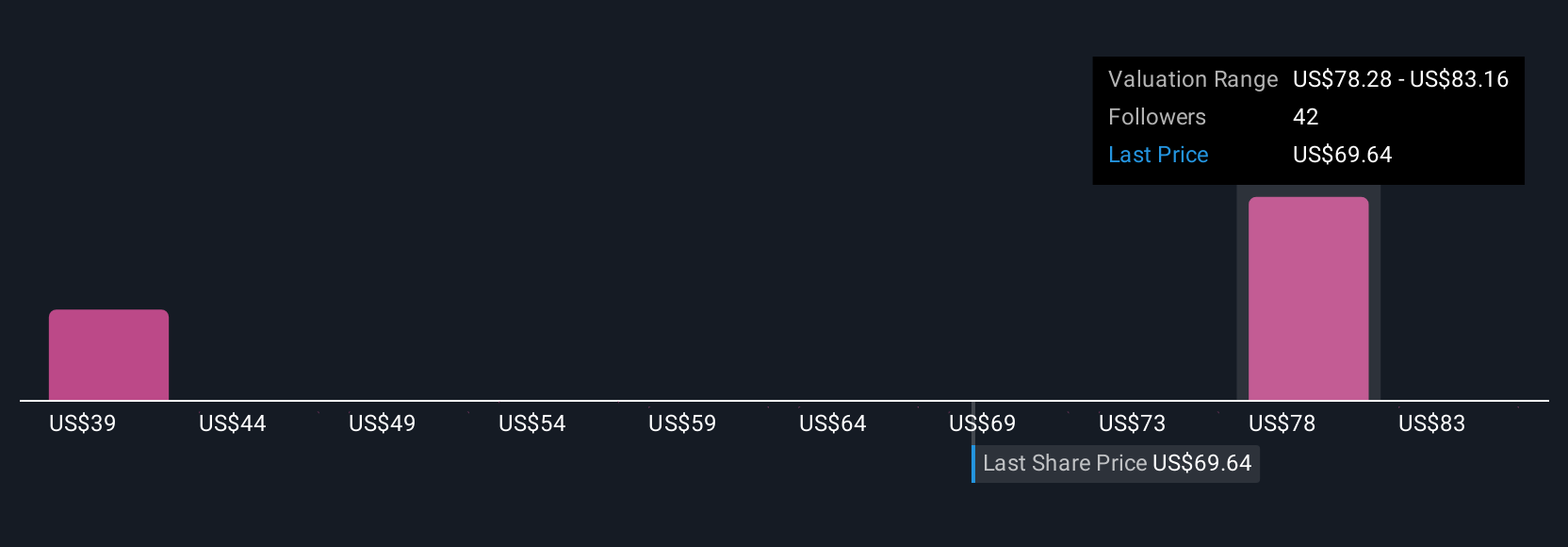

Simply Wall St Community members have submitted fair value estimates for Dutch Bros ranging from US$57.03 to US$85, reflecting eight diverse perspectives. Amid wide-ranging outlooks, potential market saturation risk remains top of mind, suggesting there are several angles for you to consider before making up your mind.

Explore 8 other fair value estimates on Dutch Bros - why the stock might be worth just $57.03!

Build Your Own Dutch Bros Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dutch Bros research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Dutch Bros research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dutch Bros' overall financial health at a glance.

No Opportunity In Dutch Bros?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BROS

Dutch Bros

Operates and franchises drive-thru shops in the United States.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives