- United States

- /

- Hospitality

- /

- NYSE:BH.A

Most Shareholders Will Probably Find That The Compensation For Biglari Holdings Inc.'s (NYSE:BH.A) CEO Is Reasonable

Shareholders may be wondering what CEO Sardar Biglari plans to do to improve the less than great performance at Biglari Holdings Inc. (NYSE:BH.A) recently. They will get a chance to exercise their voting power to influence the future direction of the company in the next AGM on 27 May 2021. It has been shown that setting appropriate executive remuneration incentivises the management to act in the interests of shareholders. In our opinion, CEO compensation does not look excessive and we discuss why.

View our latest analysis for Biglari Holdings

Comparing Biglari Holdings Inc.'s CEO Compensation With the industry

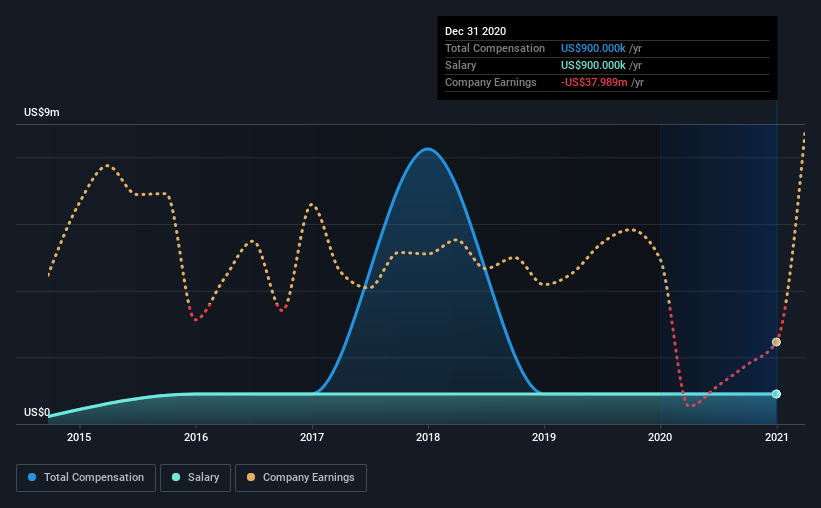

According to our data, Biglari Holdings Inc. has a market capitalization of US$547m, and paid its CEO total annual compensation worth US$900k over the year to December 2020. This was the same as last year. It is worth noting that the CEO compensation consists entirely of the salary, worth US$900k.

On examining similar-sized companies in the industry with market capitalizations between US$200m and US$800m, we discovered that the median CEO total compensation of that group was US$2.0m. In other words, Biglari Holdings pays its CEO lower than the industry median.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$900k | US$900k | 100% |

| Other | - | - | - |

| Total Compensation | US$900k | US$900k | 100% |

On an industry level, roughly 22% of total compensation represents salary and 78% is other remuneration. At the company level, Biglari Holdings pays Sardar Biglari solely through a salary, preferring to go down a conventional route. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Biglari Holdings Inc.'s Growth

Biglari Holdings Inc. has seen its earnings per share (EPS) increase by 42% a year over the past three years. In the last year, its revenue is down 37%.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's always a tough situation when revenues are not growing, but ultimately profits are more important. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Biglari Holdings Inc. Been A Good Investment?

Given the total shareholder loss of 16% over three years, many shareholders in Biglari Holdings Inc. are probably rather dissatisfied, to say the least. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

Biglari Holdings pays CEO compensation exclusively through a salary, with non-salary compensation completely ignored. The loss to shareholders over the past three years is certainly concerning. This diverges with the robust growth in EPS, suggesting that there is a large discrepancy between share price and fundamentals. A key question may be why the fundamentals have not yet been reflected into the share price. In the upcoming AGM, shareholders should take this opportunity to raise these concerns with the board and revisit their investment thesis with regards to the company.

CEO pay is simply one of the many factors that need to be considered while examining business performance. In our study, we found 3 warning signs for Biglari Holdings you should be aware of, and 1 of them makes us a bit uncomfortable.

Important note: Biglari Holdings is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you decide to trade Biglari Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Biglari Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:BH.A

Biglari Holdings

Through its subsidiaries, primarily operates and franchises restaurants in the United States.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success