- United States

- /

- Consumer Services

- /

- NYSE:BFAM

Bright Horizons (BFAM): Assessing Valuation After Recent Short-Term Share Price Strength

Reviewed by Simply Wall St

Bright Horizons Family Solutions (BFAM) has quietly outperformed the broader market over the past week, with shares climbing about 7%, even as longer term returns remain mixed and invite a closer look at the setup.

See our latest analysis for Bright Horizons Family Solutions.

Zooming out, that 8.5% 1 month share price return only partly offsets a negative year to date share price move and a flat 1 year total shareholder return. This suggests momentum is tentatively rebuilding rather than fully back in gear at the current $104.52 level.

If this kind of early momentum catches your eye, it could be worth scanning for other childcare and broader consumer services names by exploring fast growing stocks with high insider ownership.

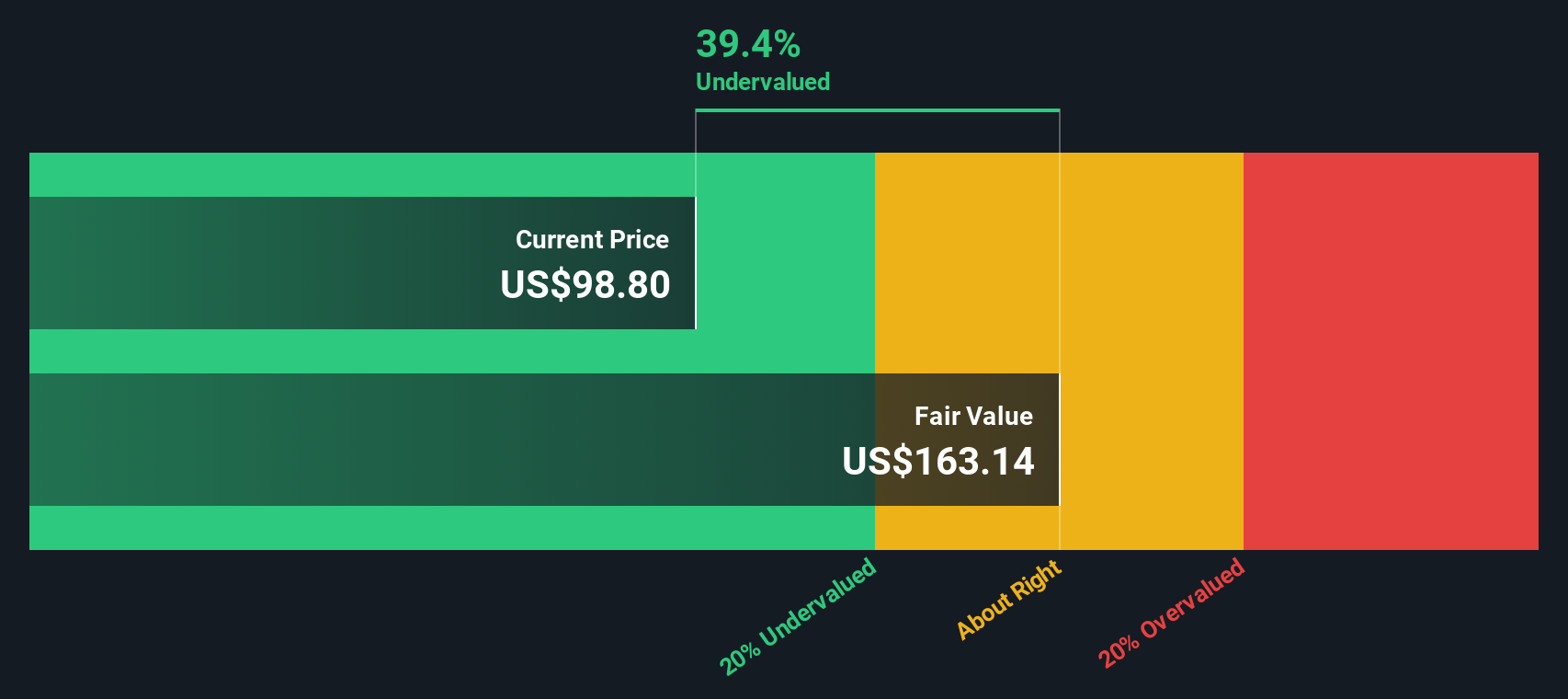

With the shares still trading at a notable discount to analyst targets despite solid revenue and earnings growth, the key question now is whether Bright Horizons is undervalued or if the market is already pricing in its recovery.

Most Popular Narrative Narrative: 19.3% Undervalued

Against a last close of $104.52, the most widely followed narrative points to a notably higher fair value, hinging on durable earnings and margin expansion.

Operating margin improvement is being realized and guided to continue due to investments in technology and enhanced center efficiencies, as well as ongoing rationalization (exiting or improving underperforming centers). Incremental enrollment in "improver" centers, alongside digital initiatives streamlining the parent experience, should lead to operating leverage and higher net margins over time.

Curious how steady revenue growth, rising margins, and a richer earnings mix can still justify a premium future multiple for childcare? See the full narrative math behind that conviction.

Result: Fair Value of $129.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained weak enrollment at underperforming centers and sector wide wage pressure could stall margin recovery and undermine the undervaluation case.

Find out about the key risks to this Bright Horizons Family Solutions narrative.

Another Angle on Valuation

Our SWS DCF model takes a longer term cash flow view and lands at a fair value of about $243 per share, implying BFAM is trading roughly 57% below that level. That is far more optimistic than analyst targets. This raises the question of which set of assumptions proves closer to reality.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Bright Horizons Family Solutions Narrative

If you prefer to dig into the numbers yourself and challenge these assumptions, you can quickly build a personalized view in just minutes: Do it your way.

A great starting point for your Bright Horizons Family Solutions research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Do not stop at one opportunity. Use the Simply Wall St Screener to systematically uncover stocks that fit your strategy before the market fully catches on.

- Capture potential mispricings by reviewing these 908 undervalued stocks based on cash flows where strong cash flow analysis suggests the market has not yet fully appreciated the opportunity.

- Ride powerful structural trends by scanning these 29 healthcare AI stocks at the intersection of medical innovation and intelligent automation.

- Tap into frontier digital finance by assessing these 80 cryptocurrency and blockchain stocks positioned to benefit from growing blockchain adoption and token based ecosystems.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Bright Horizons Family Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BFAM

Bright Horizons Family Solutions

Provides early education and childcare, back-up care, educational advisory, and other workplace solutions services for employers and families in the United States, Puerto Rico, the United Kingdom, the Netherlands, Australia, and India.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion