- United States

- /

- Consumer Services

- /

- NYSE:ATGE

The Bull Case For Adtalem Global Education (ATGE) Could Change Following Securities Fraud Investigation Into Enrollment Disclosures

Reviewed by Sasha Jovanovic

- In the past week, Adtalem Global Education reported first-quarter fiscal 2026 results with sales of US$462.29 million and net income of US$61.83 million, while confirming annual revenue guidance and completing a share buyback tranche valued at US$7.59 million.

- The company is now under investigation by a law firm for potential securities fraud, centering on its statements about student demand and regulatory changes following concerns about slowed enrollment growth at its Chamberlain University.

- We'll explore how the launch of this investigation into disclosure practices shapes Adtalem's investment narrative going forward.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Adtalem Global Education's Investment Narrative?

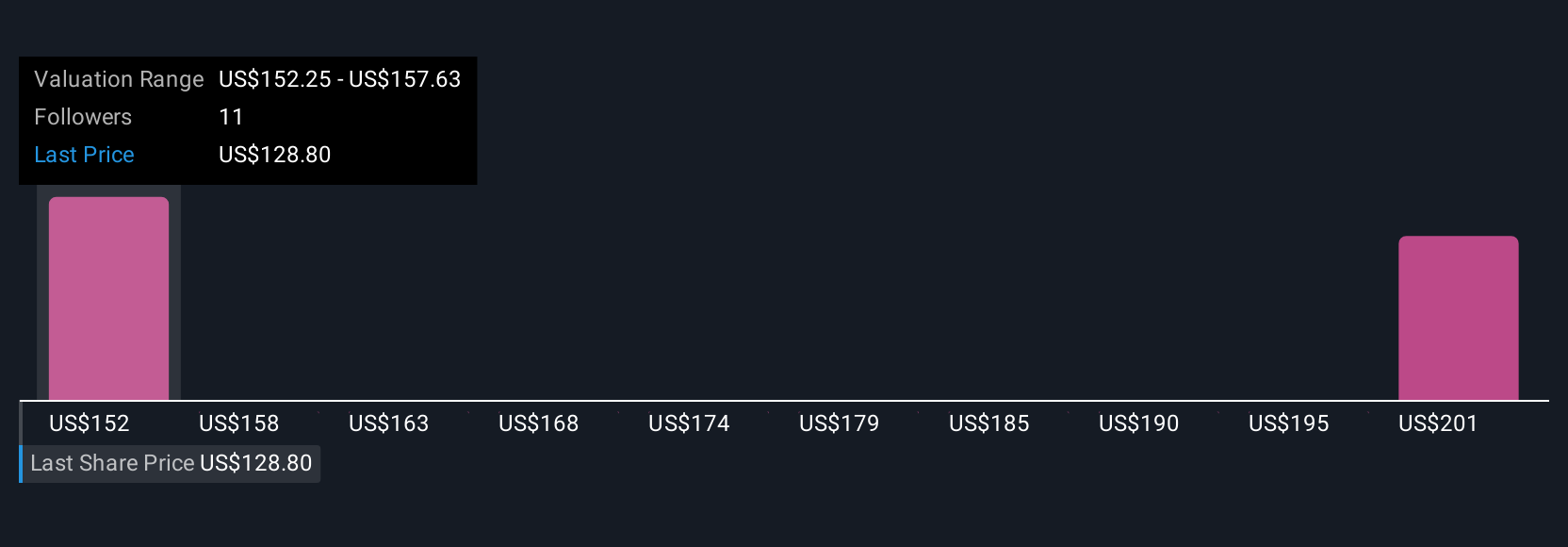

For anyone considering Adtalem Global Education, the big picture requires confidence in the company’s ability to deliver consistent growth in student enrollments, maintain healthy margins, and navigate a changing regulatory climate. The recent quarter’s solid sales and earnings, plus reaffirmed full-year revenue guidance, might inspire optimism, but the sudden law firm investigation into possible securities fraud marks a new risk for shareholders. This probe focuses on Adtalem’s recent disclosures about student demand and regulatory changes after its Chamberlain University segment reported slower enrollment growth, which coincided with a sharp stock decline. Until now, most catalysts seemed grounded in steady operational execution and expansion of innovative programs like the new AI credentials initiative, with valuation appearing highly attractive relative to analyst price targets. However, with legal scrutiny now front and center, investor attention may shift from operational performance to uncertainty around disclosure and reputational risk. While it’s not yet clear if this will materially impact Adtalem’s future, the situation has injected fresh uncertainty into what was once a more predictable outlook.

By contrast, the sudden legal inquiry highlights real risks investors should not overlook.

Exploring Other Perspectives

Explore 2 other fair value estimates on Adtalem Global Education - why the stock might be worth as much as 90% more than the current price!

Build Your Own Adtalem Global Education Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Adtalem Global Education research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Adtalem Global Education research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Adtalem Global Education's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ATGE

Adtalem Global Education

Provides healthcare education in the United States, Barbados, St.

Very undervalued with solid track record.

Market Insights

Community Narratives