- United States

- /

- Consumer Services

- /

- NYSE:ATGE

Is Adtalem Global Education's (ATGE) Moderate Outlook at Odds With Its Strong Enrollment Momentum?

Reviewed by Sasha Jovanovic

- Adtalem Global Education reported first quarter results for fiscal 2026, posting revenue of US$462.29 million and year-over-year net income growth to US$61.83 million, alongside 8% higher total student enrollment driven by strong performances at its Chamberlain and Walden University segments.

- Despite these gains, the company's reaffirmed revenue growth outlook for the full year reflected more moderate expectations, bringing attention to the potential for slower expansion ahead.

- We’ll explore how Adtalem’s tempered fiscal year guidance amid robust enrollment growth is shaping its investment narrative for stakeholders.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is Adtalem Global Education's Investment Narrative?

To be invested in Adtalem Global Education, you’d need confidence in the continued demand for career-driven higher education, especially in fields like healthcare and digital credentials. The company’s first-quarter results for fiscal 2026, showing strong revenue and profit growth with 8% enrollment expansion, would typically be reassuring short-term catalysts. However, reinstated annual guidance that signals more modest revenue growth, combined with a sharp share price drop in reaction to the news, may shift risk perceptions. The tempered outlook brings attention to management’s ability to sustain elevated enrollment momentum and execute on strategic initiatives against execution hiccups, especially at Chamberlain, and emerging regulatory pressures and insider selling. While the headline financials remain robust, the disconnect between recent performance and near-term guidance will likely keep investor focus on management’s delivery in the quarters ahead.

Yet, execution risk and reliance on a few key segments remain important red flags to watch.

Exploring Other Perspectives

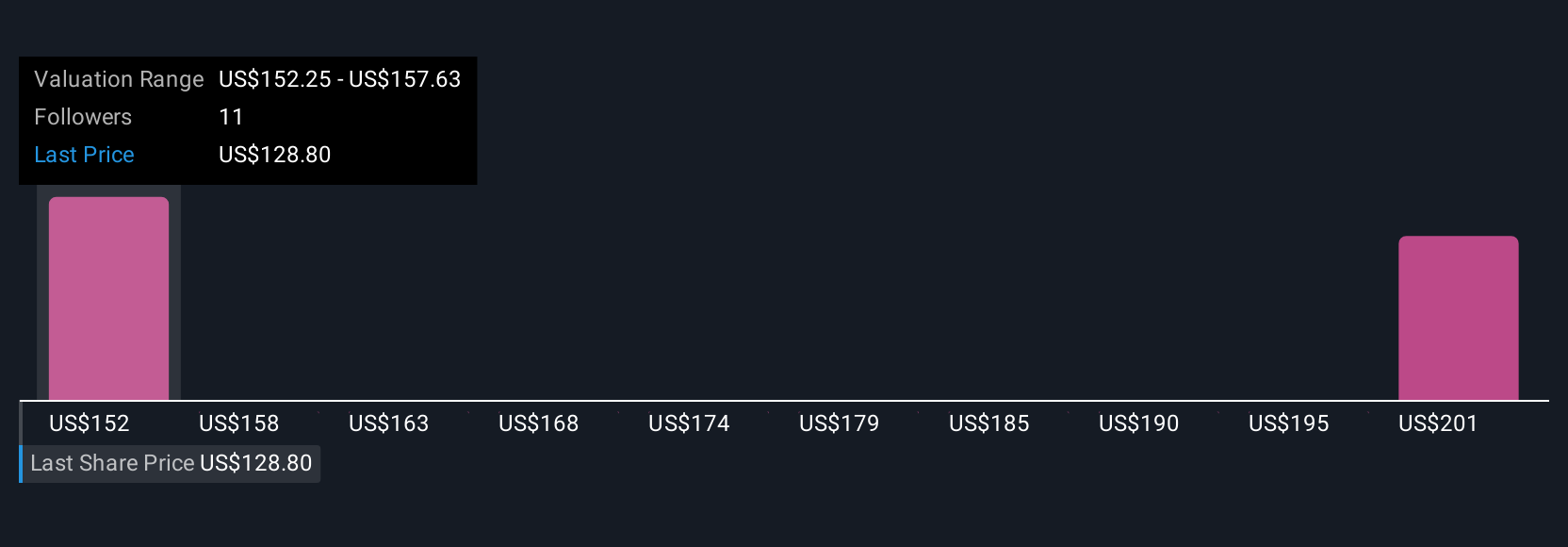

Explore 2 other fair value estimates on Adtalem Global Education - why the stock might be worth as much as 81% more than the current price!

Build Your Own Adtalem Global Education Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Adtalem Global Education research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Adtalem Global Education research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Adtalem Global Education's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ATGE

Adtalem Global Education

Provides healthcare education in the United States, Barbados, St.

Very undervalued with solid track record.

Market Insights

Community Narratives