- United States

- /

- Consumer Services

- /

- NYSE:ATGE

Is Adtalem Global Education a Bargain After Recent 35% Drop in Share Price?

Reviewed by Bailey Pemberton

- Ever wondered if Adtalem Global Education stock is genuinely undervalued, or if the market’s recent moves have already priced in all the upside? Let’s break down what is driving opinions on this education sector leader.

- Shares have seen big swings lately, dropping 35.9% in just the past week and down 34.8% over the last month. The stock is still up 23% in the past year and has surged by more than 275% over five years.

- Adtalem’s recent price action has caught attention in the wake of sector-wide volatility, with headlines highlighting shifts in higher education policy and evolving student demand. This context helps explain investors’ nervousness and the focus on future growth drivers beyond just the fundamentals.

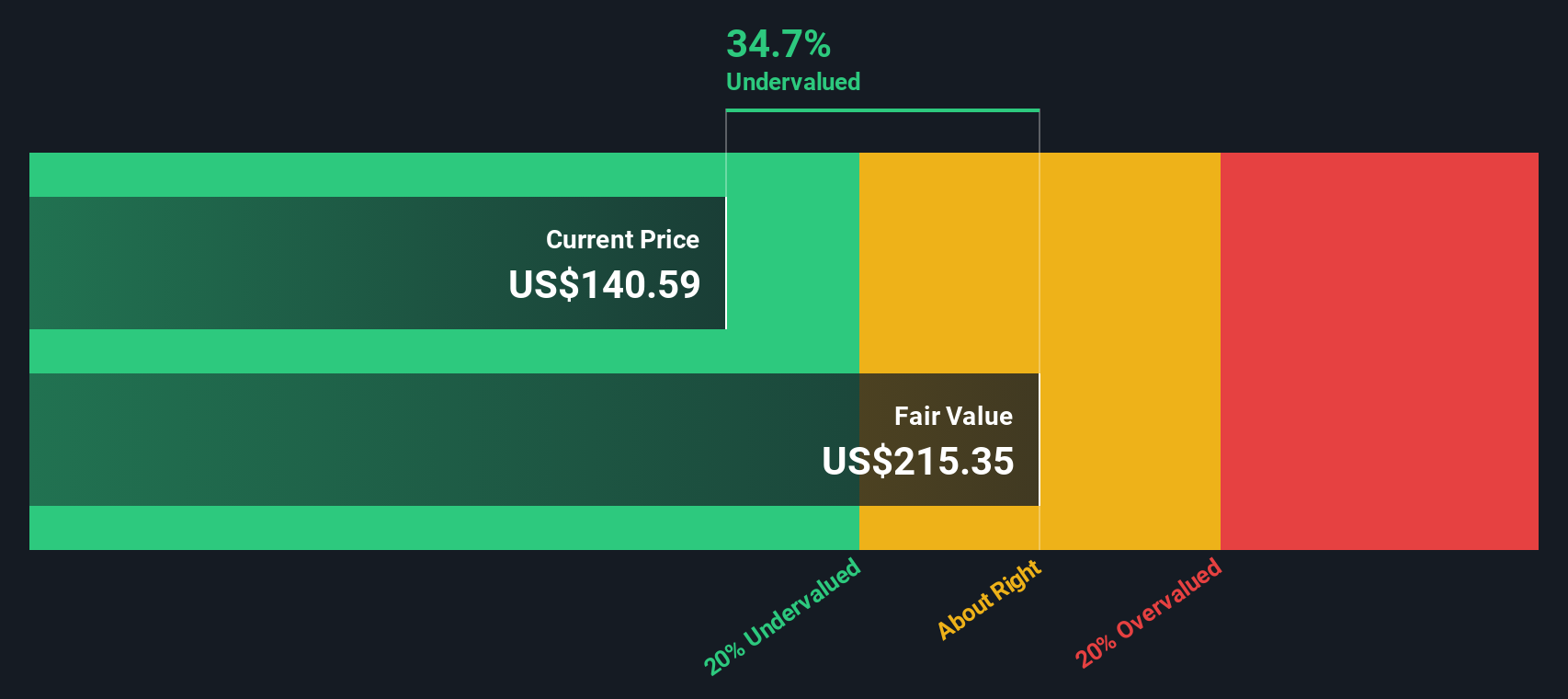

- The current valuation check gives Adtalem a 6 out of 6, showing it is undervalued across the board. However, is that score telling the whole story? Before evaluating the methods behind this result, let’s look at why there may be an even better way to understand value by the end of this article.

Approach 1: Adtalem Global Education Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) method estimates a company’s value by projecting its future cash flows and discounting them back to today’s dollars. This approach provides insight into what the business could be worth based on its ability to generate cash in the years to come.

For Adtalem Global Education, the most recent trailing twelve months Free Cash Flow comes in at $328.7 Million. Analysts forecast that annual free cash flow will remain in the $320 to $330 Million range over the next few years, with longer-term projections by Simply Wall St suggesting a gradual increase, reaching $381.6 Million by 2035. These projections, though extrapolated, show a steady upward trend.

Based on these cash flow trends and discounting them at an appropriate rate, the DCF model calculates an intrinsic value of $194.38 per share. This suggests that Adtalem is currently trading at a 49.6% discount to its fair value according to the DCF, meaning the market price is significantly below what these cash flow projections would justify.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Adtalem Global Education is undervalued by 49.6%. Track this in your watchlist or portfolio, or discover 834 more undervalued stocks based on cash flows.

Approach 2: Adtalem Global Education Price vs Earnings

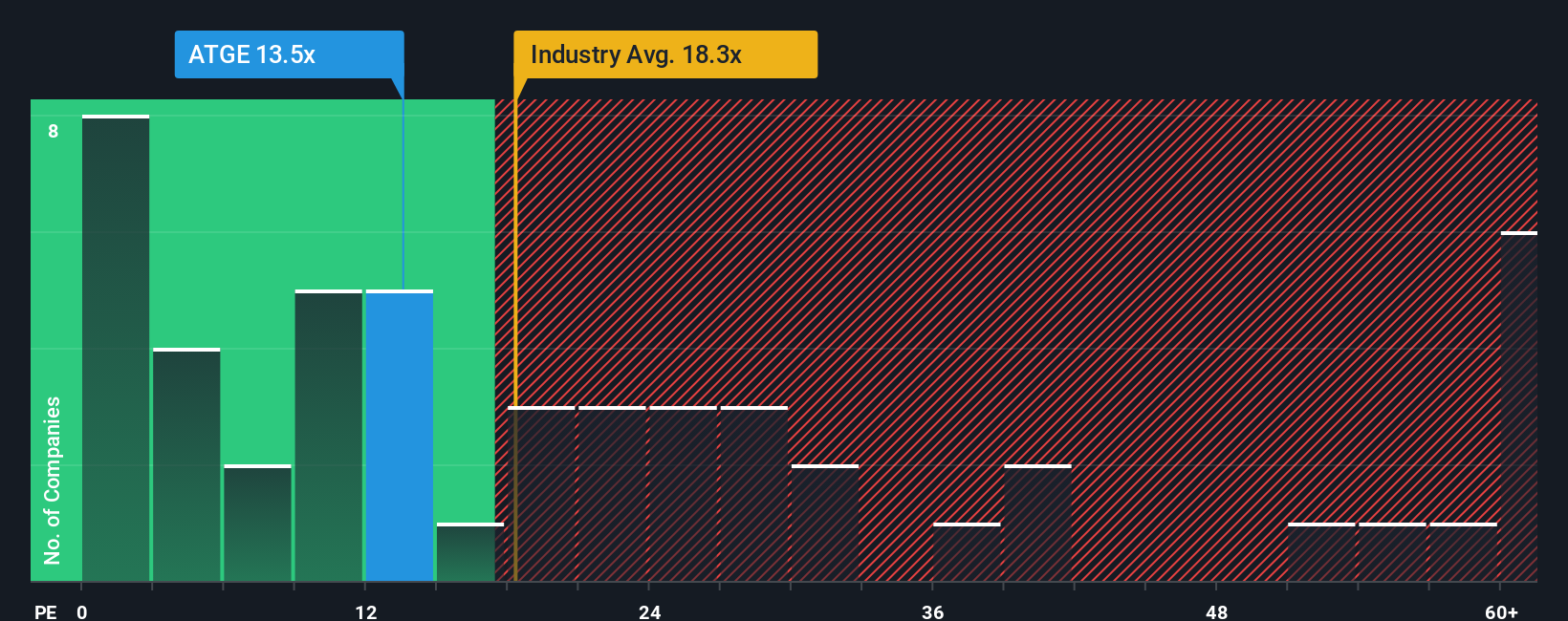

The Price-to-Earnings (PE) ratio is widely considered a reliable valuation metric for profitable companies, as it directly relates a company’s current share price to its per-share earnings. Because Adtalem Global Education posts consistent profits, PE makes sense for evaluating how the market is valuing those earnings relative to competitors and expected growth.

In general, investors expect companies with higher growth prospects or lower risk to trade at higher PE ratios, while those with slower growth or elevated risks tend to command lower PE multiples. A “normal” or “fair” PE ratio should balance expectations for the company’s earnings growth against these risks and the overall industry environment.

Currently, Adtalem trades at a PE ratio of 14.39x. This compares favorably to the industry average of 18.43x and is below the peer group’s average of 18.15x. On the surface, this suggests the stock is less expensive than many of its direct competitors within the Consumer Services industry.

However, rather than relying solely on broad industry averages, Simply Wall St’s proprietary “Fair Ratio” provides a more nuanced benchmark. The Fair Ratio, calculated at 23.22x for Adtalem, accounts for company-specific factors like projected earnings growth, profit margins, market cap, and unique risk factors. This method offers a deeper valuation read than blanket peer or industry comparisons.

With Adtalem’s actual PE of 14.39x sitting well below its Fair Ratio of 23.22x, the analysis indicates the stock remains substantially undervalued on an earnings basis, even after considering all the factors that should matter most for investors deciding what to pay for future profits.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1409 companies where insiders are betting big on explosive growth.

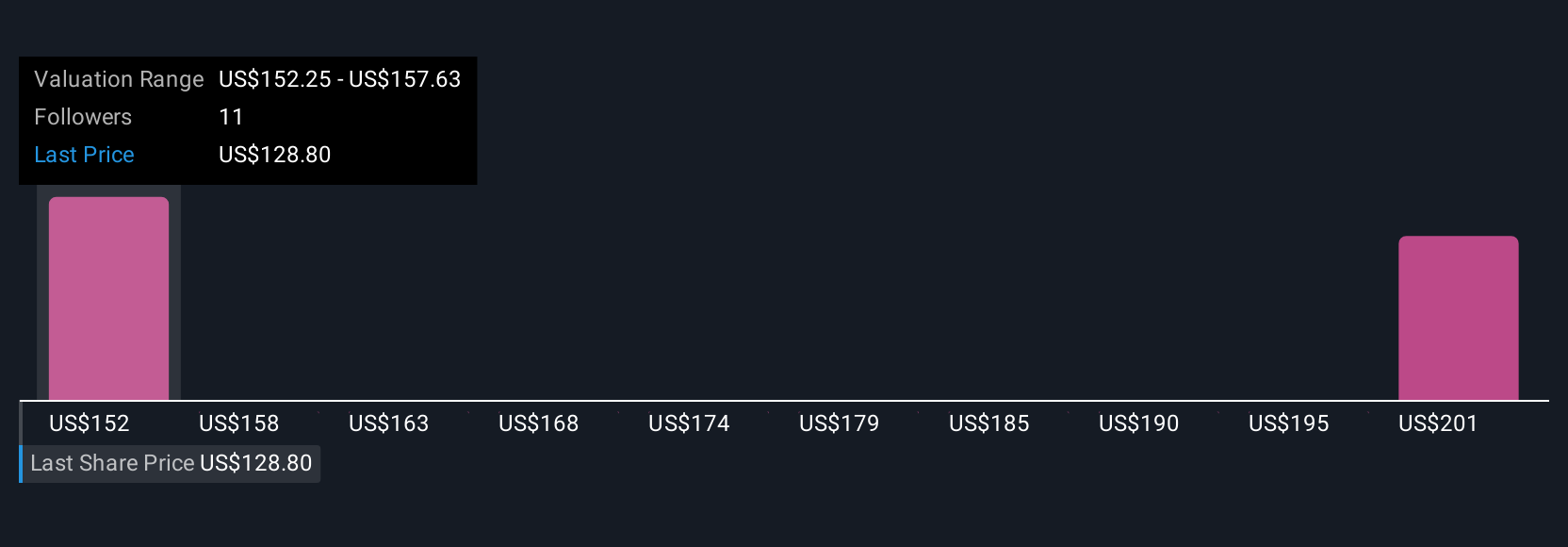

Upgrade Your Decision Making: Choose your Adtalem Global Education Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative combines your unique perspective on Adtalem Global Education’s story with a financial forecast of future revenue, earnings, and margins, ultimately linking that story directly to a fair value for the stock. Narratives make valuation accessible and meaningful by allowing you to project what you believe will happen, then see how that translates into a price target. On Simply Wall St’s Community page, millions of investors are already using Narratives to decide when to buy or sell by comparing their fair value to the current market price, making it an easy and powerful tool.

Best of all, Narratives update dynamically as news or earnings reports come in, helping you react quickly to new information. For example, one investor’s Narrative might forecast robust enrollment growth resulting in a much higher fair value, while another may anticipate regulatory pressures and set a far more conservative target. Narratives put you in control and turn company research into actionable insights tailored to your own view of Adtalem’s future.

Do you think there's more to the story for Adtalem Global Education? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ATGE

Adtalem Global Education

Provides healthcare education in the United States, Barbados, St.

Very undervalued with solid track record.

Market Insights

Community Narratives