- United States

- /

- Consumer Services

- /

- NYSE:ATGE

Adtalem Global Education (ATGE): Evaluating Valuation After Cautious Guidance Tempers Strong Earnings Surprise

Reviewed by Simply Wall St

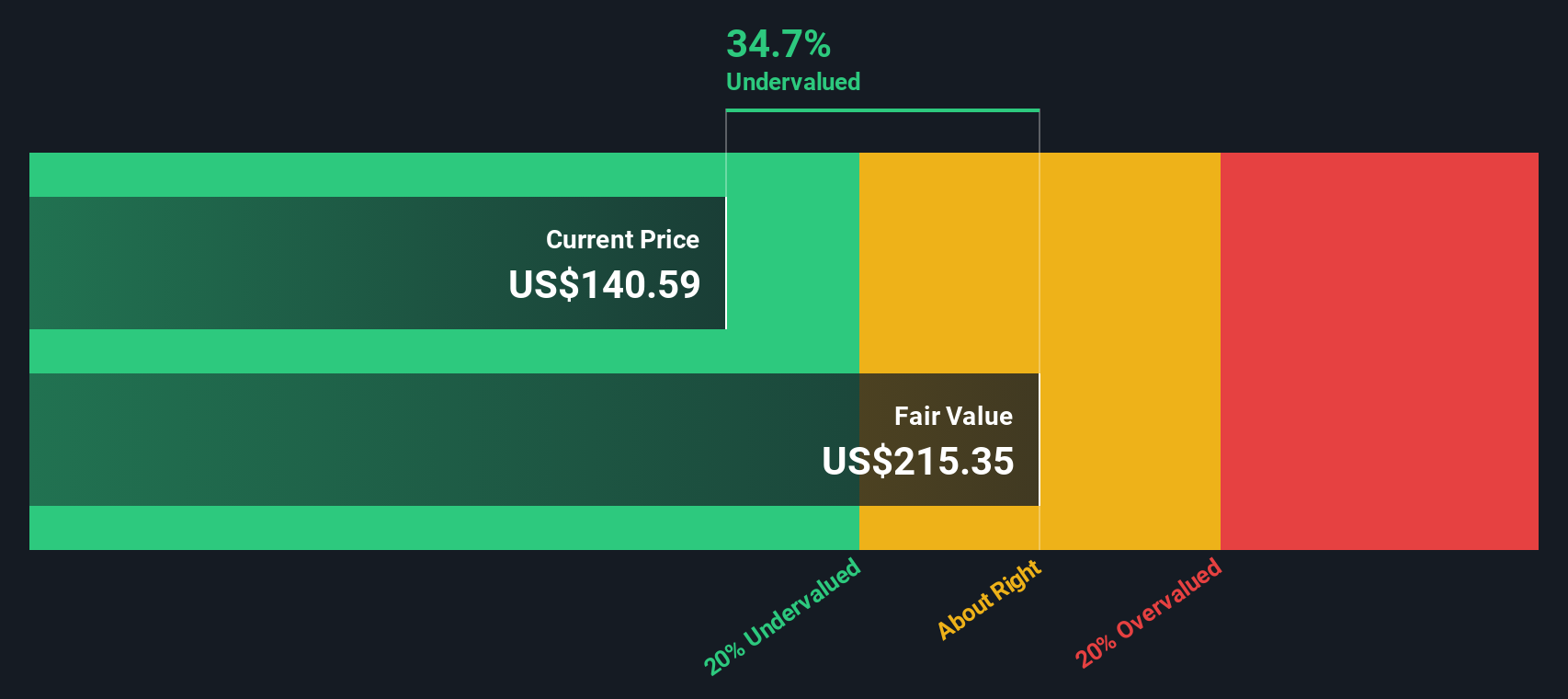

Adtalem Global Education (ATGE) recently posted quarterly results with revenues climbing 11% from last year and earnings ahead of expectations. However, its cautious full-year revenue outlook, in line with analyst expectations and lagging industry peers, quickly weighed on the stock.

See our latest analysis for Adtalem Global Education.

After a strong surge that saw a 3-year total shareholder return of 135% and a five-year figure above 200%, Adtalem Global Education’s momentum has cooled recently. The latest earnings surprise was not enough to offset investor caution. Its share price has slid more than 30% over the last quarter, and year-to-date performance is modest as the market weighs growth potential against cautious guidance.

If you’re looking to expand beyond a single name, now is a great time to discover fast growing stocks with high insider ownership.

With shares now trading at a significant discount to analyst targets after the sharp pullback, the key question is whether Adtalem Global Education is truly undervalued or if the market is simply pricing in slower future growth.

Price-to-Earnings of 13.6x: Is it justified?

Adtalem Global Education is trading at a price-to-earnings (P/E) ratio of 13.6x, which is currently below both its peer group and industry averages. This may signal the market is underpricing its earnings strength after the recent pullback.

The price-to-earnings ratio compares a company’s current share price to its per-share earnings and is often used to assess whether a stock appears cheap or expensive relative to the company’s recent profitability. In the case of Adtalem, this ratio takes on particular importance given its notable earnings acceleration over the past year.

Adtalem’s P/E of 13.6x trails the Consumer Services industry average of 15.9x, and it is even further below the estimated fair ratio of 20.1x. This discrepancy highlights a valuation gap that could close if investor sentiment shifts on the company’s growth trajectory, especially given its strong recent profit expansion.

Explore the SWS fair ratio for Adtalem Global Education

Result: Price-to-Earnings of 13.6x (UNDERVALUED)

However, continued cautious guidance and recent declines in share price could limit upside if industry growth slows or if investor confidence remains subdued.

Find out about the key risks to this Adtalem Global Education narrative.

Another View: What Does Our DCF Model Reveal?

Looking at Adtalem Global Education through the lens of the SWS DCF model, the shares appear even more undervalued, trading at a 48.4% discount to our estimated fair value. This method goes beyond current earnings and factors in future cash flows, which provides a different perspective on opportunity.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Adtalem Global Education for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 915 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Adtalem Global Education Narrative

If you want a different angle on the story or prefer to dig into the numbers yourself, it’s simple to put together your own take in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Adtalem Global Education.

Looking for more investment ideas?

Smart investors never settle for just one opportunity. Expand your horizons and get ahead of the pack by searching for companies that match your strategy using our powerful screener.

- Start building your income stream and spot financial strength among these 15 dividend stocks with yields > 3% offering yields above 3% and reliable returns.

- Unlock the explosive upside of artificial intelligence by reviewing these 25 AI penny stocks shaping tomorrow’s markets across multiple innovative industries.

- Target hidden bargains that could be trading below their cash flow value with these 915 undervalued stocks based on cash flows. Do not let undervalued opportunities pass you by.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ATGE

Adtalem Global Education

Provides healthcare education in the United States, Barbados, St.

Very undervalued with solid track record.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026