- United States

- /

- Consumer Services

- /

- NYSE:ADT

Will ADT’s (ADT) Latest Debt Move Enhance Financial Flexibility or Signal New Strategic Priorities?

Reviewed by Sasha Jovanovic

- ADT Inc. recently amended its credit agreement, incurring US$300 million in new term loans to refinance existing debt and securing an additional US$325 million facility for general corporate purposes.

- This refinancing initiative signals ADT's intention to optimize its debt structure and improve financial flexibility, actions that may influence how investors assess its market positioning.

- We’ll look at how ADT’s focus on debt optimization could shape its long-term investment narrative and financial outlook.

Find companies with promising cash flow potential yet trading below their fair value.

ADT Investment Narrative Recap

To believe in ADT as a shareholder, you need confidence in its ability to sustain recurring revenue as the security market evolves toward smart home integration, while keeping debt manageable. The recent announcement regarding US$300 million in new term loans and an added US$325 million facility is focused on strengthening ADT’s balance sheet, but it has no immediate effect on the company’s most important short-term catalyst: adoption of connected smart home devices. In contrast, the refinancing effort does address the company’s most pressing risk, its still-elevated net debt, which continues to weigh on future flexibility.

Among ADT’s latest product launches, the integration of biometric security features with the Yale Assure Lock 2 Touch and ADT+ platform is highly relevant to the broader narrative. This type of innovation supports the shift toward smarter, integrated security ecosystems, which remains a key driver for ADT’s revenue growth and competitiveness, especially as pressure from DIY-oriented rivals persists.

However, it’s worth noting that despite ADT’s focus on new technology and refinancing, investors should be aware that competitive threats from DIY solutions remain and...

Read the full narrative on ADT (it's free!)

ADT's narrative projects $5.7 billion revenue and $857.3 million earnings by 2028. This requires 3.9% yearly revenue growth and a $217.3 million earnings increase from $640.0 million today.

Uncover how ADT's forecasts yield a $9.58 fair value, a 8% upside to its current price.

Exploring Other Perspectives

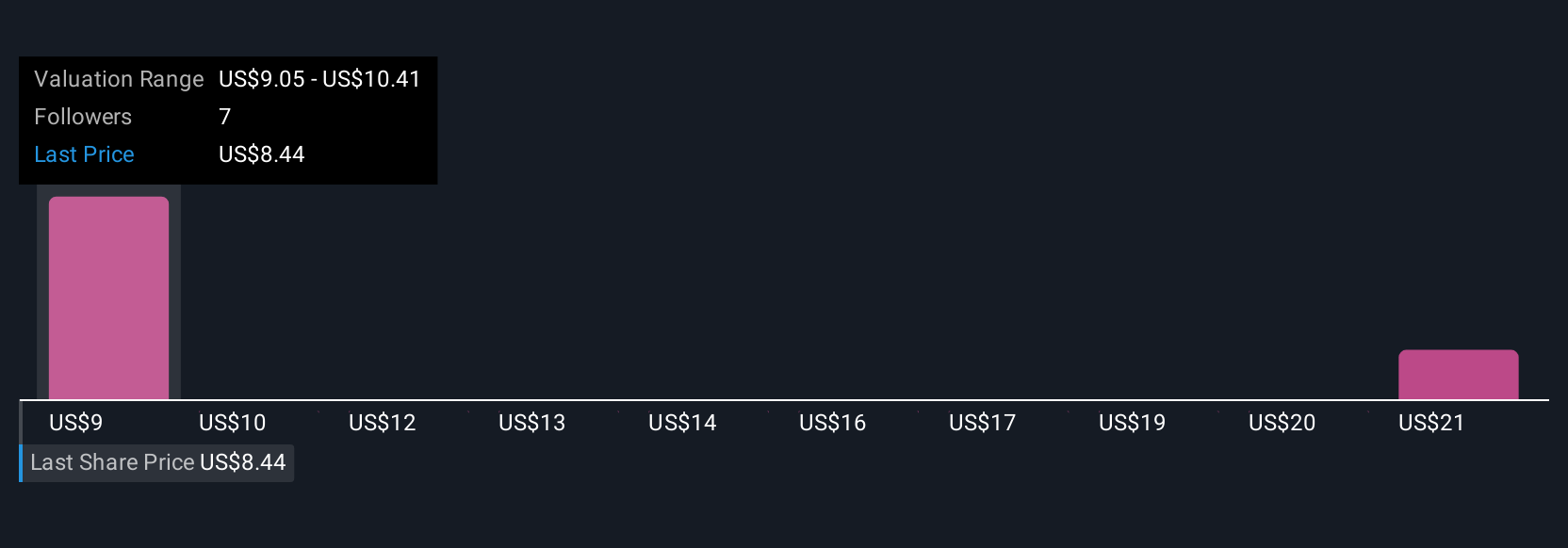

Three members of the Simply Wall St Community have valued ADT between US$9.05 and US$21.85 per share. While some see sizeable upside, adoption of integrated smart home technology remains a key influence on future growth for the company.

Explore 3 other fair value estimates on ADT - why the stock might be worth over 2x more than the current price!

Build Your Own ADT Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ADT research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ADT research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ADT's overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ADT

ADT

Provides security, interactive, and smart home solutions in the United States.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives