- United States

- /

- Consumer Services

- /

- OTCPK:ZVOI

Health Check: How Prudently Does Zovio (NASDAQ:ZVO) Use Debt?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Zovio Inc (NASDAQ:ZVO) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Zovio

What Is Zovio's Debt?

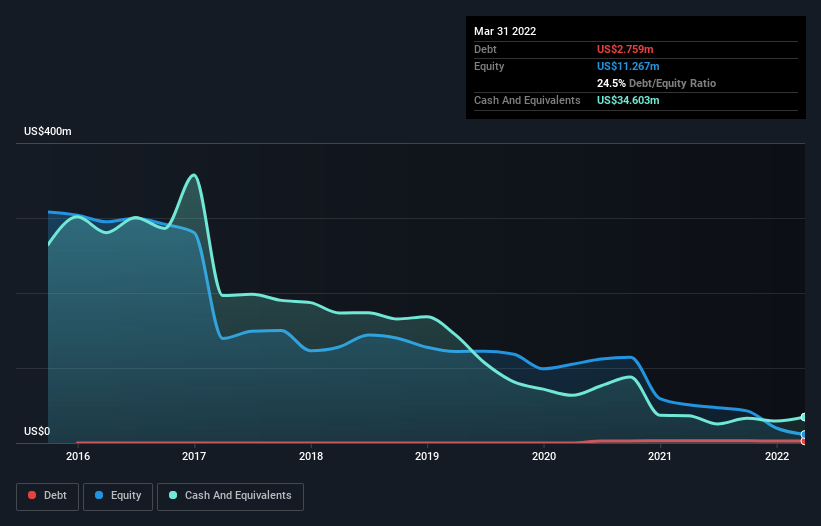

As you can see below, Zovio had US$2.76m of debt at March 2022, down from US$3.10m a year prior. But on the other hand it also has US$34.6m in cash, leading to a US$31.8m net cash position.

A Look At Zovio's Liabilities

We can see from the most recent balance sheet that Zovio had liabilities of US$100.7m falling due within a year, and liabilities of US$36.8m due beyond that. Offsetting this, it had US$34.6m in cash and US$7.11m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$95.8m.

This deficit casts a shadow over the US$33.2m company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. After all, Zovio would likely require a major re-capitalisation if it had to pay its creditors today. Given that Zovio has more cash than debt, we're pretty confident it can handle its debt, despite the fact that it has a lot of liabilities in total. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Zovio can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

In the last year Zovio had a loss before interest and tax, and actually shrunk its revenue by 34%, to US$248m. To be frank that doesn't bode well.

So How Risky Is Zovio?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And the fact is that over the last twelve months Zovio lost money at the earnings before interest and tax (EBIT) line. And over the same period it saw negative free cash outflow of US$16m and booked a US$40m accounting loss. Given it only has net cash of US$31.8m, the company may need to raise more capital if it doesn't reach break-even soon. Summing up, we're a little skeptical of this one, as it seems fairly risky in the absence of free cashflow. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 5 warning signs for Zovio (2 don't sit too well with us!) that you should be aware of before investing here.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Zovio might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OTCPK:ZVOI

Zovio

Operates as an education technology services company in the United States.

Slight risk with weak fundamentals.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Q3 Outlook modestly optimistic

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion