- United States

- /

- Consumer Services

- /

- NasdaqCM:ZSPC

zSpace, Inc. (NASDAQ:ZSPC) Might Not Be As Mispriced As It Looks After Plunging 38%

To the annoyance of some shareholders, zSpace, Inc. (NASDAQ:ZSPC) shares are down a considerable 38% in the last month, which continues a horrid run for the company. To make matters worse, the recent drop has wiped out a year's worth of gains with the share price now back where it started a year ago.

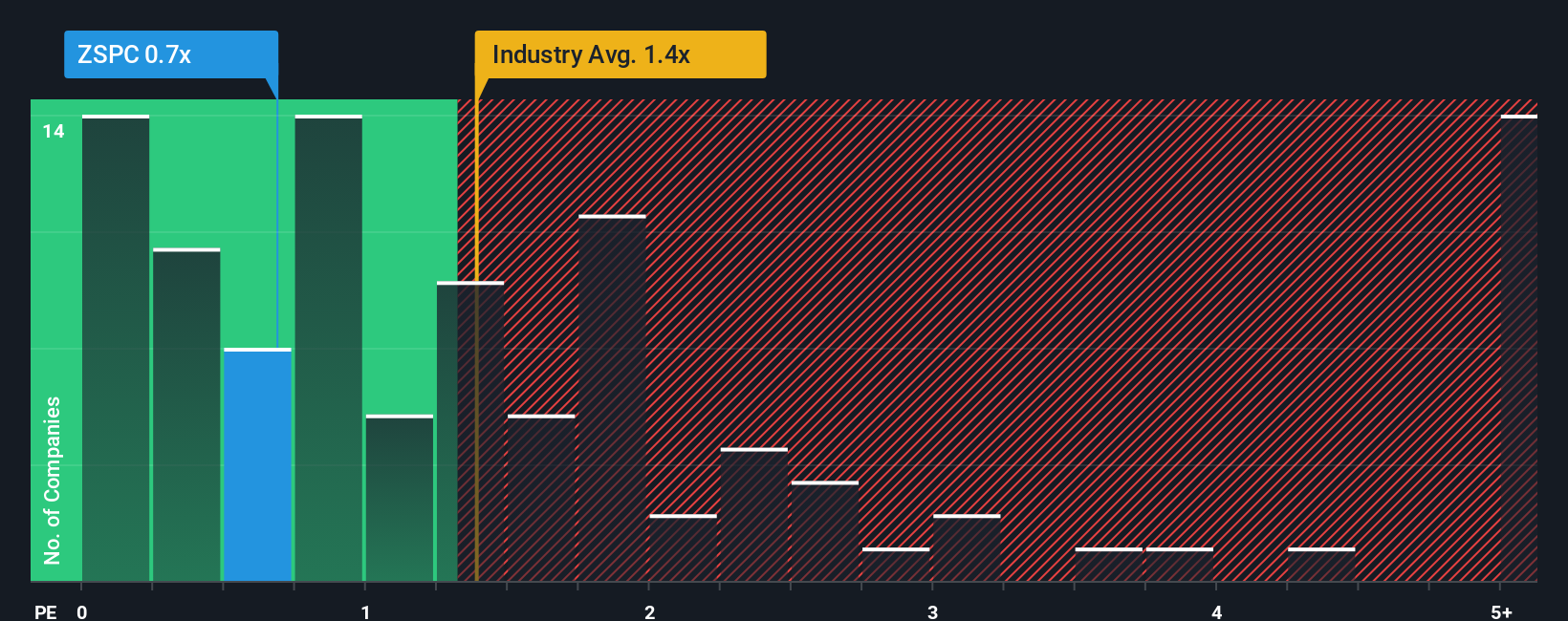

Following the heavy fall in price, it would be understandable if you think zSpace is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.7x, considering almost half the companies in the United States' Consumer Services industry have P/S ratios above 1.4x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for zSpace

How Has zSpace Performed Recently?

While the industry has experienced revenue growth lately, zSpace's revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on zSpace.How Is zSpace's Revenue Growth Trending?

zSpace's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a frustrating 24% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 12% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 13% as estimated by the three analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 10%, which is noticeably less attractive.

With this in consideration, we find it intriguing that zSpace's P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

zSpace's P/S has taken a dip along with its share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

To us, it seems zSpace currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

We don't want to rain on the parade too much, but we did also find 5 warning signs for zSpace (4 don't sit too well with us!) that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:ZSPC

zSpace

Provides augmented and virtual reality educational technology solutions for K-12 schools, and career and technical education markets in the United States and internationally.

Moderate risk and fair value.

Similar Companies

Market Insights

Community Narratives