- United States

- /

- Consumer Services

- /

- NasdaqCM:ZCMD

Here's Why We're Watching Zhongchao's (NASDAQ:ZCMD) Cash Burn Situation

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. But while history lauds those rare successes, those that fail are often forgotten; who remembers Pets.com?

Given this risk, we thought we'd take a look at whether Zhongchao (NASDAQ:ZCMD) shareholders should be worried about its cash burn. In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

How Long Is Zhongchao's Cash Runway?

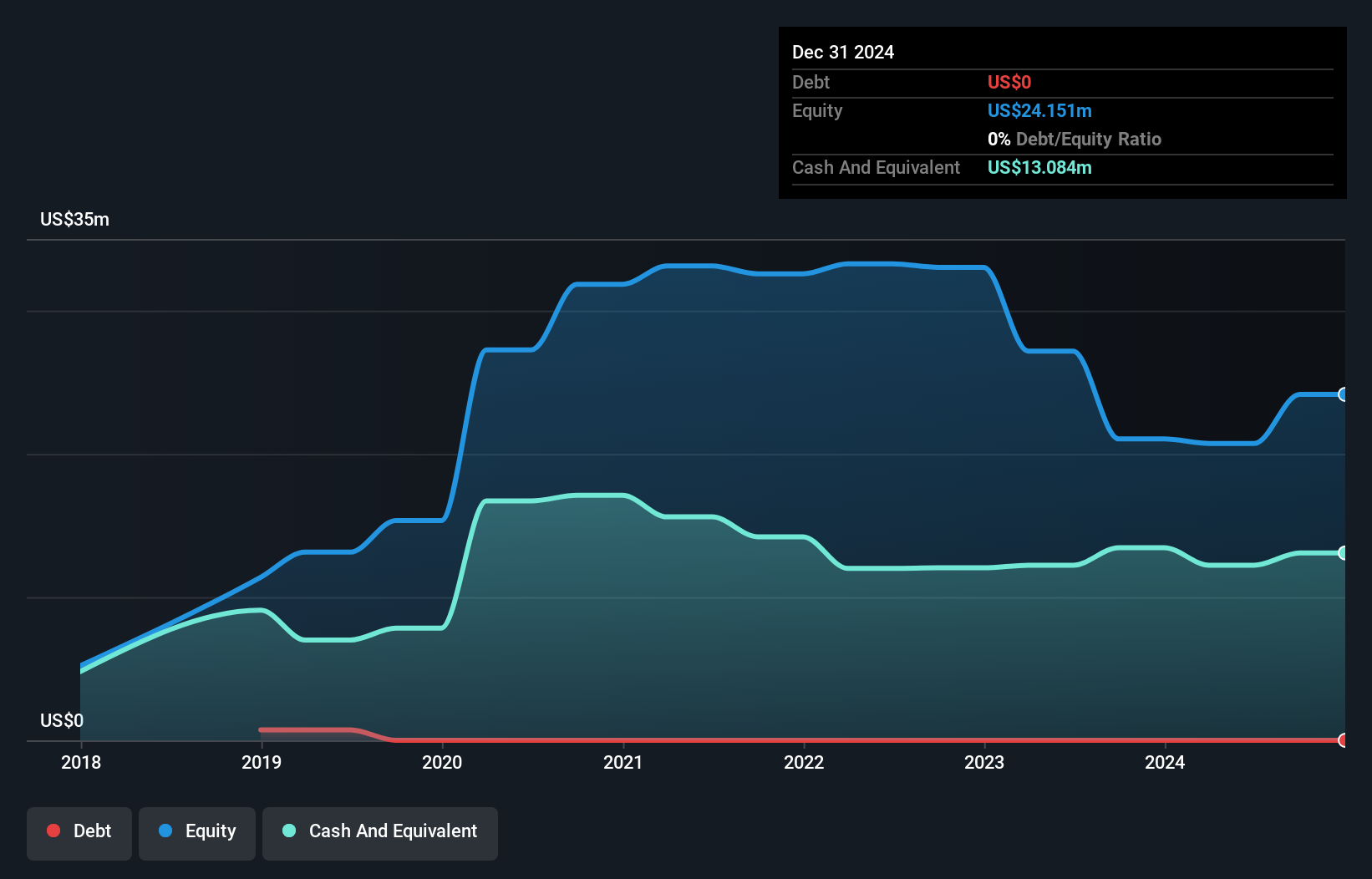

A company's cash runway is calculated by dividing its cash hoard by its cash burn. In December 2024, Zhongchao had US$13m in cash, and was debt-free. In the last year, its cash burn was US$4.5m. So it had a cash runway of about 2.9 years from December 2024. That's decent, giving the company a couple years to develop its business. You can see how its cash balance has changed over time in the image below.

See our latest analysis for Zhongchao

How Well Is Zhongchao Growing?

It was quite stunning to see that Zhongchao increased its cash burn by 475% over the last year. While that's concerning on it's own, the fact that operating revenue was actually down 18% over the same period makes us positively tremulous. Considering these two factors together makes us nervous about the direction the company seems to be heading. In reality, this article only makes a short study of the company's growth data. You can take a look at how Zhongchao has developed its business over time by checking this visualization of its revenue and earnings history.

How Hard Would It Be For Zhongchao To Raise More Cash For Growth?

While Zhongchao seems to be in a fairly good position, it's still worth considering how easily it could raise more cash, even just to fuel faster growth. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Commonly, a business will sell new shares in itself to raise cash and drive growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Zhongchao's cash burn of US$4.5m is about 14% of its US$33m market capitalisation. Given that situation, it's fair to say the company wouldn't have much trouble raising more cash for growth, but shareholders would be somewhat diluted.

How Risky Is Zhongchao's Cash Burn Situation?

On this analysis of Zhongchao's cash burn, we think its cash runway was reassuring, while its increasing cash burn has us a bit worried. Cash burning companies are always on the riskier side of things, but after considering all of the factors discussed in this short piece, we're not too worried about its rate of cash burn. Taking a deeper dive, we've spotted 4 warning signs for Zhongchao you should be aware of, and 2 of them are a bit unpleasant.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

Valuation is complex, but we're here to simplify it.

Discover if Zhongchao might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:ZCMD

Zhongchao

Provides healthcare information, education, and training services to healthcare professionals under their MDMOOC brand in the People’s Republic of China.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success