- United States

- /

- Hospitality

- /

- NasdaqGS:WYNN

Will Wynn Resorts’ (WYNN) Al Marjan Expansion with Aman Transform Its Global Growth Narrative?

Reviewed by Sasha Jovanovic

- Earlier in November 2025, Wynn Resorts and Marjan LLC announced a second joint resort collaboration with Aman Group for the upcoming Janu Al Marjan Island, adding to Wynn’s expanding presence on Al Marjan Island in the United Arab Emirates. This new development, set to open in late 2028, will introduce Aman’s luxury "soulful" hospitality concept and exclusive residences alongside Wynn’s previously announced integrated resort in the region.

- The high-profile partnership underscores Al Marjan Island’s emergence as a luxury hospitality and lifestyle destination in Ras Al Khaimah, reflecting growing international interest in upscale leisure developments in the Middle East.

- We’ll explore how the addition of Janu Al Marjan Island deepens Wynn Resorts’ international expansion strategy and affects its investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Wynn Resorts Investment Narrative Recap

To be a Wynn Resorts shareholder, you need conviction in the value of truly premium, globally diversified integrated resorts, and faith that the company's bold moves into emerging luxury markets like Ras Al Khaimah will drive long-term returns. The recent partnership with Aman Group for Janu Al Marjan Island strengthens Wynn’s international expansion story, but does not materially affect the imminent revenue catalyst: the opening of Wynn Al Marjan Island in 2027. The most significant short-term risk remains Wynn’s capital-intensive development programs and exposure to cost overruns or soft demand in new regions.

Relevant to this expansion, Wynn’s third-quarter 2025 earnings report showed continued revenue and profit growth, with net income of US$88.34 million compared to a loss last year. This financial momentum supports the company’s ongoing investments and may provide added confidence as it enters new luxury hospitality markets with significant capital commitments.

However, contrasting this growth story, investors should be aware that significant financial risk can arise if major projects like Wynn Al Marjan Island or Janu underdeliver on their...

Read the full narrative on Wynn Resorts (it's free!)

Wynn Resorts' narrative projects $8.0 billion in revenue and $624.0 million in earnings by 2028. This requires 4.6% yearly revenue growth and a $240.1 million increase in earnings from the current $383.9 million.

Uncover how Wynn Resorts' forecasts yield a $137.91 fair value, a 15% upside to its current price.

Exploring Other Perspectives

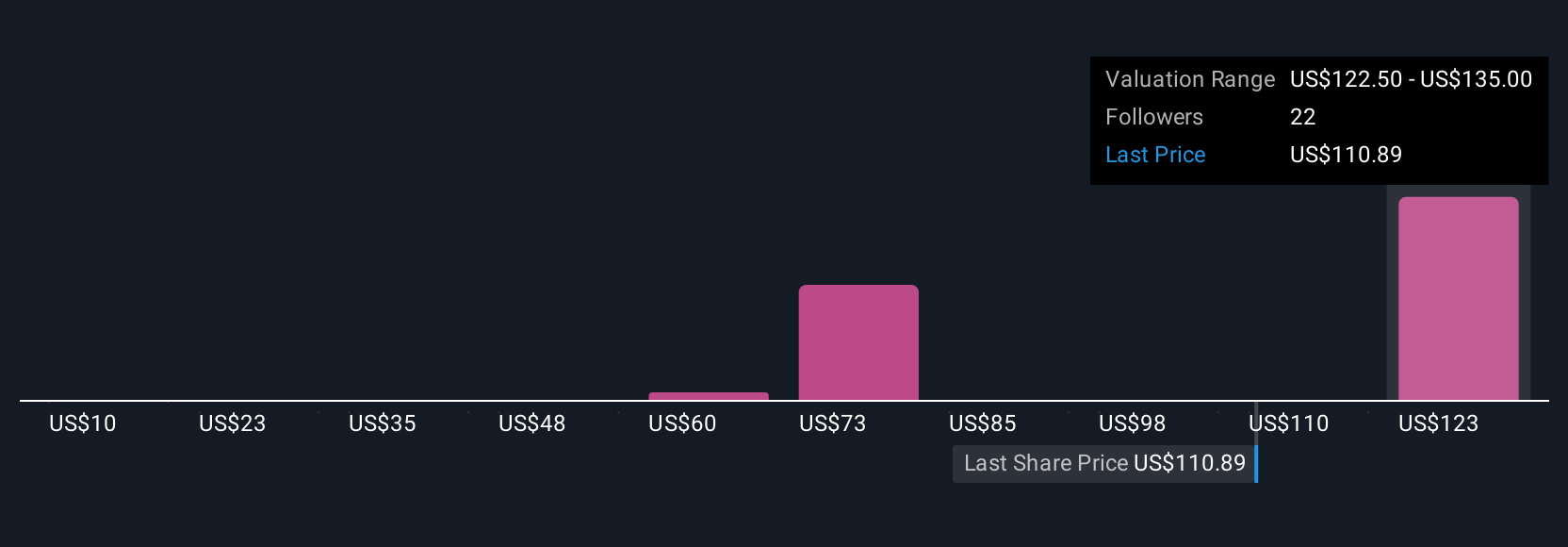

Private investors in the Simply Wall St Community place Wynn Resorts’ fair value between US$10 and US$137.91, with 9 unique estimates revealing very wide opinion gaps. Against this backdrop, Wynn’s reliance on large-scale development as a key earnings driver calls for close attention to execution risk and project returns over time.

Explore 9 other fair value estimates on Wynn Resorts - why the stock might be worth less than half the current price!

Build Your Own Wynn Resorts Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Wynn Resorts research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Wynn Resorts research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Wynn Resorts' overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wynn Resorts might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WYNN

Low risk with limited growth.

Similar Companies

Market Insights

Community Narratives