- United States

- /

- Hospitality

- /

- NasdaqGS:WYNN

What the Macau Travel Visa Update Means for Wynn Stock’s Price in 2025

Reviewed by Bailey Pemberton

- If you have ever wondered if Wynn Resorts is genuinely worth its latest price tag, you are not alone. This might be your moment to find out.

- The stock has seen an impressive rise, with a 49.4% gain so far this year and an 88.2% return over the last three years, which hints at renewed optimism or changing risk factors.

- Market sentiment around Wynn Resorts has been especially active after news of expanding Macau travel visas and regulatory developments for US casinos. Both of these factors have fueled renewed interest in the gaming sector and have prompted notable moves in peer stocks as well.

- Right now, Wynn Resorts scores just 1 out of 6 possible marks on our valuation checks. We will dive deeper into what that means, cover classic valuation approaches, and then introduce a better way to judge if the stock is truly undervalued.

Wynn Resorts scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Wynn Resorts Discounted Cash Flow (DCF) Analysis

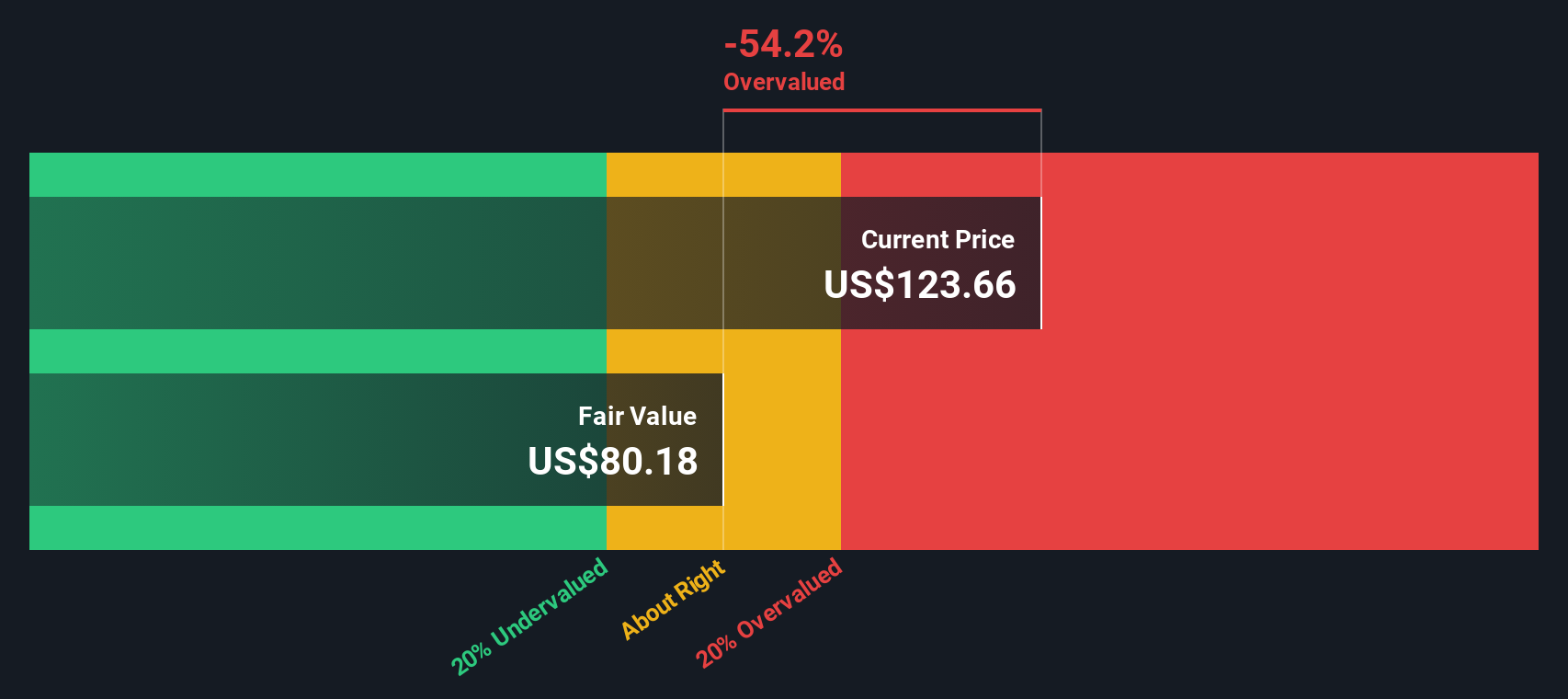

The Discounted Cash Flow (DCF) approach takes Wynn Resorts’ expected future cash flows and discounts them back to today’s value to estimate what the company is worth now. This model uses projections of cash the business will generate, recognizing that money earned in the future is worth less than money today.

For Wynn Resorts, the latest Free Cash Flow reported is $798.5 Million. Forecasts suggest Free Cash Flow could reach $1,053.95 Million by the end of 2024. Beyond the next few years, projections are extended up to 2035. It is important to keep in mind that the reliability of these estimates decreases the further out we go.

Based on this analysis, the calculated fair value for Wynn Resorts is $83.10 per share. However, with the current share price sitting much higher, the DCF model indicates the stock is trading around 50.6% above its intrinsic value. This suggests it may be significantly overvalued at the moment.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Wynn Resorts may be overvalued by 50.6%. Discover 840 undervalued stocks or create your own screener to find better value opportunities.

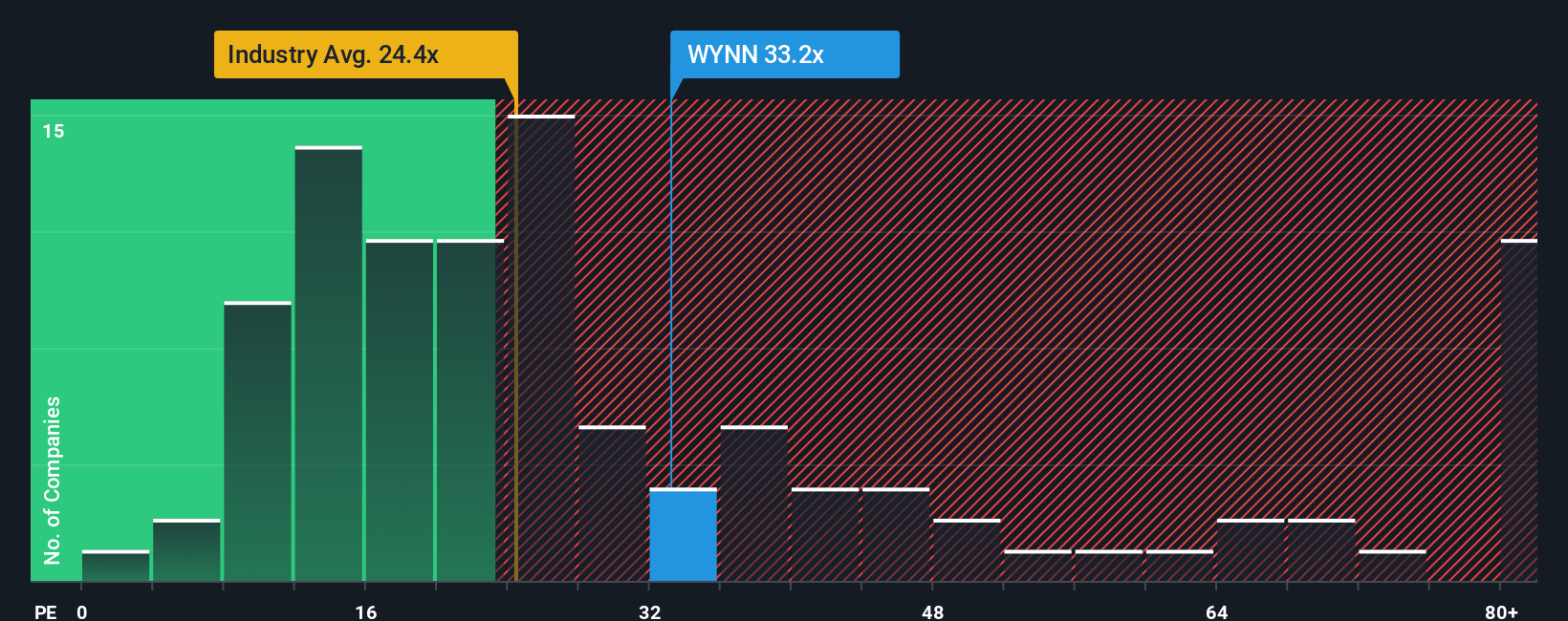

Approach 2: Wynn Resorts Price vs Earnings (PE Ratio)

The Price-to-Earnings (PE) ratio is a widely recognized metric for valuing profitable companies like Wynn Resorts. It tells us how much investors are willing to pay today for each dollar of the company’s earnings, making it a straightforward way to gauge market expectations.

Typically, a higher PE ratio reflects greater investor confidence in future growth, while a lower ratio may signal concerns over profitability or higher risk. Other factors, such as the company’s size and the stability of its earnings, can also influence what a “normal” or “fair” PE ratio should be.

Wynn Resorts currently trades at a PE ratio of 33.6x. This is well above both the Hospitality industry average of 23.4x and its peer average, which stands at 57.4x. However, looking only at these benchmarks can be misleading, as they do not consider Wynn’s unique growth profile, risk factors, or profitability.

This is where the Simply Wall St “Fair Ratio” comes in. This tailored metric estimates what PE ratio Wynn Resorts deserves right now, based on factors including its earnings growth expectations, profit margins, industry context, market cap, and key risks. The Fair Ratio for Wynn Resorts is 25.2x, meaning the current PE ratio is notably higher than what its fundamentals suggest is justified. This points to Wynn Resorts being overvalued by this approach.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1409 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Wynn Resorts Narrative

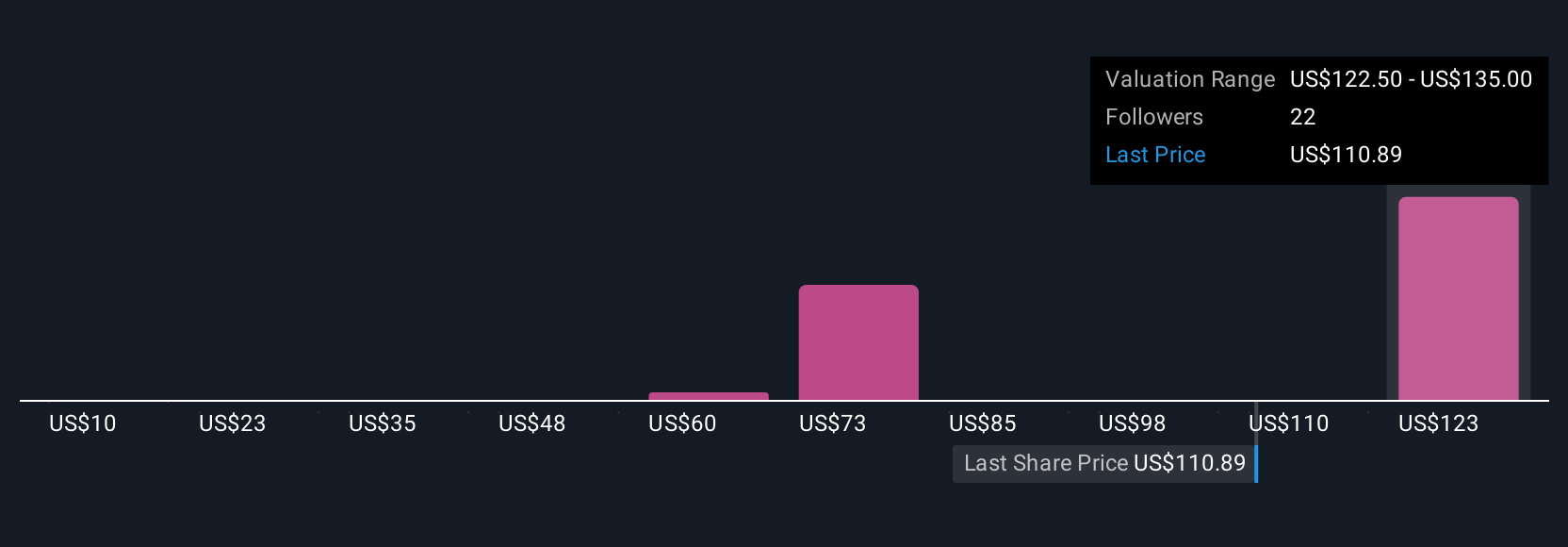

Earlier, we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your story about a company: the logic, facts, and forecasts you believe in that explain why Wynn Resorts is worth what you think it is. On Simply Wall St’s Community page, Narratives make it easy for any investor to connect the dots between their view of Wynn’s future revenue, earnings, and margins, and the share price they think is fair.

By building a Narrative, you link the company’s story to real financial forecasts and instantly see an updated estimate of fair value, allowing you to spot opportunities or risks in one clear step. Narratives are dynamic; if fresh news or earnings are released, your story’s fair value will automatically update, keeping your insights relevant. For example, some investors focus on Wynn’s luxury market growth and project higher margins, which could lead to a bullish fair value near $147 per share. Others might highlight risks in Macau or rising costs, resulting in a bearish outlook closer to $110. Narratives empower you to act confidently by comparing your fair value to the latest market price.

Do you think there's more to the story for Wynn Resorts? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wynn Resorts might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WYNN

Low risk with limited growth.

Similar Companies

Market Insights

Community Narratives