- United States

- /

- Consumer Services

- /

- NasdaqCM:SUPX

AI Supercomputing Breakthrough Might Change The Case For Investing In SuperX AI Technology (SUPX)

- SuperX AI Technology recently announced the launch of the SuperX GB300 NVL72 System, a rack-scale AI supercomputing platform powered by the NVIDIA GB300 Grace Blackwell Ultra Superchip and featuring advanced liquid cooling technology for high-density, energy-efficient performance.

- This innovation is positioned to redefine data center infrastructure, enabling organizations, governments, and research institutions to train and deploy next-generation trillion-parameter AI models with exascale compute capabilities.

- We'll explore how the focus on infrastructure for trillion-parameter models with exascale performance shapes SuperX AI Technology's investment narrative.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is SuperX AI Technology's Investment Narrative?

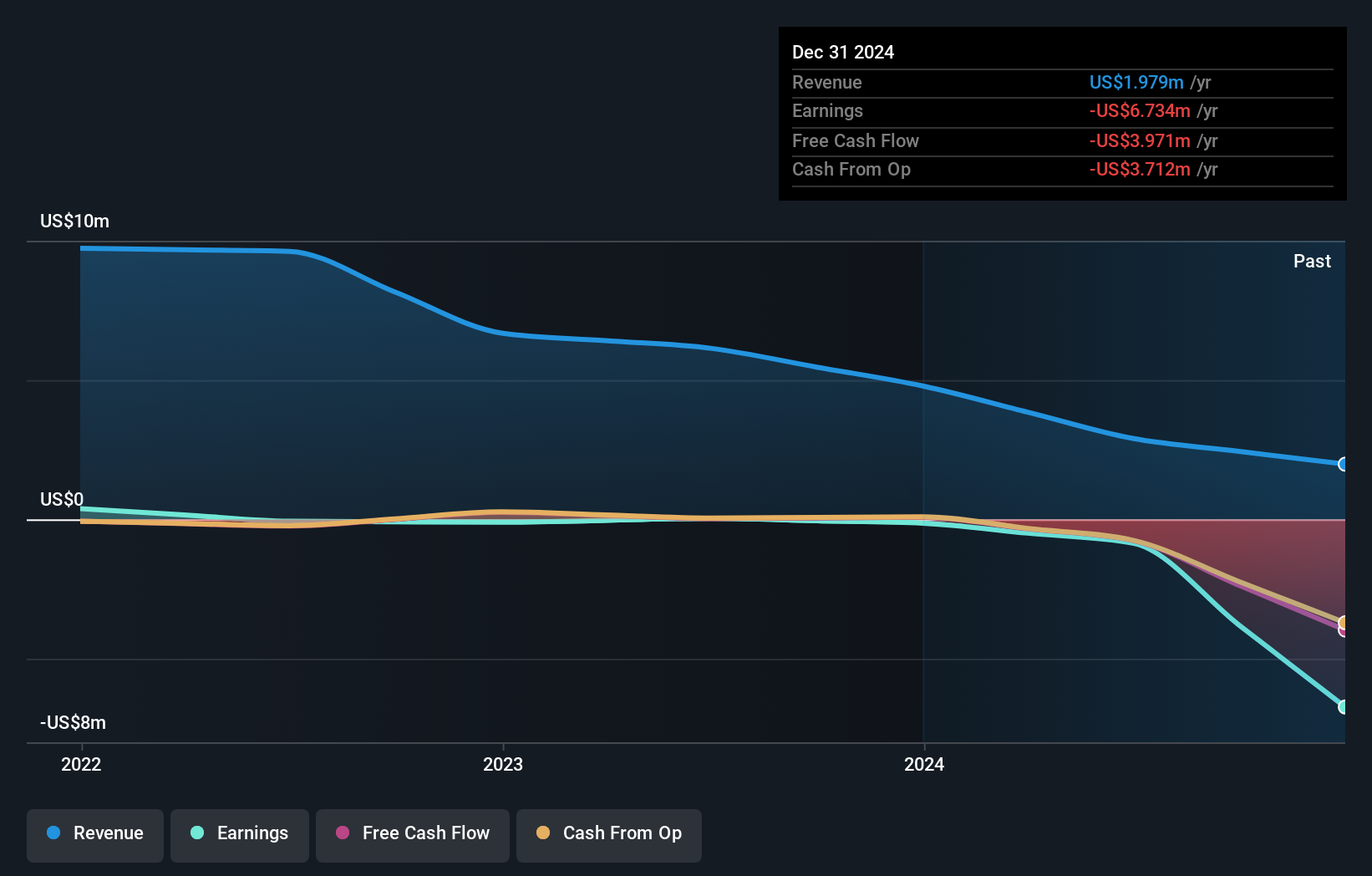

For anyone considering SuperX AI Technology as a long-term holding, the key belief centers on the rapid scale-up of AI infrastructure and the shift toward ultra-high performance systems for trillion-parameter models. The recent GB300 NVL72 System launch fits squarely into this thesis, signaling that SuperX aims to set the standard for next-generation data centers. In the short term, the news boosts excitement around SuperX’s ability to address real-world infrastructure constraints, potentially influencing institutional partnerships and competitive positioning. However, with minimal meaningful revenue, ongoing losses, heavy share dilution, and a frequently changing management team, risks around financial sustainability remain high. While this product debut is material for SuperX’s future narrative and near-term market sentiment, it does not reduce the need for clear evidence of commercial adoption or financial stabilization. On the other hand, board inexperience and high executive turnover remain critical risks to watch.

According our valuation report, there's an indication that SuperX AI Technology's share price might be on the expensive side.Exploring Other Perspectives

Explore 2 other fair value estimates on SuperX AI Technology - why the stock might be worth less than half the current price!

Build Your Own SuperX AI Technology Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SuperX AI Technology research is our analysis highlighting 4 important warning signs that could impact your investment decision.

- Our free SuperX AI Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SuperX AI Technology's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SUPX

SuperX AI Technology

Provides AI infrastructure solutions for enterprises, research institutions, and cloud and edge computing deployments worldwide.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Delta loses shine after warning of falling travel demand, but still industry leader

Project Ixian Accelerated Rollout will Drive Valuation Expansion to £0.0150.

EU#5 - From Industrial Giant to the Digital Operating System of the Real World

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The Strategic Revaluation of Adobe: A Critical Analysis of Market Sentiment

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.