- United States

- /

- Hospitality

- /

- NasdaqGS:SBUX

Starbucks (SBUX): Has the Recent Share Price Slide Created an Undervalued Opportunity?

Reviewed by Simply Wall St

Starbucks (SBUX) shares have slipped around 4% in the past week, extending their decline to roughly 6% over the past month. Investors are weighing recent business trends and evaluating how much potential value is available at current prices.

See our latest analysis for Starbucks.

While Starbucks’ share price has slid in recent weeks, the bigger story is the loss of momentum this year. The latest share price is $82.62 and the 1-year total shareholder return is now -15.2%. With sentiment cooler than it has been in a while, the market appears to be reassessing both growth potential and risk in light of recent headwinds.

If you’re weighing your next move, now is a smart time to branch out and explore fast growing stocks with high insider ownership.

This stretch of underperformance raises a critical question: Is Starbucks trading at a meaningful discount right now, or is the current price already reflecting the company’s longer-term prospects and potential for future growth?

Most Popular Narrative: 12.3% Undervalued

The most followed narrative puts Starbucks’ fair value at $94.17, above its last close price of $82.62. This implies market pessimism is running ahead of its fundamentals.

The Back to Starbucks strategy and Green Apron model aim to enhance customer experience and reduce service times. This is expected to increase transactions and potential revenue. Expanding in growth markets and focusing on local execution, particularly in China, is also expected to boost global revenue and mitigate risks.

Curious how this turnaround blueprint stacks up? Dive in to discover the ambitious forecasts for Starbucks' future sales, profit margins, and the premium analysts believe it should trade at compared to the rest of the industry.

Result: Fair Value of $94.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued pressure on operating margins and a slowdown in international sales growth could challenge the company's ability to meet optimistic forecasts.

Find out about the key risks to this Starbucks narrative.

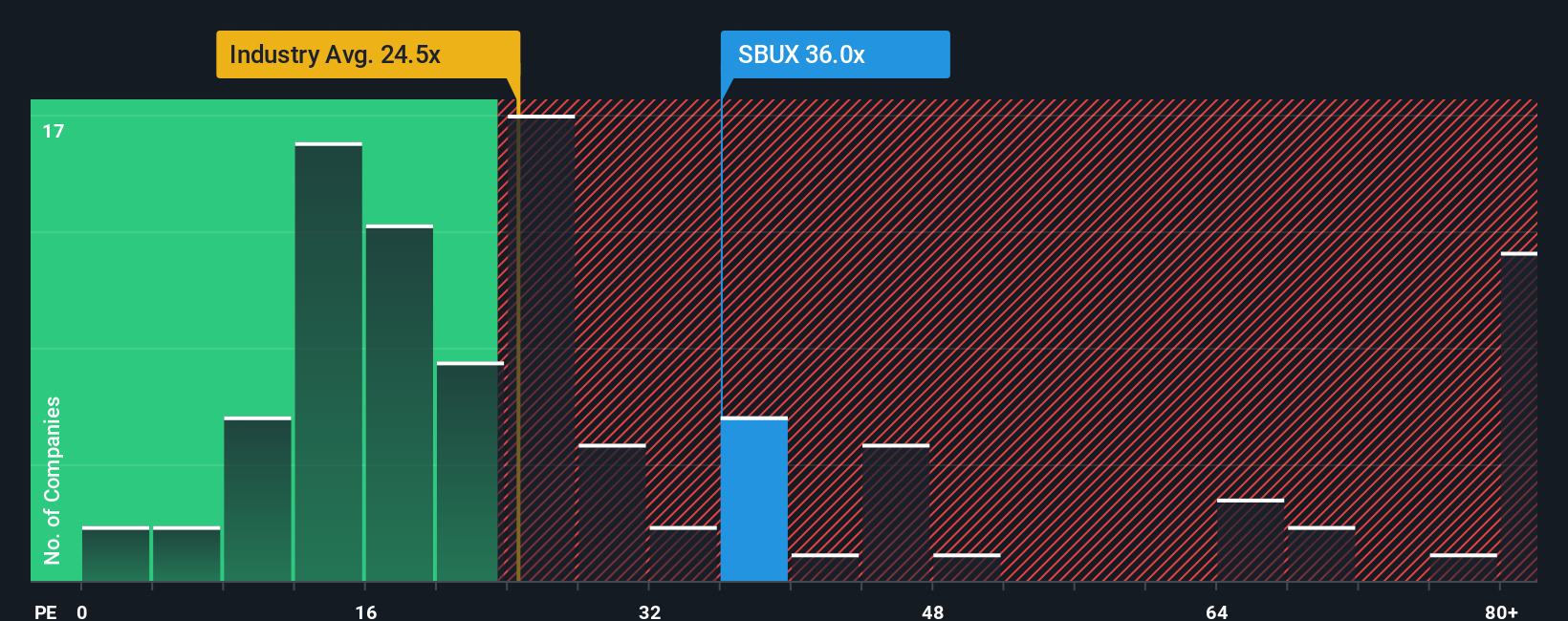

Another View: Expensive By Earnings Ratio

Looking instead at Starbucks’ price-to-earnings ratio, the stock appears expensive. Its current ratio is 50.6x, far above the US Hospitality industry average of 20.7x and even higher than its peer average of 43.6x. The fair ratio, based on market trends, sits at just 35.6x. This kind of gap suggests investors are paying a significant premium, but does that reflect true long-term potential, or could it mean extra valuation risk if momentum falters?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Starbucks Narrative

If the consensus hasn't won you over or you want to shape your own perspective, it only takes a few minutes to craft your own view. Do it your way

A great starting point for your Starbucks research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let potential winners slip through your fingers. Maximize your opportunities and see what else is possible for your portfolio using these hand-picked tools:

- Spot high-yield opportunities and boost income by checking out these 16 dividend stocks with yields > 3%, which offers strong yields above 3%.

- Position yourself at the forefront of disruptive change by starting with these 26 AI penny stocks, which is reshaping tomorrow’s markets.

- Capture untapped value by reviewing these 919 undervalued stocks based on cash flows to find companies priced attractively based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SBUX

Starbucks

Operates as a roaster, marketer, and retailer of coffee internationally.

Moderate risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives