- United States

- /

- Hospitality

- /

- NasdaqGS:SBUX

Is Starbucks Still Worth a Look After Revamped Loyalty Program and 14% Pullback?

Reviewed by Bailey Pemberton

- Ever wondered if now is the right time to scoop up Starbucks shares or if the current price still leaves room for upside? Here is a breakdown of what is happening with the stock before diving into the valuation details you need to know.

- Starbucks stock has cooled off over the last year, slipping by 14.4% and down 9.2% year to date. This hints at shifting market sentiment and potentially fresh opportunities or risks.

- Recently, news of Starbucks' revamped loyalty program and its expansion into international markets has caught investor attention. These moves, combined with ongoing discussions around unionization, have added new layers to the evolving story behind the stock's trajectory.

- When it comes to its value checks, Starbucks earns a score of 0 out of 6 for being undervalued. This suggests there is more to the story than meets the eye. Continue reading for an overview of the standard ways investors assess value, along with a look at a different approach to evaluating Starbucks’ long-term worth.

Starbucks scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Starbucks Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a standard way for investors to estimate a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s dollars. This approach is particularly helpful when assessing businesses like Starbucks, where long-term cash generation plays a critical role in valuation.

For Starbucks, the latest reported Free Cash Flow stands at approximately $2.23 Billion. Analysts provide detailed projections for the next five years, with estimates showing future Free Cash Flow rising to around $3.61 Billion by 2028. Beyond these analyst estimates, Simply Wall St extrapolates the next several years and brings Starbucks’ projected 2035 Free Cash Flow to about $4.14 Billion.

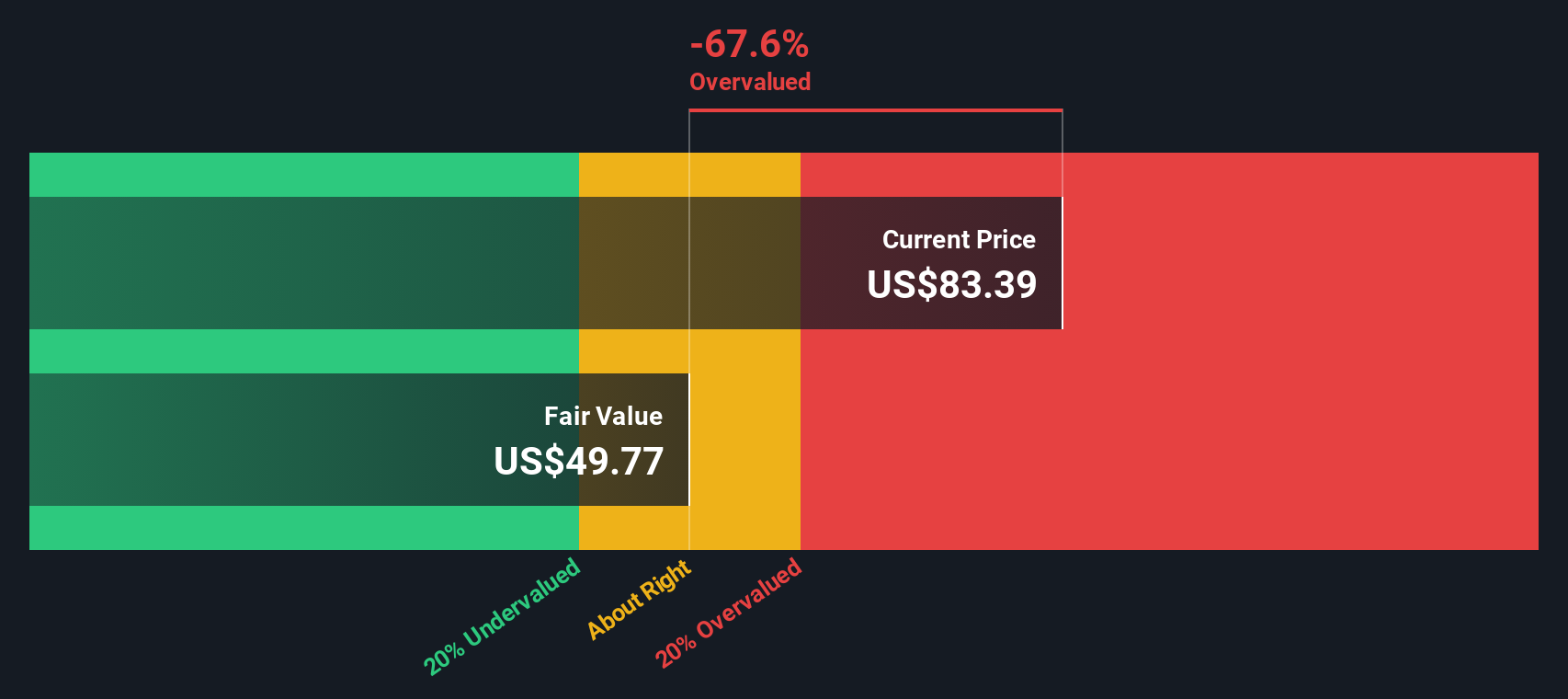

Based on these projections, the DCF valuation model arrives at an intrinsic value of $49.08 per share. Notably, this suggests the current stock price is around 70.5% above its fair value estimate, meaning the stock may be significantly overvalued according to this methodology.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Starbucks may be overvalued by 70.5%. Discover 905 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Starbucks Price vs Earnings

The Price-to-Earnings (PE) ratio is one of the most widely used metrics for valuing profitable companies like Starbucks. Because it directly compares a company’s market value to its actual earnings, the PE ratio gives investors a quick sense of how much they are paying for each dollar of profit a business generates.

The “right” PE ratio is not the same for every company. Fast-growing or less risky companies typically command higher PE multiples since investors are willing to pay more now in anticipation of stronger future earnings. In contrast, slower growth or heightened risk often leads to a lower “normal” PE ratio.

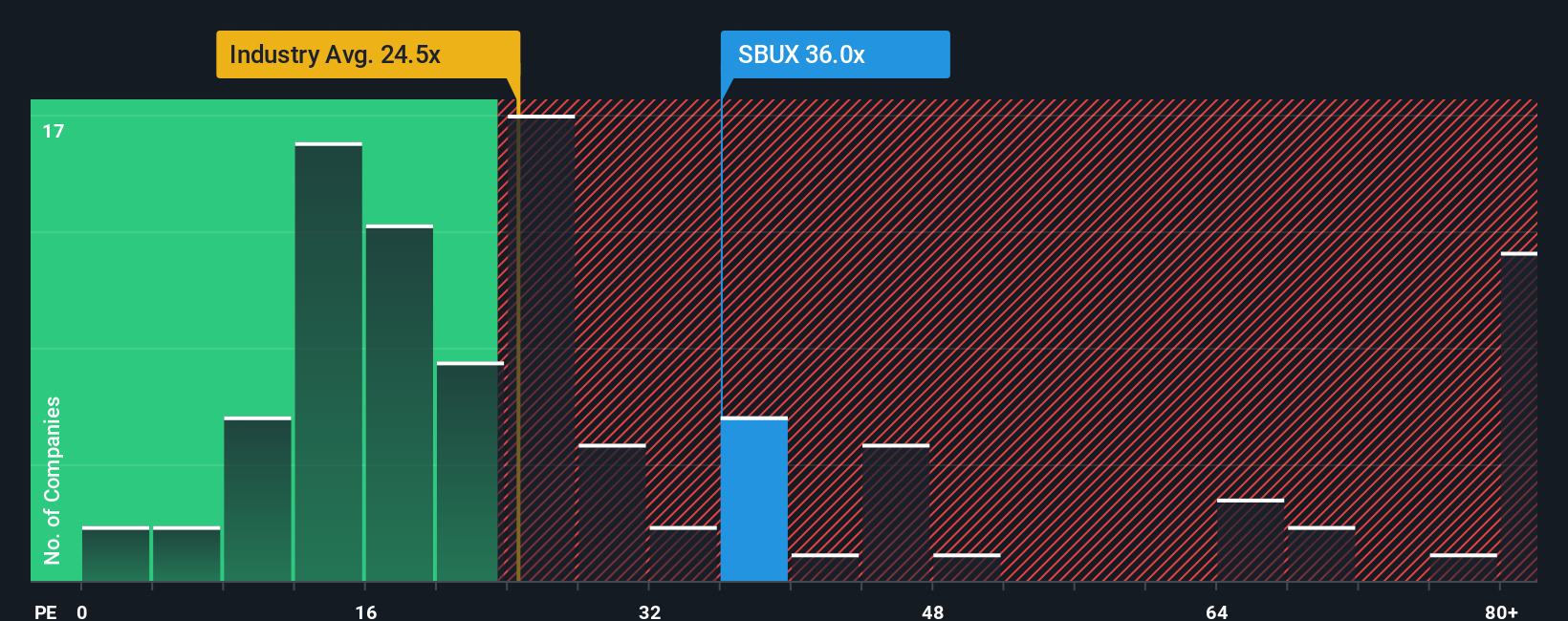

Currently, Starbucks is trading at a PE of 51.3x. This is well above the hospitality industry average of 20.7x and also exceeds the peer group average of 46.4x. To put these numbers into context, Simply Wall St calculates a proprietary Fair Ratio for Starbucks, set at 35.7x. The Fair Ratio is a more tailored benchmark that reflects Starbucks' unique combination of earnings growth prospects, industry trends, profit margins, business scale, and associated risks. Unlike simple averages, it aims to show what a truly “fair” multiple should be for this specific company in this particular market context.

Comparing Starbucks’ actual PE to its Fair Ratio reveals a considerable gap, suggesting the stock is still priced at a premium even when considering its strengths. The current valuation appears elevated relative to the individualized Fair Ratio.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1421 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Starbucks Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your personal thesis about Starbucks, connecting the company’s story, such as its growth plans, challenges, or leadership shifts, to realistic numbers, such as future revenue or earnings, which then produces an estimated fair value.

On Simply Wall St’s Community page, Narratives make investing accessible by letting you take these big-picture stories, tie them to your own forecasts, and see whether Starbucks looks undervalued or overvalued compared to today’s price. Narratives update automatically as new earnings or major news hits, so your decisions are always informed by the latest facts.

For example, one investor might create a bullish Narrative, believing Starbucks’ expansion and operational changes will drive margins higher, leading to a fair value north of $115 per share. Another might have a more cautious or bearish Narrative, emphasizing cost pressures and the competitive China market, resulting in a fair value closer to $73 per share. Narratives empower you to compare these perspectives, including your own, so you can decide when to buy or sell based on your view, not just the headlines.

Do you think there's more to the story for Starbucks? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SBUX

Starbucks

Operates as a roaster, marketer, and retailer of coffee internationally.

Moderate risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives