- United States

- /

- Hospitality

- /

- NasdaqCM:SBET

Assessing SharpLink Gaming (SBET) Valuation Following Recent Strong Share Price Performance

Reviewed by Simply Wall St

SharpLink Gaming (NasdaqCM:SBET) has caught attention as investors assess its recent performance. The company’s share price closed at $13.84, and its year-to-date return stands at 71%. This has sparked conversations about what could come next for the stock.

See our latest analysis for SharpLink Gaming.

SharpLink Gaming’s 71% year-to-date share price return has been fueled by renewed optimism about its growth prospects, even as the last month saw a notable pullback. While momentum has cooled in the short term, the one-year total shareholder return stands at an impressive 89%. This highlights the stock’s volatility and potential for significant moves in either direction.

If you’re interested in what else the market has to offer right now, it could be the perfect moment to discover fast growing stocks with high insider ownership.

This leaves investors with a crucial question: is SharpLink Gaming trading at a bargain given its recent gains, or is the market already factoring in all its future growth potential?

Price-to-Book Ratio of 6x: Is it Justified?

SharpLink Gaming is trading at a price-to-book ratio of 6x, which places it well above both its peers and the wider US Hospitality industry. With a last close price of $13.84, this valuation metric signals a premium that is hard to ignore.

The price-to-book ratio compares a company’s market value to its book value. It reveals what investors are willing to pay for each dollar of net assets. For companies in the consumer services sector, this measure can highlight market confidence or speculative interest, especially if the business is early-stage or loss-making.

With peers averaging just 2.1x and the US Hospitality industry at 2.7x, SharpLink Gaming’s multiple stands out as markedly higher. This suggests the market is pricing in exceptional future growth or unique assets not yet reflected on the balance sheet. However, no fair ratio estimate is available to provide another valuation benchmark investors might look for.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book Ratio of 6x (OVERVALUED)

However, slowing revenue growth or continued net losses could quickly dampen enthusiasm. These factors serve as key risks that investors should watch closely.

Find out about the key risks to this SharpLink Gaming narrative.

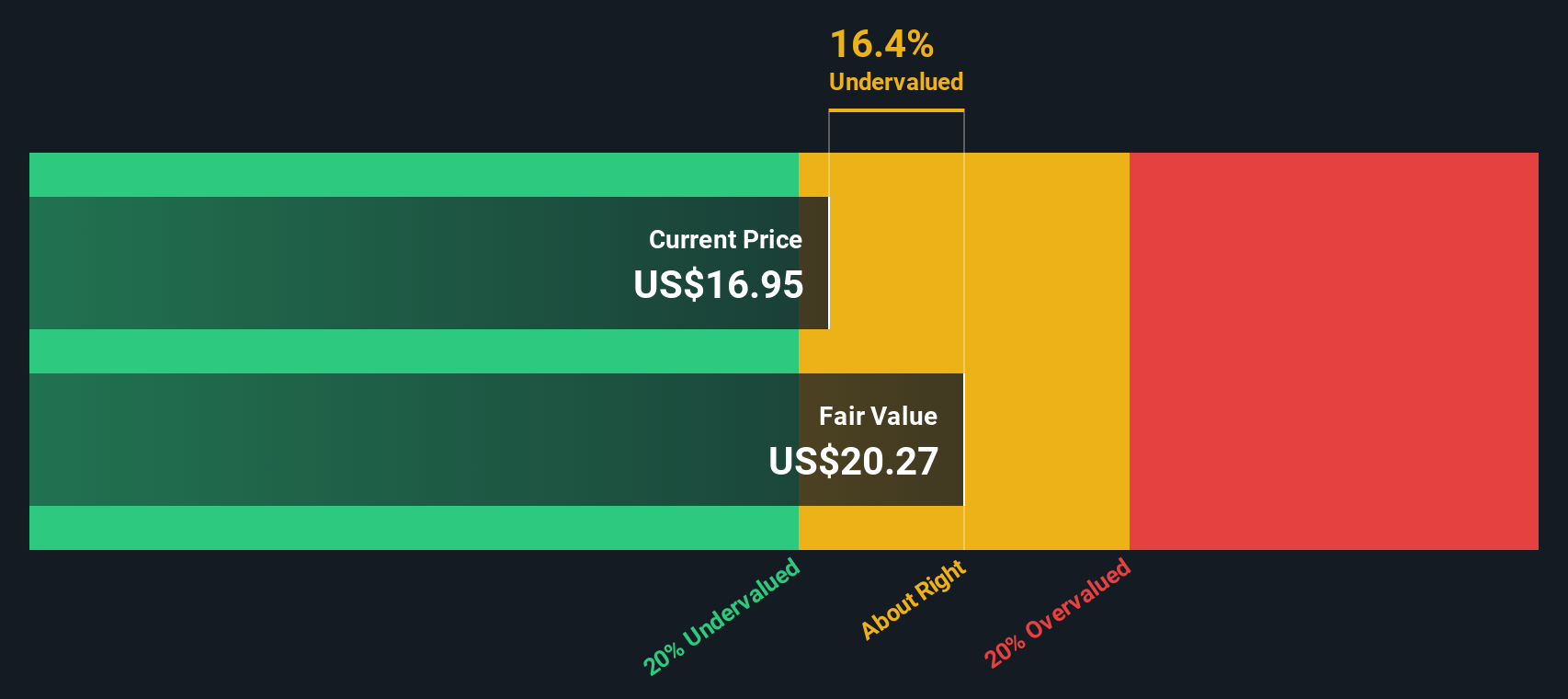

Another View: Our DCF Model Offers a Different Perspective

While the price-to-book multiple points to a stretched valuation, the SWS DCF model suggests a slightly different story. According to this approach, SharpLink Gaming’s current share price of $13.84 sits just above our estimate of fair value at $13.18. This indicates the market may be only modestly optimistic rather than excessively overvalued.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out SharpLink Gaming for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 832 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own SharpLink Gaming Narrative

If you have a different perspective or want to dive deeper into SharpLink Gaming’s data, you can craft your own narrative in just minutes. Do it your way.

A great starting point for your SharpLink Gaming research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let opportunity pass you by. Widen your portfolio with powerful trends and strong financials using our suite of targeted stock screeners from Simply Wall St.

- Capture the momentum by checking out these 832 undervalued stocks based on cash flows, which are currently trading below their intrinsic value and could be set for a rebound.

- Tap into unstoppable innovation and see which companies are leading the frontier with these 26 AI penny stocks, bringing artificial intelligence into real-world profit potential.

- Build long-term wealth with stable returns by reviewing these 22 dividend stocks with yields > 3%, focused on stocks offering impressive yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SBET

SharpLink Gaming

An online performance marketing company, delivers fan activation solutions to its sportsbook and casino partners.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives