- United States

- /

- Hospitality

- /

- NasdaqGS:RRR

Why Red Rock Resorts (RRR) Is Up 8.5% After Boosting Earnings Dividend and Buyback Plan

Reviewed by Sasha Jovanovic

- On October 28, 2025, Red Rock Resorts reported higher quarterly and year-to-date earnings, raised its fourth-quarter dividend to US$0.26 per share, and increased its share repurchase authorization by US$300 million to a total of US$900 million, extending the buyback plan through 2027.

- This combination of improved financial performance, enhanced shareholder returns, and a larger buyback program highlights management's focus on rewarding investors and confidence in the company's outlook.

- We’ll now explore how Red Rock Resorts’ stronger earnings and increased capital returns could impact its investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Red Rock Resorts Investment Narrative Recap

Red Rock Resorts appeals to shareholders who believe in the sustained growth of the Las Vegas locals market, fueled by expanding residential populations and steady consumer demand for entertainment. The recent earnings beat and expanded capital returns reinforce management’s confidence but do not fundamentally alter the key near-term catalyst: successful ramp-up of new and upgraded properties. Similarly, the biggest immediate risk remains heightened exposure to any economic volatility in Las Vegas, and this risk profile is largely unchanged after the latest results.

The company’s announcement of a US$0.26 per share quarterly dividend increase is especially relevant, as it signals continued emphasis on direct shareholder returns. For investors, this growing cash payout is a reflection of solid financial footing, yet its sustainability could come under pressure if large-scale property expansions face unexpected challenges or delays in capturing new customer segments.

However, investors should also keep in mind that if demographic shifts or local economic slowdowns emerge...

Read the full narrative on Red Rock Resorts (it's free!)

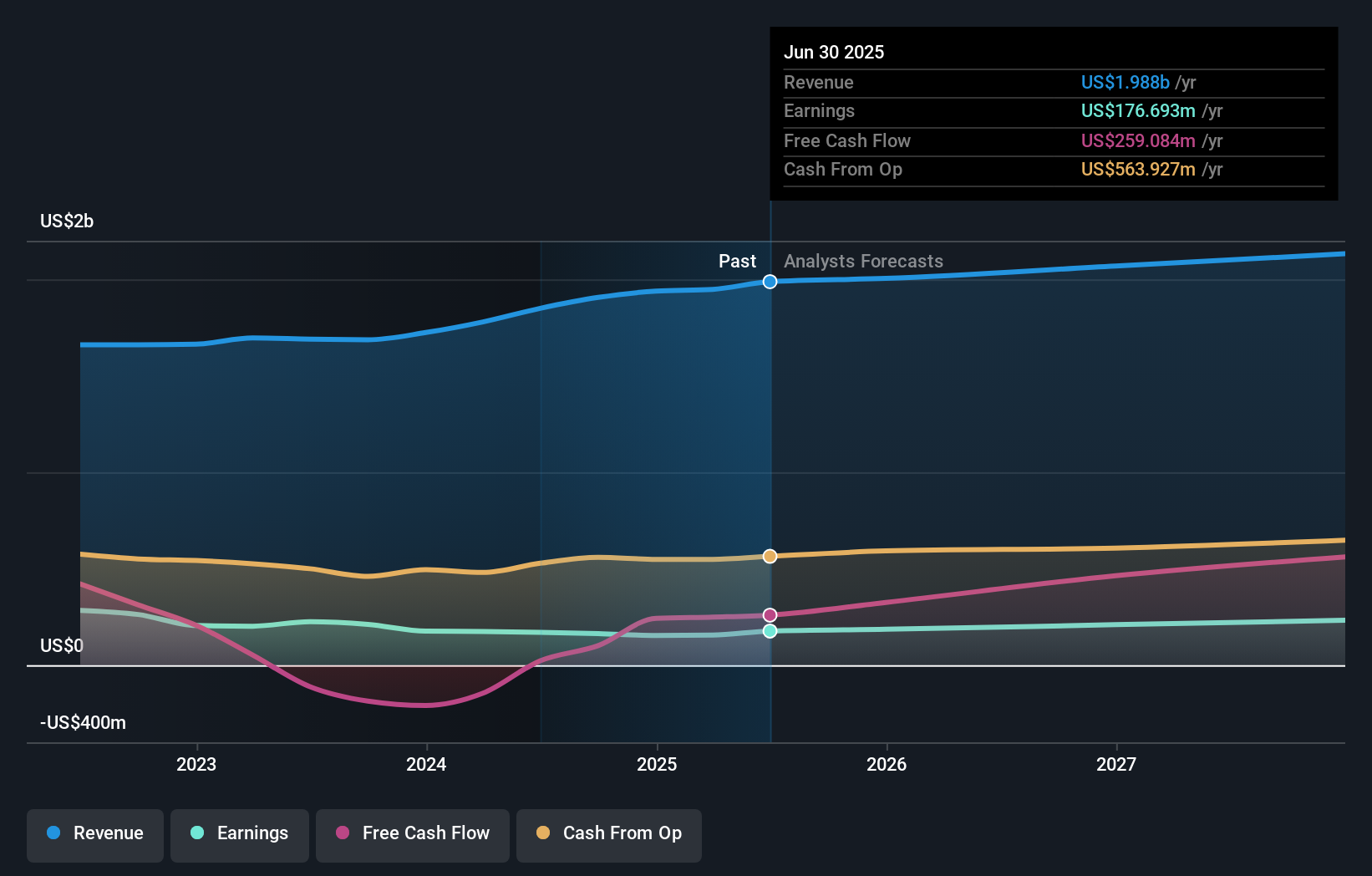

Red Rock Resorts' projections indicate $2.2 billion in revenue and $249.6 million in earnings by 2028. This outlook is based on analysts expecting a 2.9% annual revenue growth rate and an earnings increase of about $72.9 million from the current $176.7 million.

Uncover how Red Rock Resorts' forecasts yield a $65.85 fair value, a 14% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community estimates a single fair value at US$101.14, far above recent trading levels. Many market participants are focused on Red Rock Resorts’ ability to execute expansion plans in high-growth local markets, which can influence future revenue and margin potential. Explore several alternative viewpoints now.

Explore another fair value estimate on Red Rock Resorts - why the stock might be worth just $101.14!

Build Your Own Red Rock Resorts Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Red Rock Resorts research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Red Rock Resorts research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Red Rock Resorts' overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RRR

Red Rock Resorts

Through its interest in Station Casinos LLC, develops and manages casino and entertainment properties in the United States.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives