- United States

- /

- Leisure

- /

- NasdaqGM:HERE

QuantaSing Group (NasdaqGM:QSG) Net Margin Expansion Challenges Concerns on Sustainable Profit Growth

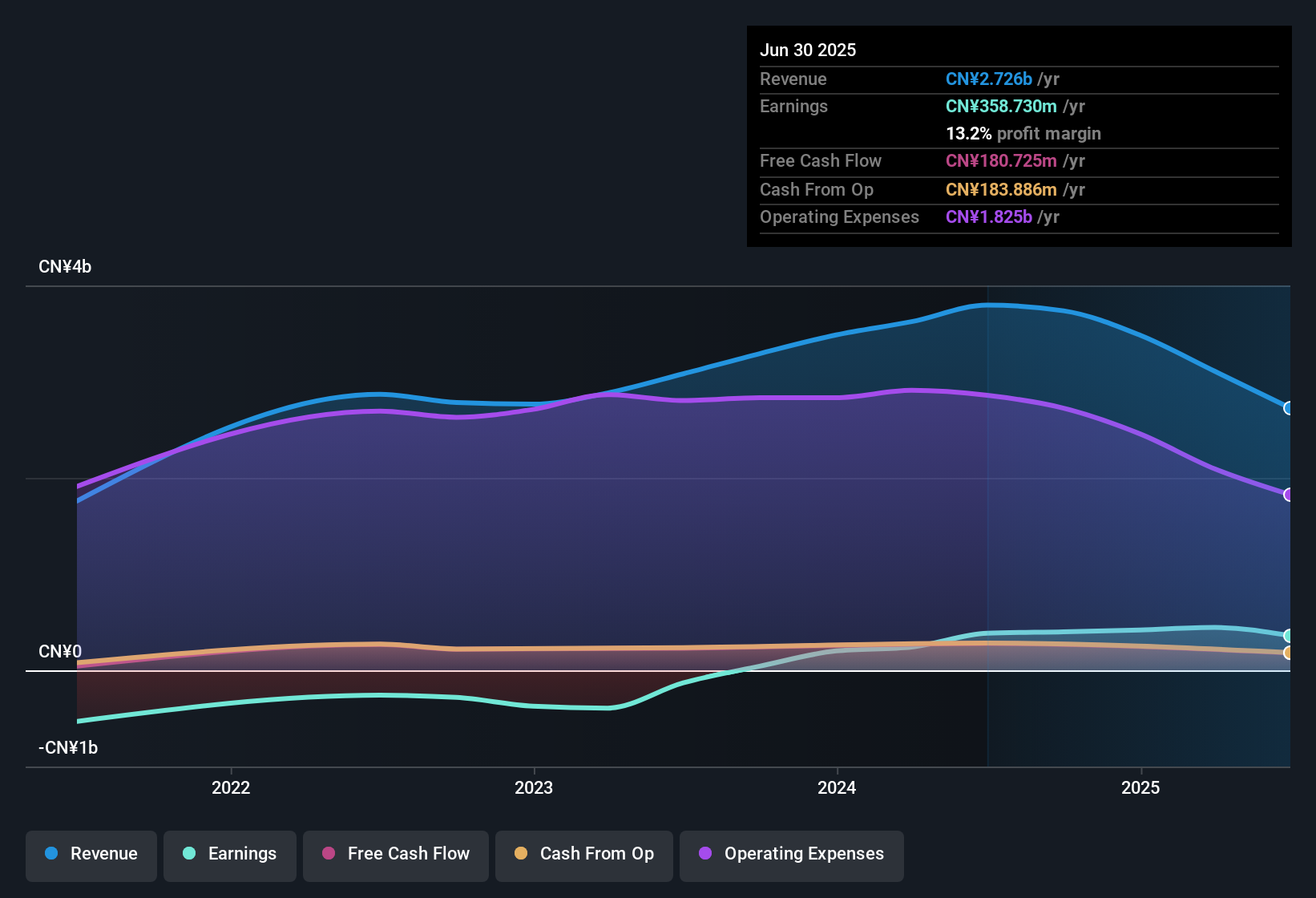

QuantaSing Group (NasdaqGM:QSG) posted robust numbers, with average annual earnings growth of 90.4% over the past five years and net profit margins rising to 13.2% from 10.2% last year. Revenue is expected to climb at 10.4% per year, while earnings are projected to grow 26.5% per year over the next three years. Both figures outpace US market averages. With shares trading at $7.16, below the estimated fair value of $8.21, and a price-to-earnings ratio of 7.3x that is well under industry peers, investors may see QSG's results as a compelling combination of value and strong growth outlook.

See our full analysis for QuantaSing Group.The next section will put these numbers side by side with the most widely discussed narratives to see which stories hold up and which get challenged by the data.

See what the community is saying about QuantaSing Group

Net Margins Climb Amid Cost Discipline

- Net profit margins grew to 13.2%, up from 10.2% last year. This reflects the company’s sharper focus on higher-value business lines and improved operational efficiency.

- Analysts' consensus view expects ongoing margin pressure from restructuring and initial outlays tied to new market entries. However, the margin advance this year strongly supports the move to high-quality growth.

- Consensus narrative highlights that improved cost discipline and strategic targeting of higher-value segments are the driving forces behind the margin gains.

- On the other hand, the consensus also flags a looming risk that initial costs and restructuring related to these shifts could drag on future net margins.

- Results this year provide a reality check to concerns about execution risk. Even so, the consensus narrative still advises caution as expansion costs may offset efficiency gains if not managed tightly.

📊 Read the full QuantaSing Group Consensus Narrative.

Revenue Volatility During Strategic Shift

- Revenue experienced a 25.9% decrease year-over-year during the recent pivot from traffic-driven to high-quality growth. This signals that the transition period poses real risks to revenue stability.

- Consensus narrative notes the decline stands in sharp contrast to the bullish argument for sustained top-line growth through business diversification.

- While expansion into wellness and senior-targeted offerings has added new revenue streams, the steep drop in core online learning billings, down 42.2% year-over-year, demonstrates that execution is not guaranteed to yield immediate benefits.

- The consensus further flags that ramp-up costs and the reliance on new business lines could lead to bumpy earnings as the company works to stabilize its base.

Valuation Signals Discount Versus Peers

- The current price-to-earnings ratio of 7.3x sits well below the US Consumer Services industry average of 18.8x and the peer average of 29.5x. This positions the stock at a notable discount even after recent performance swings.

- According to the analysts' consensus view, this discount is not simply a reflection of operational headwinds but also optimism that margin improvements and cost discipline may generate greater long-term value than the market currently recognizes.

- With shares trading at $7.16, both below DCF fair value ($8.21) and the average peer PE, the consensus suggests investors are underpricing QSG’s growth potential and emergent diversification in wellness and senior-oriented education.

- Nevertheless, the consensus narrative observes that volatility in revenues and fast-evolving market exposures warrant careful monitoring despite the value gap.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for QuantaSing Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your take on the numbers? Share your perspective and craft a fresh narrative in just a few minutes. Do it your way

A great starting point for your QuantaSing Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

While QuantaSing Group’s net margins are improving, its volatile revenues during the strategic pivot expose risks to steady and reliable growth.

If you want companies that consistently deliver through ups and downs, check out stable growth stocks screener (2087 results) to find those with proven, stable performance across cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Here Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:HERE

Here Group

Designs and sells pop toys in China.

Excellent balance sheet and good value.

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Superintelligence Pivot: Meta’s $135 Billion Bet on the Energy-Compute Nexus

The Privacy Fortress: Apple’s Lean AI Path and the $100 Billion Buyback Engine

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.