- United States

- /

- Hospitality

- /

- NasdaqGS:PZZA

Papa John's International, Inc. (NASDAQ:PZZA) Stock's 27% Dive Might Signal An Opportunity But It Requires Some Scrutiny

Papa John's International, Inc. (NASDAQ:PZZA) shareholders won't be pleased to see that the share price has had a very rough month, dropping 27% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 45% in that time.

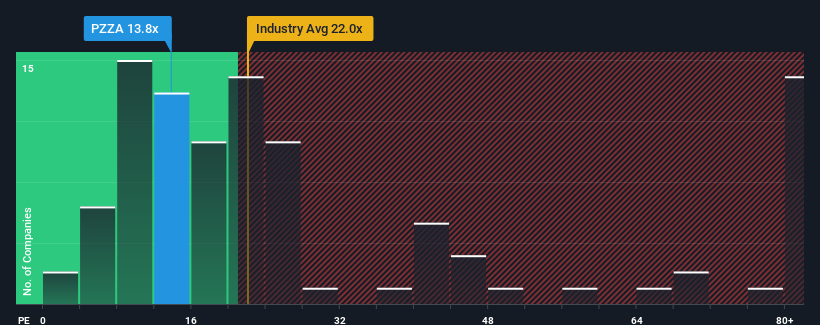

After such a large drop in price, Papa John's International's price-to-earnings (or "P/E") ratio of 13.8x might make it look like a buy right now compared to the market in the United States, where around half of the companies have P/E ratios above 16x and even P/E's above 30x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

There hasn't been much to differentiate Papa John's International's and the market's earnings growth lately. It might be that many expect the mediocre earnings performance to degrade, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could pick up some stock while it's out of favour.

See our latest analysis for Papa John's International

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Papa John's International would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered virtually the same number to the company's bottom line as the year before. Although pleasingly EPS has lifted 2,093% in aggregate from three years ago, notwithstanding the last 12 months. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 15% per annum over the next three years. With the market only predicted to deliver 11% each year, the company is positioned for a stronger earnings result.

With this information, we find it odd that Papa John's International is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

The softening of Papa John's International's shares means its P/E is now sitting at a pretty low level. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Papa John's International's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Papa John's International (of which 1 is a bit unpleasant!) you should know about.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:PZZA

Papa John's International

Operates and franchises pizza delivery and carryout restaurants under the Papa Johns trademark in the United States, Canada, and internationally.

Average dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives