- United States

- /

- Consumer Services

- /

- NasdaqCM:OSW

OneSpaWorld Holdings (OSW): Assessing Valuation After Strong Q3 Results, Fresh Guidance, and Bigger Shareholder Returns

Reviewed by Simply Wall St

OneSpaWorld Holdings (OSW) packed several updates into its latest announcement, including new revenue guidance, a quarterly dividend increase, a major share repurchase, and solid third-quarter financial results. There is a lot for investors to unpack here.

See our latest analysis for OneSpaWorld Holdings.

OSW’s run of upbeat announcements, including double-digit revenue growth, an expanded buyback, and a higher dividend, has fueled investor enthusiasm, with a 20% year-to-date share price return and a standout 34% total shareholder return over the past year. Momentum is clearly building as the company continues to post consistent gains and shareholder rewards.

If you like finding opportunity where growth and confidence intersect, this is a perfect time to explore fast growing stocks with high insider ownership.

But with shares already rallying and new forecasts on the table, the big question remains: is OneSpaWorld still trading below its true worth, or are investors paying top dollar for future growth expectations?

Most Popular Narrative: 10.5% Undervalued

With OneSpaWorld's most followed narrative estimating fair value at $26, compared to a last close of $23.27, the stock stands out against current market pricing. The story behind this valuation hinges on changing industry dynamics and ambitious company strategies that could unlock further upside if delivered.

Increasing deployment of new wellness centers on additional cruise ships, along with expanded exclusive partnerships, positions OneSpaWorld to benefit from the global growth of experiential travel and rising cruise passenger volumes. This is expected to drive sustained revenue growth as fleet count and utilization increase.

Curious what ambitious projections anchor this bullish call? The strategy leans on sharply rising revenue, improved profit margins, and an earnings target that rivals fast-growth sectors. Find out which numbers have driven analysts to raise the bar for the stock’s potential.

Result: Fair Value of $26 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a downturn in cruise travel or regulatory shifts in the wellness industry could quickly challenge even the most optimistic outlook for OneSpaWorld.

Find out about the key risks to this OneSpaWorld Holdings narrative.

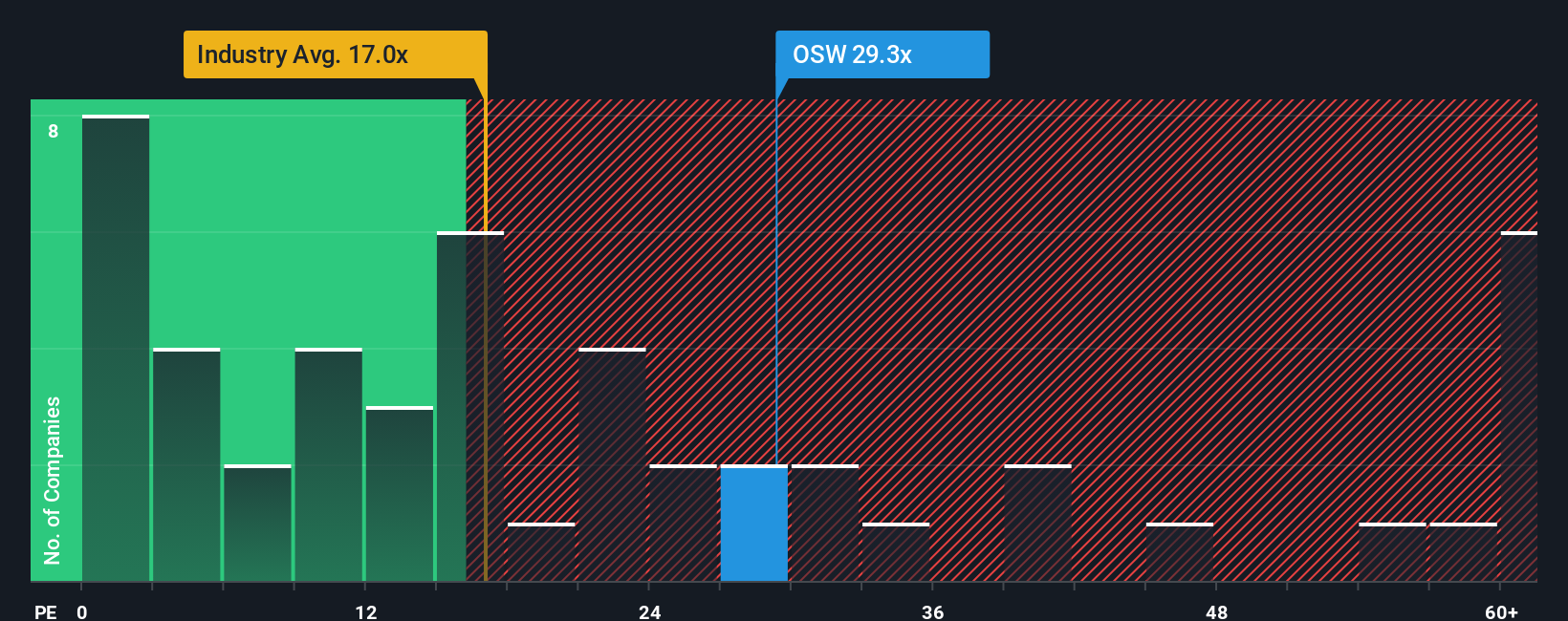

Another View: Caution on Price Tag

Looking from a different angle, OneSpaWorld trades at a price-to-earnings ratio of 32.1x, which is significantly higher than both the US Consumer Services industry average of 18.8x and its peer group at 15.1x. The fair ratio estimate sits at 20.2x, highlighting the risk that the current share price already reflects high expectations. If momentum wanes, could the market move toward this fair ratio and create downside for latecomers?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own OneSpaWorld Holdings Narrative

If the numbers or perspectives above do not quite fit your own view, you can analyze the same data and craft your own story in just a few minutes. Do it your way

A great starting point for your OneSpaWorld Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know opportunities stretch far beyond a single stock. Miss out on these, and you might overlook tomorrow’s game-changers hiding in plain sight.

- Catch income opportunities by tapping into these 20 dividend stocks with yields > 3% on solid companies yielding over 3% in today's volatile market.

- Ride the wave of innovation with these 27 AI penny stocks powering advancements in automation, analytics, and next-level computing.

- Strengthen your portfolio with these 845 undervalued stocks based on cash flows that reveal hidden value through strong fundamentals and cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:OSW

OneSpaWorld Holdings

Operates health and wellness centers onboard cruise ships and at destination resorts in the United States and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives