- United States

- /

- Consumer Services

- /

- NasdaqCM:OSW

OneSpaWorld Holdings (OSW): A Fresh Look at Valuation After Recent Share Price Volatility

Reviewed by Simply Wall St

OneSpaWorld Holdings (OSW) shares have been trending lower this month, down nearly 1% after a relatively flat spring. Investors keeping an eye on OSW are considering whether this moderation signals an opportunity.

See our latest analysis for OneSpaWorld Holdings.

Looking at the bigger picture, OneSpaWorld Holdings’ momentum has faded a bit after a strong run. The share price has retreated over the past week, but the company still posted a modest 1-year total shareholder return of 7.7% and an impressive 99% over three years. Short-term volatility aside, the longer-term trend remains robust.

If you’re curious what else is gaining traction, this could be a great opportunity to broaden your search and discover fast growing stocks with high insider ownership

With shares trading well below analyst targets, yet coming off a strong multi-year climb, investors have to weigh if OneSpaWorld Holdings is currently undervalued or if the market has already accounted for future growth prospects.

Most Popular Narrative: 24.7% Undervalued

The gap between OneSpaWorld Holdings’ fair value estimate of $26.50 and the recent closing price of $19.96 is drawing attention. This consensus perspective, based on analysts’ projections, highlights key growth drivers and strategic moves.

Increasing deployment of new wellness centers on additional cruise ships, along with expanded exclusive partnerships, positions OneSpaWorld to benefit from the global growth of experiential travel and rising cruise passenger volumes. This is expected to drive sustained revenue growth as fleet count and utilization increase.

Curious what kind of bets analysts are making to justify that high target? Revenue growth, surging margins, and valuation multiples that rival sector leaders are at the heart of this story. Want a closer look at where the real upside could come from? Unlock the narrative to see the assumptions that elevate expectations for OneSpaWorld Holdings.

Result: Fair Value of $26.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy cruise-industry reliance and slow gains from AI initiatives could become significant headwinds for OneSpaWorld Holdings if conditions shift unexpectedly.

Find out about the key risks to this OneSpaWorld Holdings narrative.

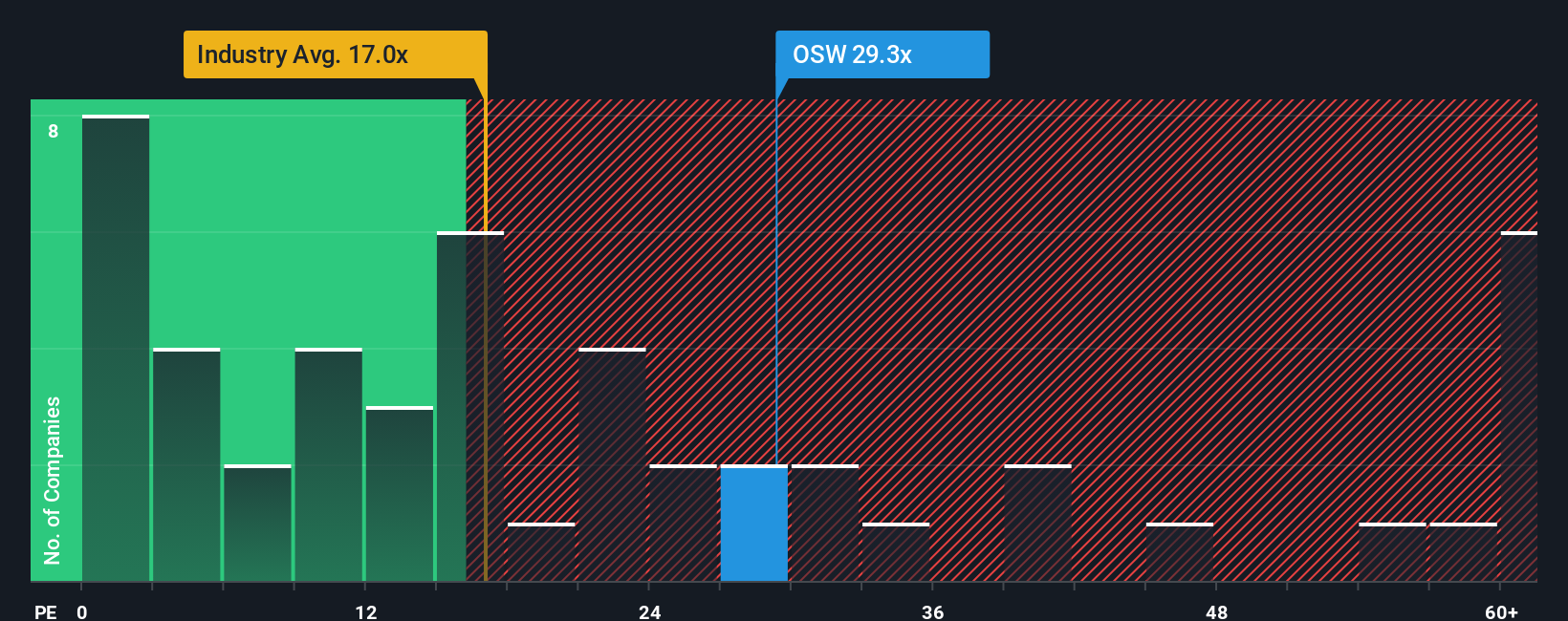

Another View: Valuation Through Multiples

Stepping back from analyst price targets, OneSpaWorld Holdings is trading at 27.5 times earnings, which puts it well above both the industry average of 16x and the average of its peers at 13.3x. Even the market’s fair ratio for this stock sits lower at 19.9x. This gap suggests that expectations are high, and investors are paying a premium. The key question is whether that premium reflects sustainable growth or if it is a risk to watch.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own OneSpaWorld Holdings Narrative

If you have a different perspective or want to investigate the numbers firsthand, you can craft your own take on OneSpaWorld Holdings in just a few minutes. Do it your way

A great starting point for your OneSpaWorld Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don't let great opportunities slip away. The Simply Wall Street Screener uncovers fresh stocks you might not have thought to consider. Take action and sharpen your investing edge today.

- Capture steady income potential and spot growth with reliable yield opportunities using these 18 dividend stocks with yields > 3%.

- Launch your search for the next tech disruptors creating breakthroughs by checking out these 27 AI penny stocks.

- Tap into emerging markets and discover price leaders making waves in alternative finance through these 82 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:OSW

OneSpaWorld Holdings

Operates health and wellness centers onboard cruise ships and at destination resorts in the United States and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives