- United States

- /

- Hospitality

- /

- NasdaqGS:MCRI

Did Monarch Casino & Resort’s (MCRI) Bet Monarch NFL Promo Just Shift Its Digital Gaming Investment Narrative?

Reviewed by Sasha Jovanovic

- In early November 2025, Monarch Casino & Resort rolled out a promotional offer through its Bet Monarch app, featuring -105 spreads on all NFL regular season games for users 21 and older in Colorado.

- This move highlights Monarch's effort to strengthen its digital gaming footprint and drive greater engagement with sports bettors during peak NFL season activity.

- Now, we'll explore how this competitive odds promotion could influence Monarch Casino & Resort's investment narrative by expanding its user base in digital gaming.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Monarch Casino & Resort's Investment Narrative?

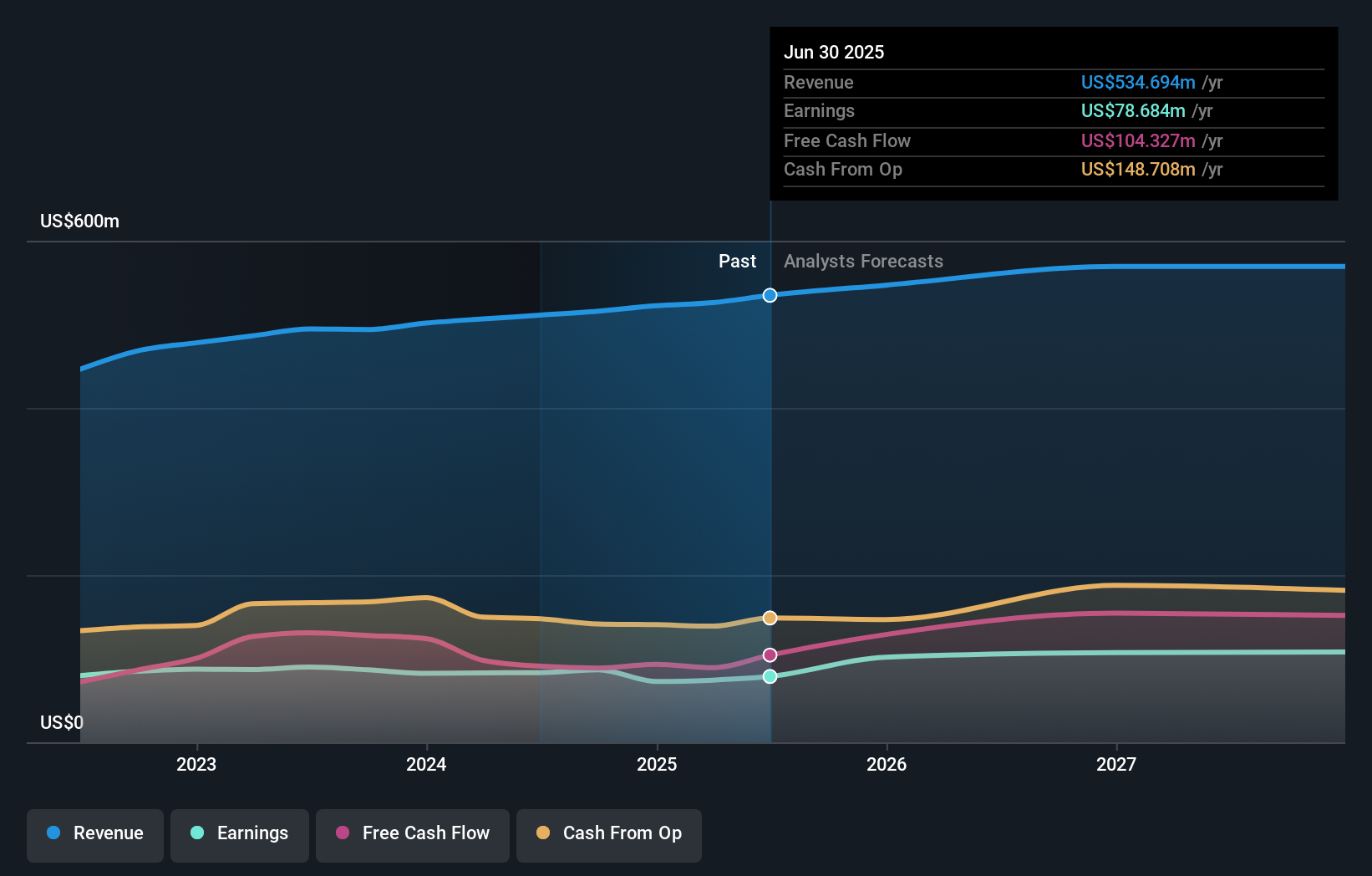

To back Monarch Casino & Resort as a shareholder, you'd want to believe in its ability to sustain growing revenue and earnings despite challenges in a maturing hospitality market. The newest promotion through the Bet Monarch app, offering improved NFL betting spreads, signals a push into digital gaming, a sector that’s fast-evolving but crowded with well-funded rivals. While this move could lift short-term engagement in Colorado, the impact on company-wide catalysts like steady earnings growth and value creation may be limited unless digital operations scale meaningfully beyond this regional offer. Core risks, such as relatively slow revenue and profit margin growth relative to broader market benchmarks, still matter. The business is returning cash to shareholders through dividends and buybacks, but the digital channel’s ability to diversify and boost long-term growth now comes into sharper focus after this announcement.

On the other hand, digital expansion efforts may add operational and competitive risks that are important for investors to follow.

Exploring Other Perspectives

Explore 2 other fair value estimates on Monarch Casino & Resort - why the stock might be worth just $107.17!

Build Your Own Monarch Casino & Resort Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Monarch Casino & Resort research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Monarch Casino & Resort research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Monarch Casino & Resort's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MCRI

Monarch Casino & Resort

Through its subsidiaries, owns and operates hotels and casinos.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives