- United States

- /

- Consumer Services

- /

- NasdaqGS:LOPE

Will Grand Canyon Education's (LOPE) Leadership Changes Shape Its Regulatory Strategy Going Forward?

Reviewed by Sasha Jovanovic

- On October 20, 2025, Grand Canyon Education, Inc. confirmed the resignation of Kathy J. Claypatch as Chief Information Officer after over a decade with the company in technology leadership roles.

- This leadership transition coincides with the company's recent resolution of several major legal and regulatory matters, marking a period of significant organizational change.

- We'll examine how the clearance of longstanding legal risks now shapes Grand Canyon Education's overall investment narrative and future prospects.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Grand Canyon Education Investment Narrative Recap

To be a shareholder in Grand Canyon Education, you generally have to believe in the persistence of its strong operating margins and its ability to expand via online program growth and employer partnerships. The recent resignation of the Chief Information Officer does not appear material to the most important near-term catalyst, broader online enrollment growth, nor does it significantly increase current business risks, as legal and regulatory overhangs have largely been resolved in recent months.

Among the latest developments, the reversal of a major regulatory decision regarding Grand Canyon University's non-profit status, alongside the rescinding of a US$37.7 million fine, stands out. These resolutions remove significant legal uncertainty that had weighed on the stock, allowing management to focus more directly on growth initiatives and margin expansion, both of which remain central to future earnings performance.

However, it is important for investors to keep in mind that, despite these positive steps, the trend of declining high school graduate numbers in the US may...

Read the full narrative on Grand Canyon Education (it's free!)

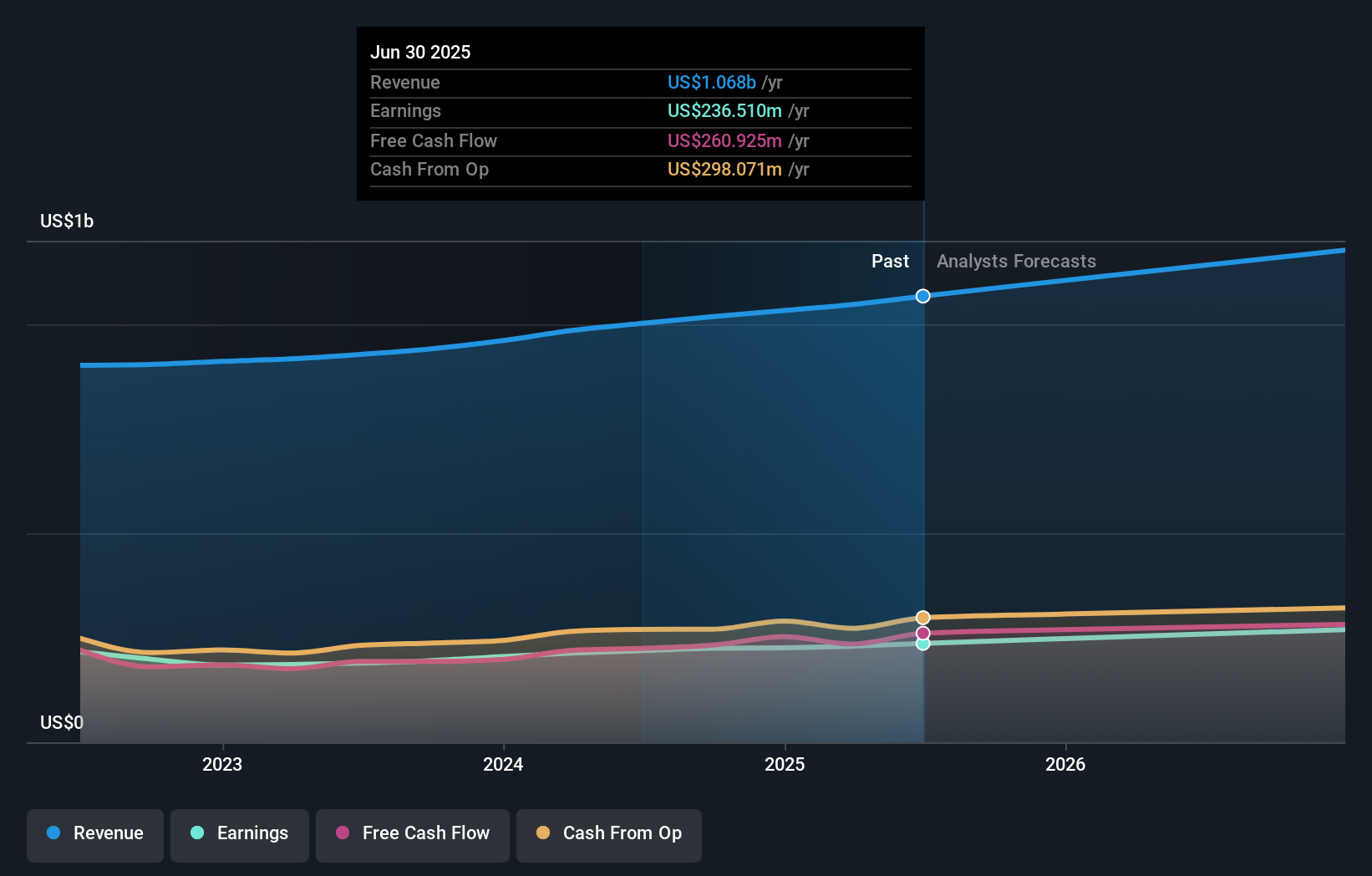

Grand Canyon Education's narrative projects $1.3 billion revenue and $306.2 million earnings by 2028. This requires 6.7% yearly revenue growth and a $69.7 million earnings increase from $236.5 million.

Uncover how Grand Canyon Education's forecasts yield a $239.00 fair value, a 27% upside to its current price.

Exploring Other Perspectives

Community members at Simply Wall St submitted two fair value estimates for Grand Canyon Education ranging from US$239 to US$275.43. While online enrollment expansion remains a focal catalyst, your own outlook could differ widely from these community perspectives.

Explore 2 other fair value estimates on Grand Canyon Education - why the stock might be worth as much as 46% more than the current price!

Build Your Own Grand Canyon Education Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Grand Canyon Education research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Grand Canyon Education research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Grand Canyon Education's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LOPE

Grand Canyon Education

Operates as an education services company in the United States.

Flawless balance sheet and good value.

Market Insights

Community Narratives